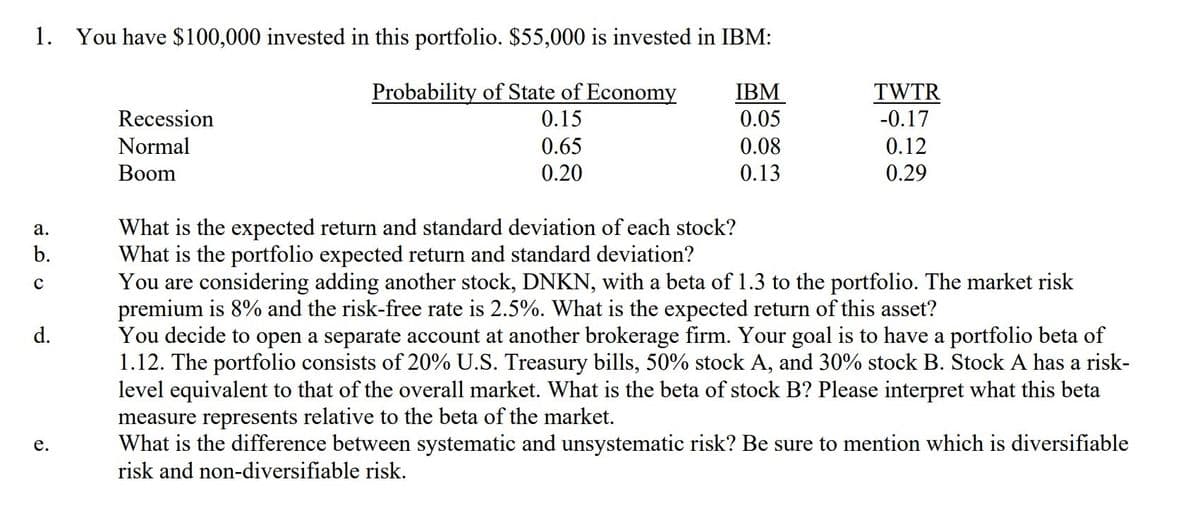

1. You have $100,000 invested in this portfolio. $55,000 is invested in IBM: Probability of State of Economy IBM TWTR -0.17 Recession 0.15 0.05 Normal 0.65 0.08 0.12 Boom 0.20 0.13 0.29 What is the expected return and standard deviation of each stock? What is the portfolio expected return and standard deviation? You are considering adding another stock, DNKN, with a beta of 1.3 to the portfolio. The market risk premium is 8% and the risk-free rate is 2.5%. What is the expected return of this asset? а. b.

1. You have $100,000 invested in this portfolio. $55,000 is invested in IBM: Probability of State of Economy IBM TWTR -0.17 Recession 0.15 0.05 Normal 0.65 0.08 0.12 Boom 0.20 0.13 0.29 What is the expected return and standard deviation of each stock? What is the portfolio expected return and standard deviation? You are considering adding another stock, DNKN, with a beta of 1.3 to the portfolio. The market risk premium is 8% and the risk-free rate is 2.5%. What is the expected return of this asset? а. b.

Chapter8: Analysis Of Risk And Return

Section: Chapter Questions

Problem 14P

Related questions

Question

100%

Transcribed Image Text:1. You have $100,000 invested in this portfolio. $55,000 is invested in IBM:

Probability of State of Economy

0.15

IBM

0.05

TWTR

-0.17

Recession

Normal

0.65

0.08

0.12

Вoom

0.20

0.13

0.29

What is the expected return and standard deviation of each stock?

What is the portfolio expected return and standard deviation?

You are considering adding another stock, DNKN, with a beta of 1.3 to the portfolio. The market risk

premium is 8% and the risk-free rate is 2.5%. What is the expected return of this asset?

You decide to open a separate account at another brokerage firm. Your goal is to have a portfolio beta of

1.12. The portfolio consists of 20% U.S. Treasury bills, 50% stock A, and 30% stock B. Stock A has a risk-

level equivalent to that of the overall market. What is the beta of stock B? Please interpret what this beta

measure represents relative to the beta of the market.

What is the difference between systematic and unsystematic risk? Be sure to mention which is diversifiable

risk and non-diversifiable risk.

а.

b.

d.

е.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning