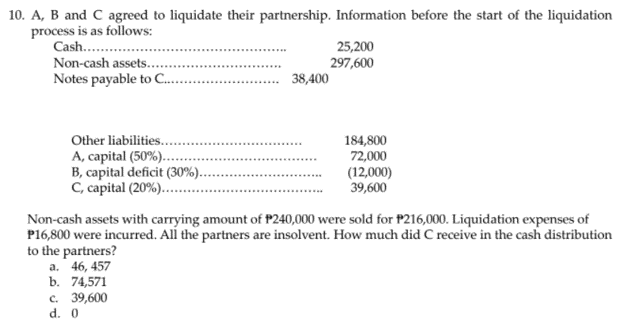

10. A, B and C agreed to liquidate their partnership. Information be process is as follows: Cash. . Non-cash assets... Notes payable to C..... 25,200 297,600 38,400 Other liabilities. A, capital (50%)... B, capital deficit (30%)... C, capital (20%).... 184,800 72,000 (12,000) 39,600

Q: In the context of a real-life company, an identification and discussion of the different types of co...

A: The question is related to Cost Accounting. Cost is the amount of resource given up in exchange of ...

Q: The following information relates to Modern, Inc.'s overhead costs for the month: Static budget vari...

A: Variance is a result of the difference between the actual and the planned results. Volume variance r...

Q: 8. Sam and Devon agree to go into business together selling college-licensed clothing. According to ...

A: Stock refers to the ownership stake that is issued by the company to raise funds from the market by ...

Q: Ali Mamat Enterprise Trial Balance as at 31 December 2019 Debit (RM) Credit (RM) 190,576 Particulars...

A: Formula: Net income = Revenues - Expenses

Q: Superior Skateboard Company, located in Ontario, is preparing to adjust entries on December 31, 2020...

A: Journal entry - It refers to the process where the business transactions are recorded in the books o...

Q: PROBLEM 2 Harris Supply Co. has the following transactions related to notes receivable during the la...

A: Solution:- Given, Harris Supply Co. has the transactions related to note receivable during the last ...

Q: Mack Company purchased equipment in 2018 for $122,000 and estimated an S12,000 salvage value at the ...

A: Depreciation: Depreciation means the reduction in the value of an asset over the life of the assets ...

Q: The net income for the year ended on September 30, 2020 for TC Corporation was $111,000. Additional ...

A:

Q: Ramon incorporated his sole proprietorship by transferring inventory, a building, and land to the co...

A: A sole proprietorship is an ego business with a sole proprietor who is taxed on earnings on a person...

Q: Walmart leases equipment to Staples on Jan 1, 2020. The lease is appropriately recorded as a purchas...

A: Lease: A lease refers to an agreement whereas the lessor transfers an asset to the lessee in return ...

Q: Element of financial position is a) Cash. b) Interest

A: This is a multiple-choice question for elements of financial statement in which we have to choose th...

Q: Company cell phone bill received, but not paid, $80 what will be the general entry?

A: Introduction: Journals: Recording of a business transactions in a chronological order. First step in...

Q: Identify which statement is incorrect: Sale of goods or services by any person or entity may re...

A: Tax is the amount of duty payable to government upon the happening of certain business transactions,...

Q: 5. Comerica's Balance Sheet information is given in the table below Assets Liabilities Reserves $75,...

A: Excess Reserves: The excess reserve is any money over the necessary minimum that the bank is holding...

Q: Sell or Process Further Turner Manufacturing Company makes a partially completed assembly unit that ...

A: Differential analysis is the process of comparing and contrasting the costs and advantages of severa...

Q: Presented below are the transactions of D'Leather Repair Shop owned by Mr. Jose Lao. Prepare the T-a...

A: The T-accounts are prepared to post the transactions to the specific accounts of the business.

Q: [The following information applies to the questions displayed below.] Saskatewan Can Company manufac...

A: Direct Material Quantity Variance: The direct material quantity variance (also known as the direct m...

Q: Required Information (The following information applies to the questions displayed below.] A company...

A: Solution 1-Calculation of recorded inventory at lower of Cost or NRV- Inventory Qty Lower of...

Q: The following information was extracted from the financial statements working papers file for year e...

A: A balance sheet is a representation of an individual's personal or corporation's financial balances ...

Q: During the current year, merchandise is sold for $158,900 cash and $434,900 on account. The cost of ...

