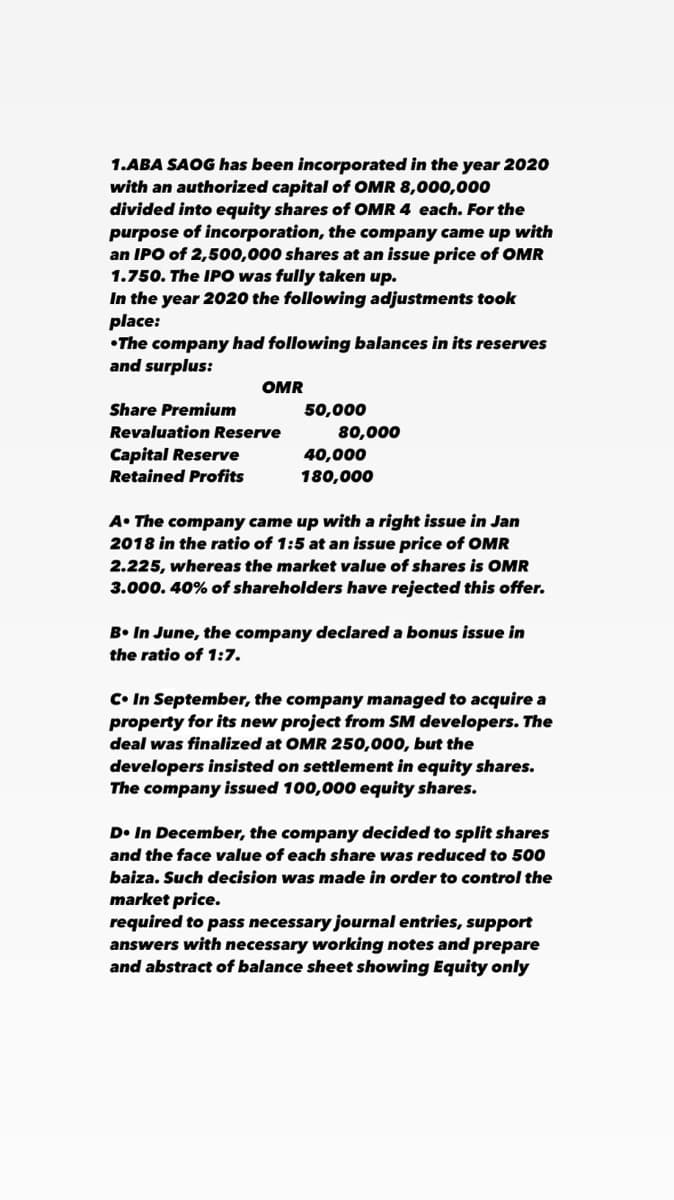

1.ABA SAOG has been incorporated in the year 2020o with an authorized capital of OMR 8,000,000 divided into equity shares of OMR 4 each. For the purpose of incorporation, the company came up with an IPO of 2,500,000 shares at an issue price of OMR 1.750. The IPO was fully taken up. In the year 2020 the following adjustments took place: •The company had following balances in its reserves and surplus: OMR Share Premium 50,000 Revaluation Reserve 80,000 Capital Reserve 40,000 Retained Profits 180,000 A• The company came up with a right issue in Jan 2018 in the ratio of 1:5 at an issue price of OMR 2.225, whereas the market value of shares is OMR 3.000. 40% of shareholders have rejected this offer. B• In June, the company declared a bonus issue in the ratio of 1:7. Co In September, the company managed to acquire a property for its new project from SM developers. The deal was finalized at OMR 250,000, but the developers insisted on settlement in equity shares. The company issued 100,000 equity shares. D• In December, the company decided to split shares and the face value of each share was reduced to 500 baiza. Such decision was made in order to control the market price. required to pass necessary journal entries, support answers with necessary working notes and prepare and abstract of balance sheet showing Equity only

1.ABA SAOG has been incorporated in the year 2020o with an authorized capital of OMR 8,000,000 divided into equity shares of OMR 4 each. For the purpose of incorporation, the company came up with an IPO of 2,500,000 shares at an issue price of OMR 1.750. The IPO was fully taken up. In the year 2020 the following adjustments took place: •The company had following balances in its reserves and surplus: OMR Share Premium 50,000 Revaluation Reserve 80,000 Capital Reserve 40,000 Retained Profits 180,000 A• The company came up with a right issue in Jan 2018 in the ratio of 1:5 at an issue price of OMR 2.225, whereas the market value of shares is OMR 3.000. 40% of shareholders have rejected this offer. B• In June, the company declared a bonus issue in the ratio of 1:7. Co In September, the company managed to acquire a property for its new project from SM developers. The deal was finalized at OMR 250,000, but the developers insisted on settlement in equity shares. The company issued 100,000 equity shares. D• In December, the company decided to split shares and the face value of each share was reduced to 500 baiza. Such decision was made in order to control the market price. required to pass necessary journal entries, support answers with necessary working notes and prepare and abstract of balance sheet showing Equity only

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter10: Stockholder's Equity

Section: Chapter Questions

Problem 81PSA

Related questions

Question

plz solve!!

Transcribed Image Text:1.ABA SAOG has been incorporated in the year 2020

with an authorized capital of OMR 8,000,000

divided into equity shares of OMR 4 each. For the

purpose of incorporation, the company came up with

an IPO of 2,500,000 shares at an issue price of OMR

1.750. The IPO was fully taken up.

In the year 2020 the following adjustments took

place:

•The company had following balances in its reserves

and surplus:

OMR

Share Premium

50,000

80,000

40,000

Revaluation Reserve

Capital Reserve

Retained Profits

180,000

A• The company came up with a right issue in Jan

2018 in the ratio of 1:5 at an issue price of OMR

2.225, whereas the market value of shares is OMR

3.000. 40% of shareholders have rejected this offer.

B. In June, the company declared a bonus issue in

the ratio of 1:7.

C• In September, the company managed to acquire a

property for its new project from SM developers. The

deal was finalized at OMR 250,000, but the

developers insisted on settlement in equity shares.

The company issued 100,000 equity shares.

D• In December, the company decided to split shares

and the face value of each share was reduced to 500

baiza. Such decision was made in order to control the

market price.

required to pass necessary journal entries, support

answers with necessary working notes and prepare

and abstract of balance sheet showing Equity only

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College