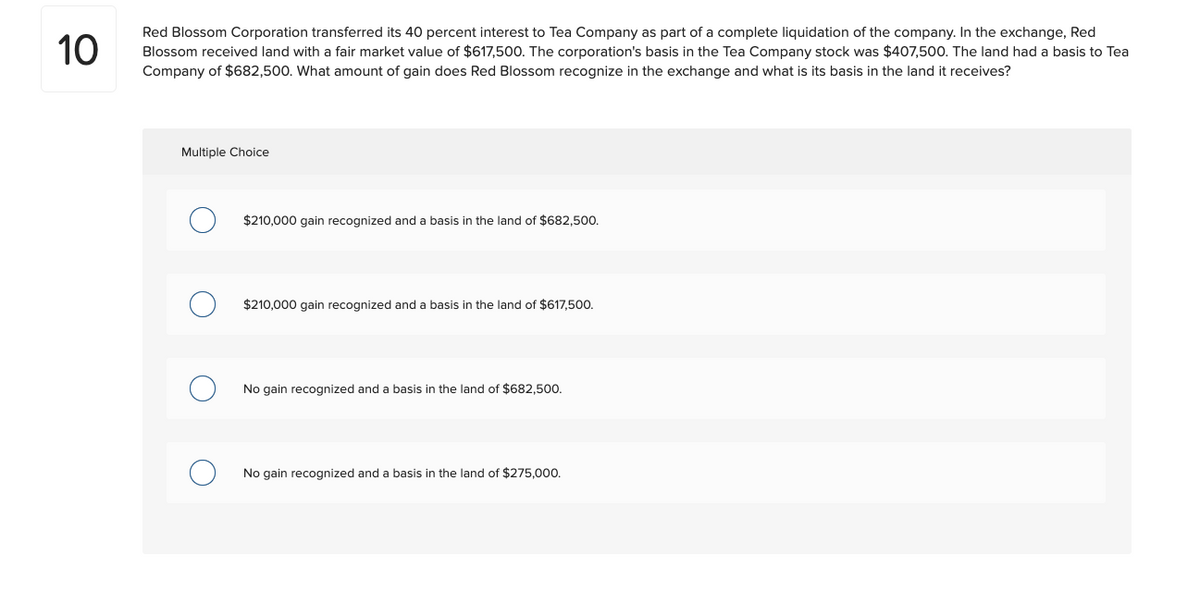

10 Red Blossom Corporation transferred its 40 percent interest to Tea Company as part of a complete liquidation of the company. In the exchange, Red Blossom received land with a fair market value of $617,500. The corporation's basis in the Tea Company stock was $407,500. The land had a basis to Tea Company of $682,500. What amount of gain does Red Blossom recognize in the exchange and what is its basis in the land it receives? Multiple Choice $210,000 gain recognized and a basis in the land of $682,500. $210,000 gain recognized and a basis in the land of $617,50o. No gain recognized and a basis in the land of $682,500. No gain recognized and a basis in the land of $275,000.

10 Red Blossom Corporation transferred its 40 percent interest to Tea Company as part of a complete liquidation of the company. In the exchange, Red Blossom received land with a fair market value of $617,500. The corporation's basis in the Tea Company stock was $407,500. The land had a basis to Tea Company of $682,500. What amount of gain does Red Blossom recognize in the exchange and what is its basis in the land it receives? Multiple Choice $210,000 gain recognized and a basis in the land of $682,500. $210,000 gain recognized and a basis in the land of $617,50o. No gain recognized and a basis in the land of $682,500. No gain recognized and a basis in the land of $275,000.

Chapter20: Corporations: Distributions In Complete Liquidation And An Overview Of Reorganizations

Section: Chapter Questions

Problem 25P

Related questions

Question

Transcribed Image Text:10

Red Blossom Corporation transferred its 40 percent interest to Tea Company as part of a complete liquidation of the company. In the exchange, Red

Blossom received land with a fair market value of $617,500. The corporation's basis in the Tea Company stock was $407,500. The land had a basis to Tea

Company of $682,500. What amount of gain does Red Blossom recognize in the exchange and what is its basis in the land it receives?

Multiple Choice

$210,000 gain recognized and a basis in the land of $682,500.

$210,000 gain recognized and a basis in the land of $617,50o.

No gain recognized and a basis in the land of $682,500.

No gain recognized and a basis in the land of $275,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you