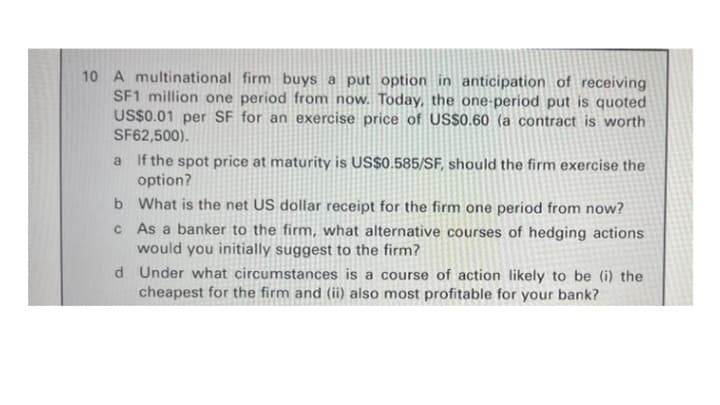

10 A multinational firm buys a put option in anticipation of receiving SF1 million one period from now. Today, the one-period put is quoted US$0.01 per SF for an exercise price of US$0.60 (a contract is worth SF62,500). a If the spot price at maturity is US$0.585/SF, should the firm exercise the option? b What is the net US dollar receipt for the firm one period from now? c As a banker to the firm, what alternative courses of hedging actions would you initially suggest to the firm? d Under what circumstances is a course of action likely to be (i) the cheapest for the firm and (ii) also most profitable for your bank?

10 A multinational firm buys a put option in anticipation of receiving SF1 million one period from now. Today, the one-period put is quoted US$0.01 per SF for an exercise price of US$0.60 (a contract is worth SF62,500). a If the spot price at maturity is US$0.585/SF, should the firm exercise the option? b What is the net US dollar receipt for the firm one period from now? c As a banker to the firm, what alternative courses of hedging actions would you initially suggest to the firm? d Under what circumstances is a course of action likely to be (i) the cheapest for the firm and (ii) also most profitable for your bank?

Chapter5: Currency Derivatives

Section: Chapter Questions

Problem 42QA

Related questions

Concept explainers

Question

M6

Transcribed Image Text:10 A multinational firm buys a put option in anticipation of receiving

SF1 million one period from now. Today, the one-period put is quoted

US$0.01 per SF for an exercise price of US$0.60 (a contract is worth

SF62,500).

If the spot price at maturity is US$0.585/SF, should the firm exercise the

option?

a

b What is the net US dollar receipt for the firm one period from now?

c As a banker to the firm, what alternative courses of hedging actions

would you initially suggest to the firm?

d Under what circumstances is a course of action likely to be (i) the

cheapest for the firm and (ii) also most profitable for your bank?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you