1. What is the IRR for each of these projects? (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) 2. If you apply the IRR decision rule, which project should the company accept? 1. Assume the required return is 12 percent. What is the NPV for each of these projects? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) -2. Which project will you choose of you apply the NPV decision rule?

1. What is the IRR for each of these projects? (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) 2. If you apply the IRR decision rule, which project should the company accept? 1. Assume the required return is 12 percent. What is the NPV for each of these projects? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) -2. Which project will you choose of you apply the NPV decision rule?

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter15: Capital Investment Analysis

Section: Chapter Questions

Problem 15.3.2P

Related questions

Question

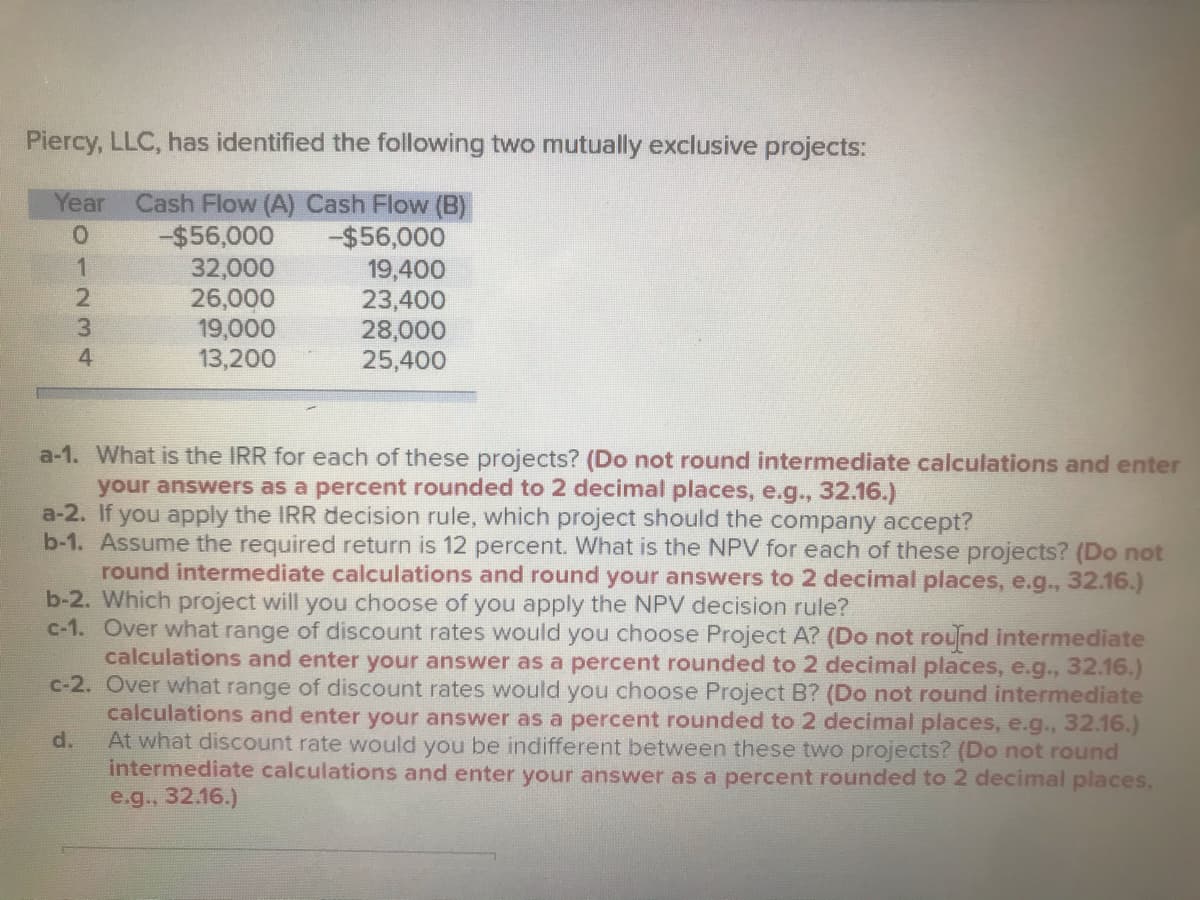

Transcribed Image Text:Piercy, LLC, has identified the following two mutually exclusive projects:

Year

Cash Flow (A) Cash Flow (B)

-$56,000

32,000

26,000

19,000

13,200

-$56,000

19,400

23,400

28,000

25,400

1

3.

4.

a-1. What is the IRR for each of these projects? (Do not round intermediate calculations and enter

your answers as a percent rounded to 2 decimal places, e.g., 32.16.)

a-2. If you apply the IRR decision rule, which project should the company accept?

b-1. Assume the required return is 12 percent. What is the NPV for each of these projects? (Do not

round intermediate calculations and round your answers to 2 decimal places, e.g.., 32.16.)

b-2. Which project will you choose of you apply the NPV decision rule?

c-1. Over what range of discount rates would you choose Project A? (Do not round intermediate

calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)

c-2. Over what range of discount rates would you choose Project B? (Do not round intermediate

calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)

At what discount rate would you be indifferent between these two projects? (Do not round

intermediate calculations and enter your answer as a percent rounded to 2 decimal places,

e.g., 32.16.)

d.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning