1. To save for their new child's college education, a couple places $28,400 in an account. What amount will accumulate in the account at the end of 18 years, assuming an interest rate of 7.25% compounded annually? 2. An individual has just inherited a piece of land. The individual plans to hold the land for three years and then expects the land sell for $208,500. What is the value today of inheriting the land, assuming an interest rate of 8.5% compounded annually? 3. To save money for the down payment on a house, an individual places $6,700 in an account at the end of each quarter. What amount will accumulate in the account at the end of four years, assuming an interest rate of 9.75% compounded quarterly? 4. To purchase a car, an individual agrees to pay $1,140 at the end of each month for the next six years. What is the cost of the cal today, assuming an interest rate of 6.5%. 5. To help repay debt that will come due in 12 years, a company places $26,800 in an account at the beginning of each six-month period. What amount will accumulate in the account at the end of 12 years, assuming an interest rate of 4.5% compounded semiannually? 6. To rent office space, a company signs a lease agreeing to pay $4,200 at the beginning of each month for the next three years. What is the cost today of the lease, assuming an interest rate of 5% compounded monthly? Future Value 100,109.00

1. To save for their new child's college education, a couple places $28,400 in an account. What amount will accumulate in the account at the end of 18 years, assuming an interest rate of 7.25% compounded annually? 2. An individual has just inherited a piece of land. The individual plans to hold the land for three years and then expects the land sell for $208,500. What is the value today of inheriting the land, assuming an interest rate of 8.5% compounded annually? 3. To save money for the down payment on a house, an individual places $6,700 in an account at the end of each quarter. What amount will accumulate in the account at the end of four years, assuming an interest rate of 9.75% compounded quarterly? 4. To purchase a car, an individual agrees to pay $1,140 at the end of each month for the next six years. What is the cost of the cal today, assuming an interest rate of 6.5%. 5. To help repay debt that will come due in 12 years, a company places $26,800 in an account at the beginning of each six-month period. What amount will accumulate in the account at the end of 12 years, assuming an interest rate of 4.5% compounded semiannually? 6. To rent office space, a company signs a lease agreeing to pay $4,200 at the beginning of each month for the next three years. What is the cost today of the lease, assuming an interest rate of 5% compounded monthly? Future Value 100,109.00

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter9: Current Liabilities, Contingencies, And The Time Value Of Money

Section: Chapter Questions

Problem 9.19E

Related questions

Question

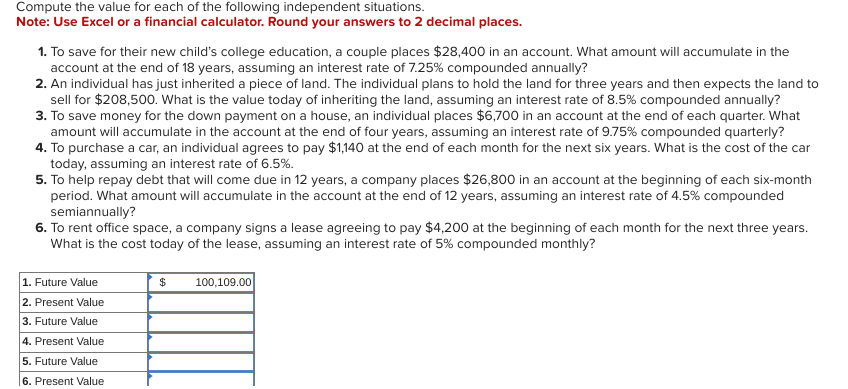

Transcribed Image Text:Compute the value for each of the following independent situations.

Note: Use Excel or a financial calculator. Round your answers to 2 decimal places.

1. To save for their new child's college education, a couple places $28,400 in an account. What amount will accumulate in the

account at the end of 18 years, assuming an interest rate of 7.25% compounded annually?

2. An individual has just inherited a piece of land. The individual plans to hold the land for three years and then expects the land to

sell for $208,500. What is the value today of inheriting the land, assuming an interest rate of 8.5% compounded annually?

3. To save money for the down payment on a house, an individual places $6,700 in an account at the end of each quarter. What

amount will accumulate in the account at the end of four years, assuming an interest rate of 9.75% compounded quarterly?

4. To purchase a car, an individual agrees to pay $1,140 at the end of each month for the next six years. What is the cost of the car

today, assuming an interest rate of 6.5%.

5. To help repay debt that will come due in 12 years, a company places $26,800 in an account at the beginning of each six-month

period. What amount will accumulate in the account at the end of 12 years, assuming an interest rate of 4.5% compounded

semiannually?

6. To rent office space, a company signs a lease agreeing to pay $4,200 at the beginning of each month for the next three years.

What is the cost today of the lease, assuming an interest rate of 5% compounded monthly?

1. Future Value

$

100,109.00

2. Present Value

3. Future Value

4. Present Value

5. Future Value

6. Present Value

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning