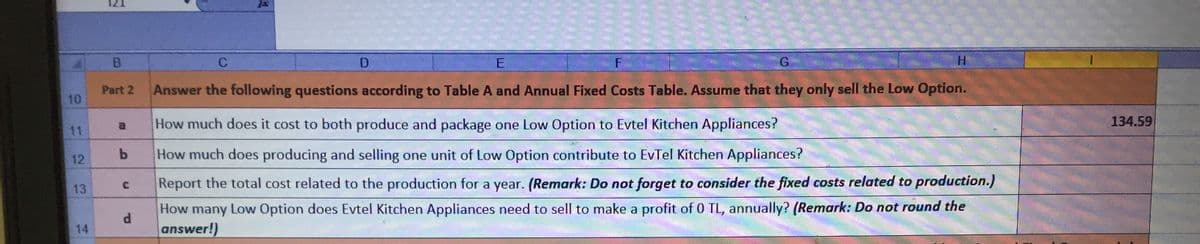

10 11 12 13 14 B D H Part 2 Answer the following questions according to Table A and Annual Fixed Costs Table. Assume that they only sell the Low Option. a How much does it cost to both produce and package one Low Option to Evtel Kitchen Appliances? b How much does producing and selling one unit of Low Option contribute to EvTel Kitchen Appliances? C Report the total cost related to the production for a year. (Remark: Do not forget to consider the fixed costs related to production.) d How many Low Option does Evtel Kitchen Appliances need to sell to make a profit of 0 TL, annually? (Remark: Do not round the answer!) 134.59

10 11 12 13 14 B D H Part 2 Answer the following questions according to Table A and Annual Fixed Costs Table. Assume that they only sell the Low Option. a How much does it cost to both produce and package one Low Option to Evtel Kitchen Appliances? b How much does producing and selling one unit of Low Option contribute to EvTel Kitchen Appliances? C Report the total cost related to the production for a year. (Remark: Do not forget to consider the fixed costs related to production.) d How many Low Option does Evtel Kitchen Appliances need to sell to make a profit of 0 TL, annually? (Remark: Do not round the answer!) 134.59

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

Show formula using Excel format

Transcribed Image Text:B.

D

E

F

G.

Part 2

Answer the following questions according to Table A and Annual Fixed Costs Table. Assume that they only sell the Low Option.

10

a.

How much does it cost to both produce and package one Low Option to Evtel Kitchen Appliances?

134.59

11

12

How much does producing and selling one unit of Low Option contribute to EvTel Kitchen Appliances?

Report the total cost related to the production for a year. (Remark: Do not forget to consider the fixed costs related to production.)

13

How many Low Option does Evtel Kitchen Appliances need to sell to make a profit of 0 TL, annually? (Remark: Do not round the

d.

14

answer!)

Transcribed Image Text:H.

K

35

36

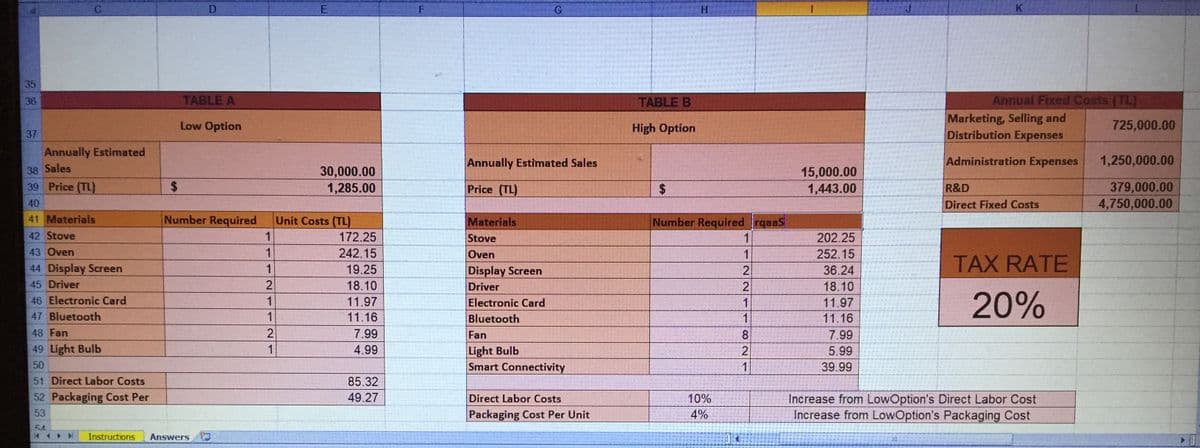

TABLE A

TABLE B

Annual Fixed Costs (TL)

Marketing, Selling and

Distribution Expenses

Low Option

High Option

725,000.00

37

Annually Estimated

Annually Estimated Sales

Administration Expenses

1,250,000.00

38 Sales

30,000.00

1,285.00

15,000.00

1,443.00

39 Price (TL)

$4

Price (TL)

2$

R&D

379,000.00

40

Direct Fixed Costs

4,750,000.00

41 Materials

Number Required

Unit Costs (TL)

Materials

Number Required rqaaS

42 Stove

1

172.25

Stove

1

202.25

43 Oven

1

242.15

Oven

1

252.15

TAX RATE

44 Display Screen

45 Driver

1

19.25

Display Screen

2

36.24

2

18.10

Driver

2

18.10

20%

46 Electronic Card

1

11.97

Electronic Card

Bluetooth

1

11.97

47 Bluetooth

1

11.16

1

11.16

48 Fan

2

7.99

Fan

8

7.99

49 Light Bulb

1

Light Bulb

Smart Connectivity

4.99

5.99

50

39.99

51 Direct Labor Costs

85.32

52 Packaging Cost Per

49.27

Direct Labor Costs

10%

Increase from LowOption's Direct Labor Cost

Increase from LowOption's Packaging Cost

53

Packaging Cost Per Unit

4%

54

Instructions

Answers

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education