Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter22: Providing And Obtaining Credit

Section: Chapter Questions

Problem 4P: Gifts Galore Inc. borrowed 1.5 million from National City Bank. The loan was made at a simple annual...

Related questions

Question

100%

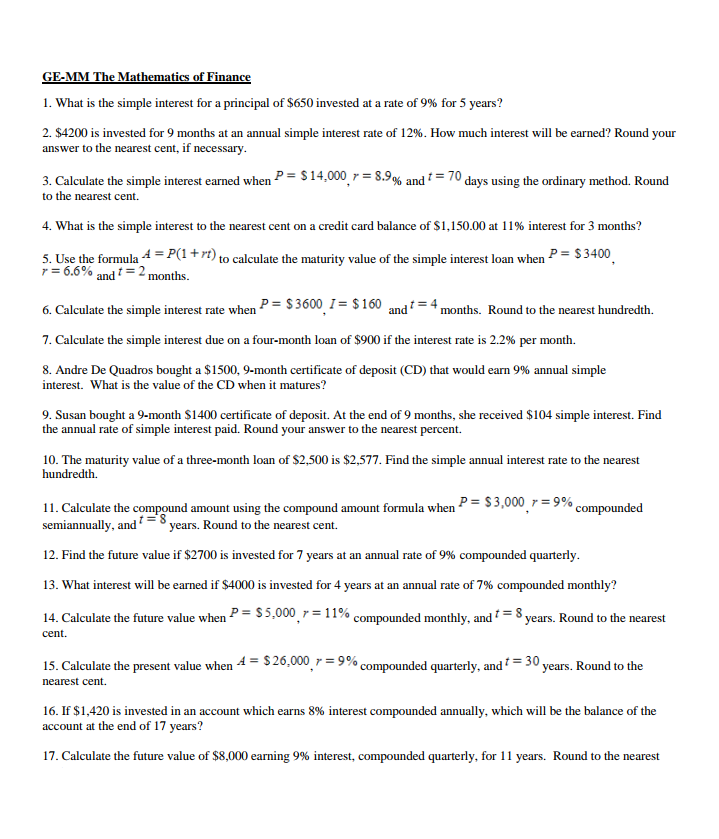

Transcribed Image Text:GE-MM The Mathematics of Finance

1. What is the simple interest for a principal of $650 invested at a rate of 9% for 5 years?

2. $4200 is invested for 9 months at an annual simple interest rate of 12%. How much interest will be earned? Round your

answer to the nearest cent, if necessary.

3. Calculate the simple interest earned when P = S 14,000, r = 8.9% and * = 70 days using the ordinary method. Round

to the nearest cent.

4. What is the simple interest to the nearest cent on a credit card balance of $1,150.00 at 11% interest for 3 months?

5. Use the formula 4 = P(1+rt) to calculate the maturity value of the simple interest loan when P = $3400,

7= 6.6% and = 2 months.

6. Calculate the simple interest rate when P = $ 3600_ I = $ 160 and

months. Round to the nearest hundredth.

7. Calculate the simple interest due on a four-month loan of $900 if the interest rate is 2.2% per month.

8. Andre De Quadros bought a $1500, 9-month certificate of deposit (CD) that would earn 9% annual simple

interest. What is the value of the CD when it matures?

9. Susan bought a 9-month $1400 certificate of deposit. At the end of 9 months, she received $104 simple interest. Find

the annual rate of simple interest paid. Round your answer to the nearest percent.

10. The maturity value of a three-month loan of $2,500 is $2,577. Find the simple annual interest rate to the nearest

hundredth.

11. Calculate the compound amount using the compound amount formula when P = $3,000,7 = 9% compounded

semiannually, and =8 years. Round to the nearest cent.

12. Find the future value if $2700 is invested for 7 years at an annual rate of 9% compounded quarterly.

13. What interest will be earned if $4000 is invested for 4 years at an annual rate of 7% compounded monthly?

14. Calculate the future value when P= S5,000 7 = 11% compounded monthly, and = 8 years. Round to the nearest

cent.

15. Calculate the present value when 4 = $ 26,000 r = 9% compounded quarterly, and t = 30

years. Round to the

nearest cent.

16. If $1,420 is invested in an account which earns 8% interest compounded annually, which will be the balance of the

account at the end of 17 years?

17. Calculate the future value of $8,000 earning 9% interest, compounded quarterly, for 11 years. Round to the nearest

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning