1. The bank statement for Juan Company shows a balance per bank of P15,907.45 on April 30,2015. On this date the balance of cash per books is P11,589.45. Additional information is provided below: Deposits in transit: April 30 deposit (received by the bank on May 1) P2,201.40 Outstanding checks: No. 453-P3,000.00 No. 457-P1,401.30 No. 460-P1,502.70 Errors: Juan wrote check no. 443 for P1,226.00 and the bank correctly paid that amount. However, he recorded the check as P1,262.00. Bank memoranda: Debit- NSF check from Pedro P425.60 Debit- Charge for printing company checks P30.00 Credit- Collection of note receivable for P1,000 plus interest earned of P50, less bank collection fee of P15.00. Required: Prepare a bank reconciliation statement using the adjusted method.

1. The bank statement for Juan Company shows a balance per bank of P15,907.45 on April 30,2015. On this date the balance of cash per books is P11,589.45. Additional information is provided below: Deposits in transit: April 30 deposit (received by the bank on May 1) P2,201.40 Outstanding checks: No. 453-P3,000.00 No. 457-P1,401.30 No. 460-P1,502.70 Errors: Juan wrote check no. 443 for P1,226.00 and the bank correctly paid that amount. However, he recorded the check as P1,262.00. Bank memoranda: Debit- NSF check from Pedro P425.60 Debit- Charge for printing company checks P30.00 Credit- Collection of note receivable for P1,000 plus interest earned of P50, less bank collection fee of P15.00. Required: Prepare a bank reconciliation statement using the adjusted method.

Financial Accounting

14th Edition

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Carl Warren, Jim Reeve, Jonathan Duchac

Chapter8: Sarbanes-oxley, Internal Control, And Cash

Section: Chapter Questions

Problem 18E

Related questions

Question

Direction: Prepare a bank reconciliation statement of the given information below. (Please refer to the picture)

Transcribed Image Text:I.

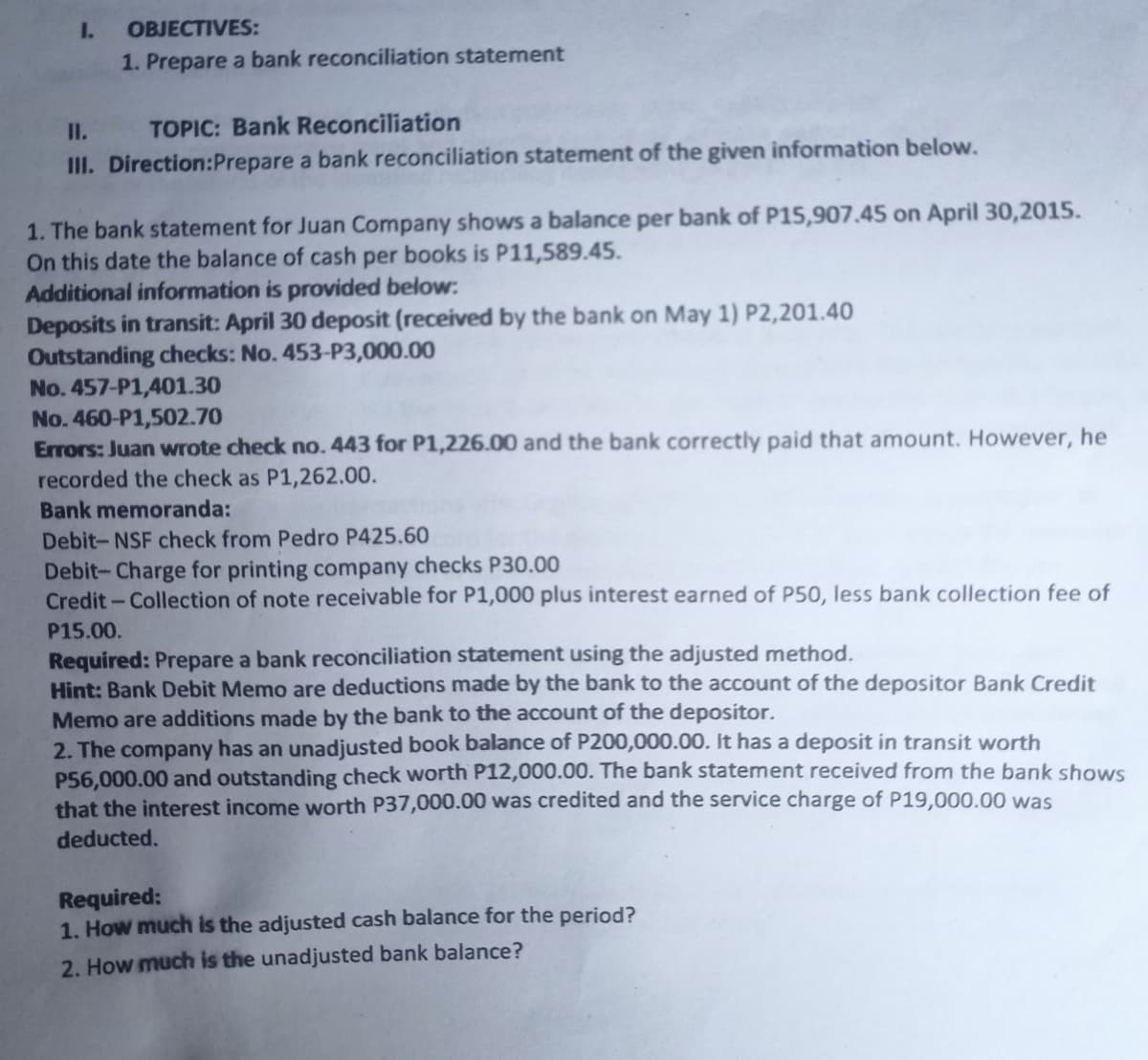

OBJECTIVES:

1. Prepare a bank reconciliation statement

I.

TOPIC: Bank Reconciliation

III. Direction:Prepare a bank reconciliation statement of the given information below.

1. The bank statement for Juan Company shows a balance per bank of P15,907.45 on April 30,2015.

On this date the balance of cash per books is P11,589.45.

Additional information is provided below:

Deposits in transit: April 30 deposit (received by the bank on May 1) P2,201.40

Outstanding checks: No. 453-P3,000.00

No. 457-P1,401.30

No. 460-P1,502.70

Errors: Juan wrote check no. 443 for P1,226.00 and the bank correctly paid that amount. However, he

recorded the check as P1,262.00.

Bank memoranda:

Debit- NSF check from Pedro P425.60

Debit- Charge for printing company checks P30.00

Credit- Collection of note receivable for P1,000 plus interest earned of P50, less bank collection fee of

P15.00.

Required: Prepare a bank reconciliation statement using the adjusted method.

Hint: Bank Debit Memo are deductions made by the bank to the account of the depositor Bank Credit

Memo are additions made by the bank to the account of the depositor.

2. The company has an unadjusted book balance of P200,000.00. It has a deposit in transit worth

P56,000.00 and outstanding check worth P12,000.00. The bank statement received from the bank shows

that the interest income worth P37,000.00 was credited and the service charge of P19,000.00 was

deducted.

Required:

1. How much is the adjusted cash balance for the period?

2. How much is the unadjusted bank balance?

Transcribed Image Text:with the bank statement balance, it provides added comfort that the bank transactions have been

• Monthly preparation of bank reconciliation assists in the regular monitoring of cash flows of a business

- If the bank balance appearing In

to be correct by comparing it

recorded correctly in the company records.

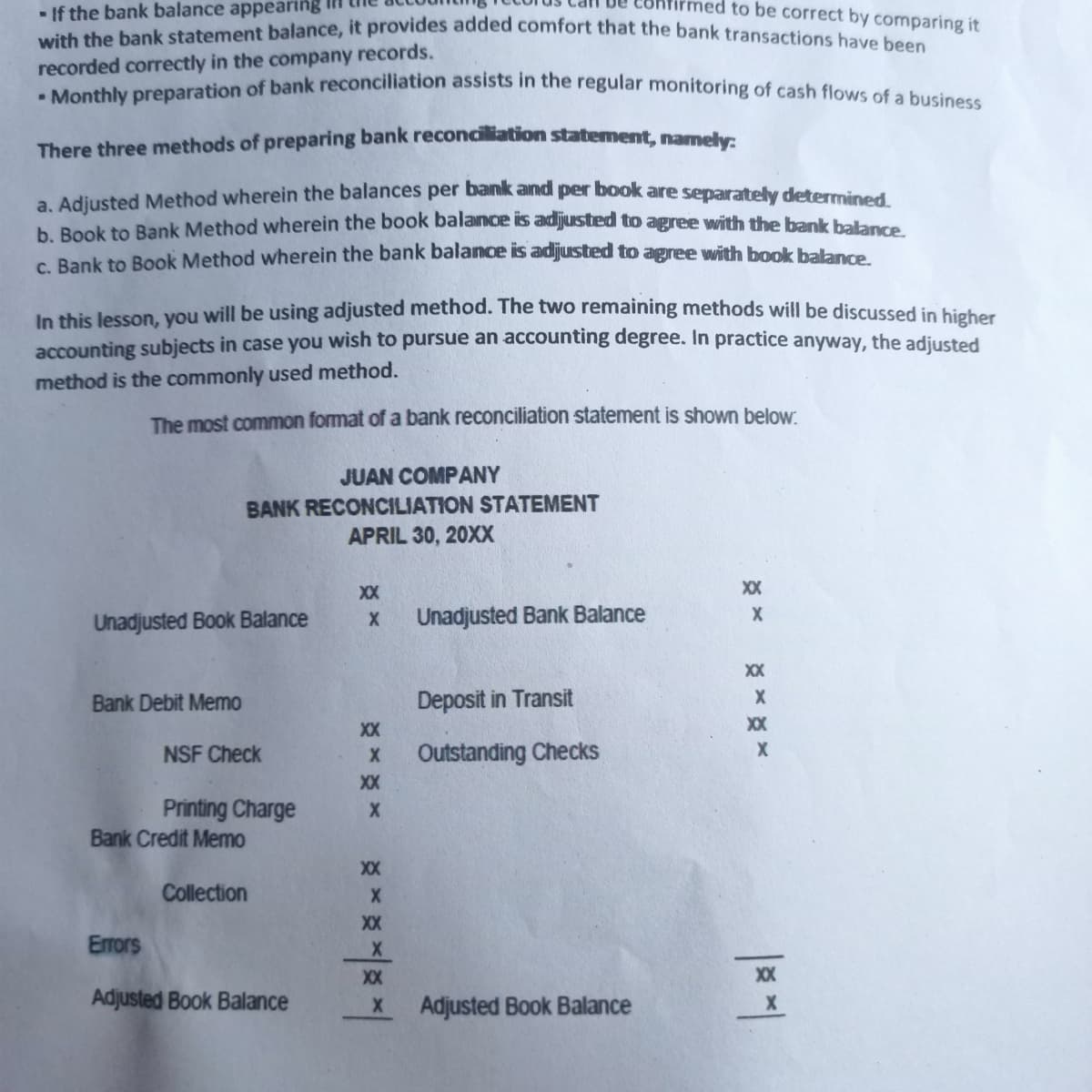

There three methods of preparing bank reconcilliation statement, namely:

a Adiusted Method wherein the balances per bainik aind per book are separately determined

b. Book to Bank Method wherein the book balaince is adijusted to agree with the bank balance

C Bank to Book Method wherein the bank balance is adijusted to agree with book balance

In this lesson, you will be using adjusted method. The two remaining methods will be discussed in higher

accounting subjects in case you wish to pursue an accounting degree. In practice anyway, the adjusted

method is the commonly used method.

The most common format of a bank reconciliation statement is shown below.

JUAN COMPANY

BANK RECONCILIATION STATEMENT

APRIL 30, 20XX

XX

XX

Unadjusted Book Balance

Unadjusted Bank Balance

XX

Bank Debit Memo

Deposit in Transit

XX

XX

NSF Check

Outstanding Checks

XX

Printing Charge

Bank Credit Memo

XX

Collection

XX

Erors

XX

XX

Adjusted Book Balance

Adjusted Book Balance

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning