1. What is your monthly payment if you choose 0% financing for 48 months? Round to the nearest dollar. 2. The rebate offer is $2600, and you can obtain a car loan at your local bank for the balance at 2.99% compounded monthly for 48 months. If you choose the rebate, what is your monthly payment? Round to the nearest dollar. 3.You want to make monthly payments of $413, but you don't want a car loan over your head for more than 48 months, so you decide to go with the down payment option. How much of a down payment do you need to make? Round to the nearest dollar.

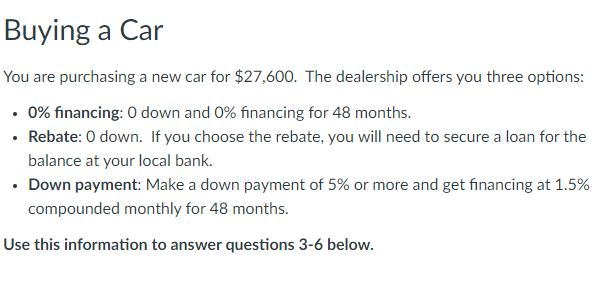

Use the screenshot attached below to answer the questions Thanks!

1. What is your monthly payment if you choose 0% financing for 48 months? Round to the nearest dollar.

2. The rebate offer is $2600, and you can obtain a car loan at your local bank for the balance at 2.99% compounded monthly for 48 months. If you choose the rebate, what is your monthly payment? Round to the nearest dollar.

3.You want to make monthly payments of $413, but you don't want a car loan over your head for more than 48 months, so you decide to go with the down payment option. How much of a down payment do you need to make? Round to the nearest dollar.

4.Suppose you make a down payment of 17% of $27,600 and finance the rest at 1.5% compounded monthly for 48 months. How much interest do you pay over the life of the loan? Round to the nearest dollar.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps