Chapter10: The Basics Of Capital Budgeting: Evaluating Cash Flows

Section10.4: Internal Rate Of Return (irr)

Problem 6ST

Related questions

Question

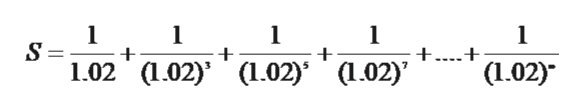

Transcribed Image Text:1.02

1.02

1.02

1.02

7T-. .T 1.0200

Expert Solution

Step 1

Formula for PV calculation is given below:

PV= CF/(1+i)^n

Below is the question asked which is till infinity. We can use the present value table and solve the same.

Since the rate is 2%, one needs to look at the 3rd year for the correct amount, so at 2% for the third year is .9423, =1/09423= 1.061233

Simlarly for all the 1/(1.02)^5; one needs to see the correct amount under 5th year for 2%; I.e. .9057=1/.9057= 1.104118

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning