1. When did the business call accountable? 1. Business Activities are accountable when they are called business Transactions and events when they affect the assets, liabilities and owner's equity 2. Accounting elements of Accounting values are classified into two categories namely external Transactions and internal Transactions. 3.External Transactions involves exchanges of economic resources by a business enterprise with another business enterprise ex.selling of services, and commodities to customers,payment of accounts to suppliers, payment of store or office rents etc. 4. Internal Transactions are Transactions or events that happened or take place within the business enterprise only . Ex. conversion of raw materials into finished product, unanticipated loss from fire and food, or any calamities affecting enterprise. A. 1-2 only B. 1-2-3 C. 1-2-3-4 D. 3-4

1. When did the business call accountable?

1. Business Activities are accountable when they are called business Transactions and events when they affect the assets, liabilities and owner's equity

2. Accounting elements of Accounting values are classified into two categories namely external Transactions and internal Transactions.

3.External Transactions involves exchanges of economic resources by a business enterprise with another business enterprise ex.selling of services, and commodities to customers,payment of accounts to suppliers, payment of store or office rents etc.

4. Internal Transactions are Transactions or events that happened or take place within the business enterprise only . Ex. conversion of raw materials into finished product, unanticipated loss from fire and food, or any calamities affecting enterprise.

A. 1-2 only

B. 1-2-3

C. 1-2-3-4

D. 3-4

2. What can you say about exchanges of equal monetary values?

1. For every value received, another value is given away as an exchange

2. These values are measured in terms of pesos which are presumed to be equal

3. If there is value received, we call a debit and value parted with we call a debit

4. This is the give and take process of Accounting as expressed in equation

5. Business Transactions are analyze from the viewpoint of the business. If the Transaction is purchased or bought, it is the business that buying, if the transaction is sold, it is the business that is selling, if the business is paid, it is the business that is paying, if the Transaction is collected, it is the business is collecting.

A. 1-2 only

B. 1-2-3

C. 1-2-3-4

D. 3-4 only

3. Which of the following is subject to

A. Land

B. Building

C. Equipment

D. Machinery

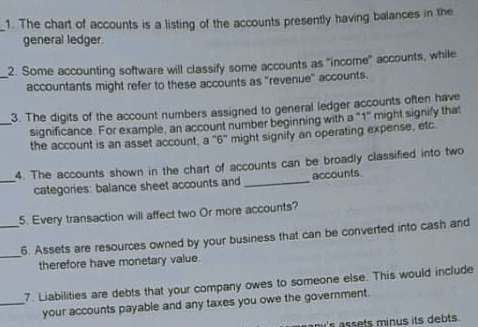

True or false ( see the attached photo)

Step by step

Solved in 2 steps