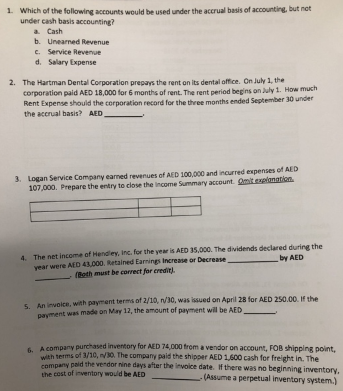

1. Which of the following accounts would be used under the accrual basis of accounting, but not under cash basis accounting? a Cash b. Unearned Revenue c. Service Revenue d. Salary Expense 2. The Hartman Dental Corporation prepays the rent on Its dental office. On July 1, the corporation paid AED 18,000 for 6 months of rent. The rent period begins on July 1. How much Rent Expense should the corporation record for the three months ended September 30 under the accrual basis? AED 3. Logan Service Company earned revenues of AED 100,000 and incurred expenses of AED 107,000. Prepare the entry to close the income Summary account. Omit explanation 4. The net income of Hendley, Inc. for the yer is AED 35,000. The dividends declared during the by AED year were AED 43,000. Retained Earnings increase or Decrease (Both must be correct for creditr). 5. An invoice, with payment terms of 2/10, r/30, was issued on April 28 for AED 250.00. If the payment was made on May 12, the amount of payment will be AED A company purchased inventory for AED 74,000 from a vendor on account, FOB shipping point, with terms of 3/10, n/30. The company paid the shipper ALD 1,600 cash for freight in. The company paid the vendor nine days after the invoice date. If there was no beginning inventory, the cost of inventory would be AED -(Assume a perpetual inventory system.)

1. Which of the following accounts would be used under the accrual basis of accounting, but not under cash basis accounting? a Cash b. Unearned Revenue c. Service Revenue d. Salary Expense 2. The Hartman Dental Corporation prepays the rent on Its dental office. On July 1, the corporation paid AED 18,000 for 6 months of rent. The rent period begins on July 1. How much Rent Expense should the corporation record for the three months ended September 30 under the accrual basis? AED 3. Logan Service Company earned revenues of AED 100,000 and incurred expenses of AED 107,000. Prepare the entry to close the income Summary account. Omit explanation 4. The net income of Hendley, Inc. for the yer is AED 35,000. The dividends declared during the by AED year were AED 43,000. Retained Earnings increase or Decrease (Both must be correct for creditr). 5. An invoice, with payment terms of 2/10, r/30, was issued on April 28 for AED 250.00. If the payment was made on May 12, the amount of payment will be AED A company purchased inventory for AED 74,000 from a vendor on account, FOB shipping point, with terms of 3/10, n/30. The company paid the shipper ALD 1,600 cash for freight in. The company paid the vendor nine days after the invoice date. If there was no beginning inventory, the cost of inventory would be AED -(Assume a perpetual inventory system.)

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter5: Closing Entries And The Post-closing Trial Balance

Section: Chapter Questions

Problem 8E: Considering the following events, determine which month the revenue or expenses would be recorded...

Related questions

Question

Transcribed Image Text:1. Which of the following accounts would be used under the accrual basis of accounting, but not

under cash basis accounting?

a Cash

b. Unearned Revenue

c. Service Revenue

d. Salary Expense

2. The Hartman Dental Corporation prepays the rent on Its dental office. On July 1, the

corporation paid AED 18,000 for 6 months of rent. The rent period begins on July 1. How much

Rent Expense should the corporation record for the three months ended September 30 under

the accrual basis? AED

3. Logan Service Company earned revenues of AED 100,000 and incurred expenses of AED

107,000. Prepare the entry to close the income Summary account. Omit explanation

4. The net income of Hendley, Inc. for the yer is AED 35,000. The dividends declared during the

by AED

year were AED 43,000. Retained Earnings increase or Decrease

(Both must be correct for creditr).

5. An invoice, with payment terms of 2/10, r/30, was issued on April 28 for AED 250.00. If the

payment was made on May 12, the amount of payment will be AED

A company purchased inventory for AED 74,000 from a vendor on account, FOB shipping point,

with terms of 3/10, n/30. The company paid the shipper ALD 1,600 cash for freight in. The

company paid the vendor nine days after the invoice date. If there was no beginning inventory,

the cost of inventory would be AED

-(Assume a perpetual inventory system.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College