1. What is the total capital balance of the partnership after the admission by Marshall? 2. What is the capital share of Marshall after he was admitted in the pait ship? 3. What is the percentage share of Marshall in the profits and losses 4. What is the combined gain realized by Manuel and Marcus upon the sale of a portion of their interest in the partnership to Marshall? 5. What is the gain realized by Manuel upon the sale of a portion of his interest in the partnership to Marshall

1. What is the total capital balance of the partnership after the admission by Marshall? 2. What is the capital share of Marshall after he was admitted in the pait ship? 3. What is the percentage share of Marshall in the profits and losses 4. What is the combined gain realized by Manuel and Marcus upon the sale of a portion of their interest in the partnership to Marshall? 5. What is the gain realized by Manuel upon the sale of a portion of his interest in the partnership to Marshall

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter14: Partnerships And Limited Liability Entities

Section: Chapter Questions

Problem 2BD

Related questions

Question

1. What is the total capital balance of the partnership after the admission by

Marshall?

2. What is the capital share of Marshall after he was admitted in the pait ship?

3. What is the percentage share of Marshall in the profits and losses

4. What is the combined gain realized by Manuel and Marcus upon the sale of a portion of their interest in the partnership to Marshall?

5. What is the gain realized by Manuel upon the sale of a portion of his interest in the partnership to Marshall

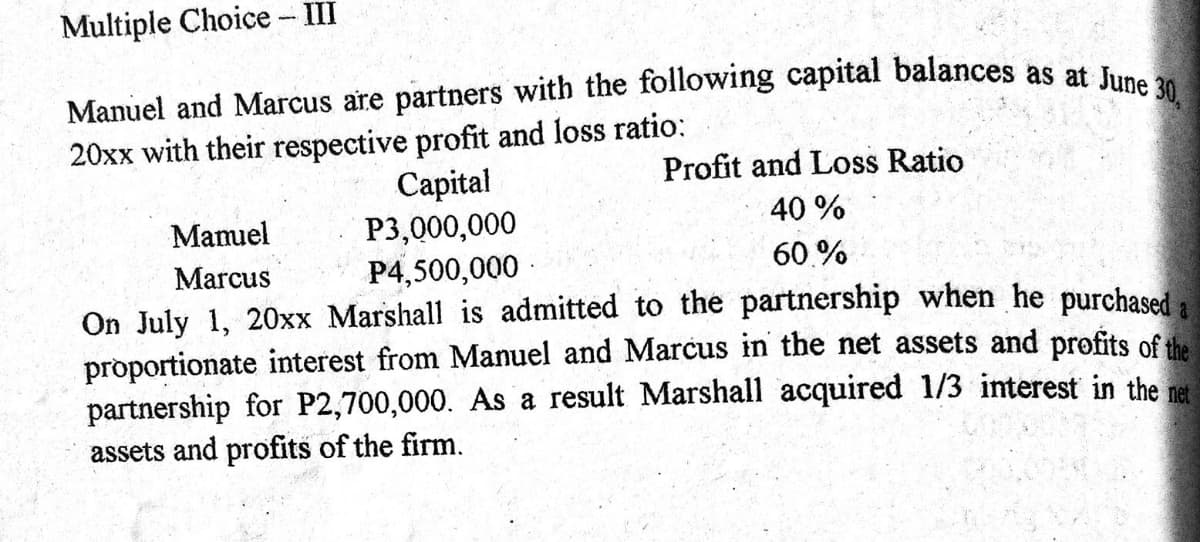

Transcribed Image Text:Manuel and Marcus are partners with the following capital balances as at June 30,

Multiple Choice - III

20xx with their respective profit and loss ratio:

Capital

P3,000,000

P4,500,000 ·

Profit and Loss Ratio

Mamuel

40 %

Marcus

60.%

On July 1, 20xx Marshall is admitted to the partnership when he purchased

proportionate interest from Manuel and Marcus in the net assets and profits of the

partnership for P2,700,000. As a result Marshall acquired 1/3 interest in the net

assets and profits of the firm.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College