1. Which of the following capital assets would not be depreciated? a) The city's streetlights. b) Purchased computer software. c) The partially completed city hall. d) The artwork owned and displayed in the city parks. 2. Goods for which a purchase order had been placed at an estimated co. were received at an actual cost of $985. The journal entry in the Gener record the receipt of the goods will include a: a) Debit to Reserve for Encumbrances for $1,000. b) Credit to Vouchers Payable for $985. c) Debit to Expenditures for $985. d) All of the above are correct.

1. Which of the following capital assets would not be depreciated? a) The city's streetlights. b) Purchased computer software. c) The partially completed city hall. d) The artwork owned and displayed in the city parks. 2. Goods for which a purchase order had been placed at an estimated co. were received at an actual cost of $985. The journal entry in the Gener record the receipt of the goods will include a: a) Debit to Reserve for Encumbrances for $1,000. b) Credit to Vouchers Payable for $985. c) Debit to Expenditures for $985. d) All of the above are correct.

Chapter10: Cost Recovery On Property: Depreciation, Depletion, And Amortization

Section: Chapter Questions

Problem 23P

Related questions

Question

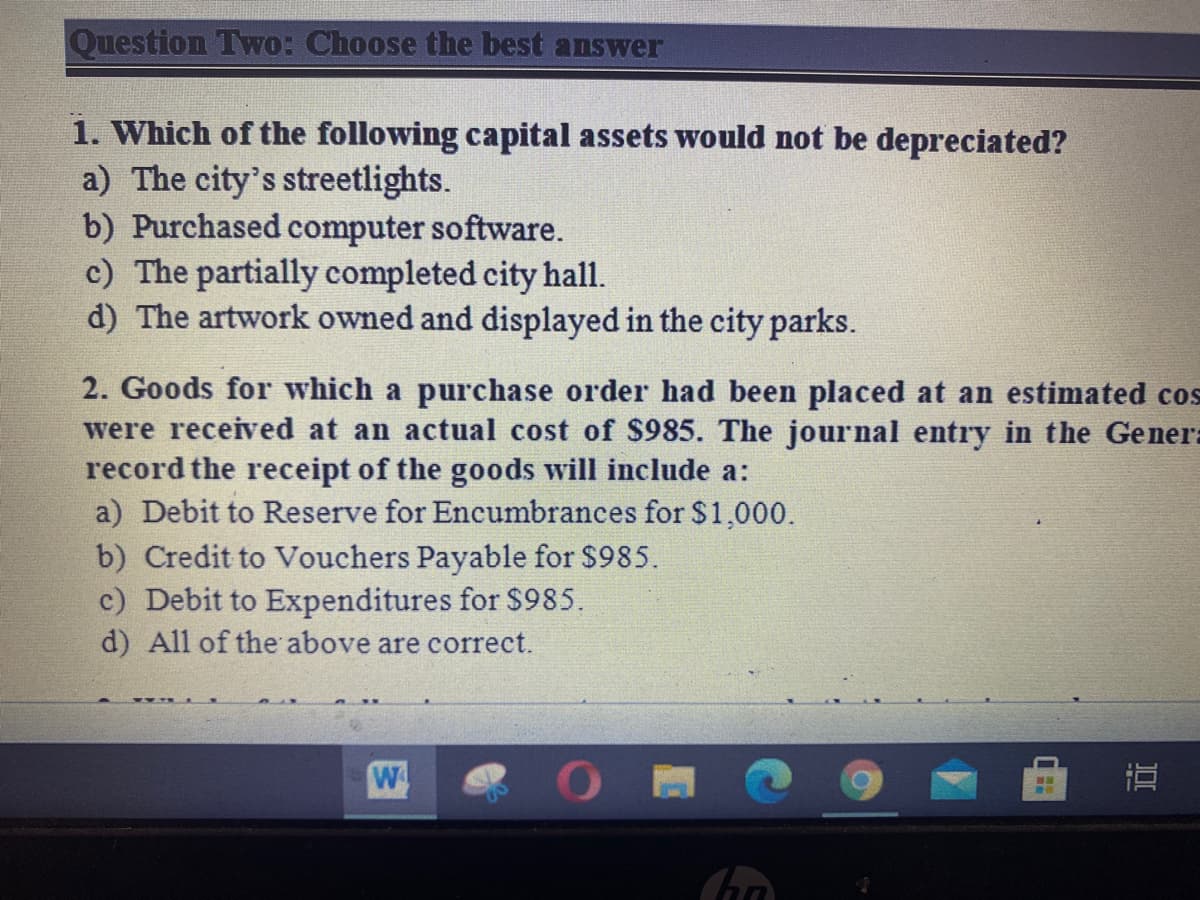

Transcribed Image Text:Question Two: Choose the best answer

1. Which of the following capital assets would not be depreciated?

a) The city's streetlights.

b) Purchased computer software.

c) The partially completed city hall.

d) The artwork owned and displayed in the city parks.

2. Goods for which a purchase order had been placed at an estimated cos

were received at an actual cost of $985. The journal entry in the Gener:

record the receipt of the goods will include a:

a) Debit to Reserve for Encumbrances for $1,000.

b) Credit to Vouchers Payable for $985.

c) Debit to Expenditures for $985.

d) All of the above are correct.

W

直

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you