A: Formula: Gross profit = Sales - Cost of goods sold

Q: Account Debit Credit

A: Income statement reflects profit or loss from business operations. Here we will ...

Q: Mementos Academy is assessing whether to outsource its student enrolment processes. The general proc...

A: Process Costing: Process costing is a bookkeeping technique that follows and collects direct expense...

Q: If Going Merry Inc. has a net income of P 200,000 and a net sales of P 5,050,000 during 2020; and a ...

A: Return on sales = Net incomeNet sales×100

Q: Problem 2. Tipan’s Company is planning to invest Php 40,000 in a 3-year project. Tipan’s expected ra...

A: Initial Investment = PV of Annual Cash Flows Cash Flow = Present Value of Cash Flow / Present Value ...

Q: Company cell phone bill received, but not paid, $80 what will be the general entry?

A: The question requires to prepare journal entry for cell phone bill received. The journal entry is th...

Q: Answer the questions below list of transactions: Jan 1 - Owner transferred cash by check from perso...

A: Since you have posted a question with multiple sub-parts we will do the first three sub-parts for yo...

Q: Pearce's Cicket Farm issued a 15-year, 10% semiannual bond 4 years ago. The bond currenty sells for ...

A: 1. Total book value of the debt = $ 60 million + 35 million = $95 million or $95,000,0...

Q: Decline Company is planning to produce and sell 20,000 units of its only product at a unit price of ...

A: Break even point = Fixed costs /Contribution margin per unit where, Contribution margin per unit = ...

Q: Department A had no Work in Process at the beginning of the period, 1.400 units were completed durin...

A: Solution: Department A Computation of Equivalent unit of Production Particulars Physical Unit...

Q: Ball Company has the following data: Units Produced: 500 finished goods units Direct Materials: $100...

A: In variable costing we should only consider variable costs, fixed overhead does not be included in p...

Q: Crane Company manufactures and sells two products. Relevant per unit data concerning each product fo...

A: Contribution Per Unit = Selling Price - Variable Cost Per Unit

Q: Best Birdies produces ornate birdcages. The company's average cost per unit is $18 when it produce...

A: Introduction:- Calculation of total cost when it produces 2,200 birdcages as follows:- =2,200 birdc...

Q: The Dimitros Company records the following transactions during September 2018: Cash sales to ...

A: Sales Revenue - Sales are recorded by company on cash and on credit basis. Cash collected on the sam...

Q: The following are budgeted data: January February March Sales in units... 15,000 20,000 18,000 Produ...

A: According to question, budgeted production units in February and March is 19,000 units and 16,000 un...

Q: Shapes 9. You and your spouse purchased a home 5 years ago for $110,000. The home was financed by pa...

A: Equity in Home: Equity is the distinction between what one owes on their home loan and what their ho...

Q: Accounting for Income Taxes Cullumber Corporation has one temporary difference at the end of 2020 th...

A: Lets understand the basics. When there is taxable temporary difference between the tax liability as ...

Q: Beryllium Company had $330,000 sales in December 20X1 and expects total sales of $360,000 in January...

A: Cash receipts is the amount of sales which is received. It shows the amount of sales which is collec...

Q: On January 2020, DEF Corporation is a VAT registered manufacturer ofrefined sugar, purchased in cash...

A: Let's understand some basics VAT= Value-Added-Tax A value-added tax (VAT) is a consumption tax that ...

Q: Lompany purchased equipment in 2018 for $122,000 and estimated an S12,000 salvage value at the end o...

A: Given info Cost of equipment $122,000 Salvage value $12000 Accumulated depreciation as at 31, Decem...

Q: BJ Company produces "JUICE". To produce JUICE, BJ will require 15 units of Material X at P8 per unit...

A: Absorption costing: Absorption costing is also called traditional costing. This method of costing di...

Q: J. Keith commenced business on 1 September, and had several special transactions during the month: ...

A: Solution A journal is a book in which a business records its business transactions. The process of r...

Q: Entries for Bonds Payable and Installment Note Transactions The following transactions were compl...

A: The question is based on the concept of Financial Accounting.

Q: Medical Assistance Developers (MAD) provides services to physicians including research assistance, d...

A: Requirement 1: Ethical issues involved are: Here, fraudulent financial reporting is included and th...

Q: gets $250 uniform allowance every month. Calculate CPP and El cont Also calculate her Employee's con...

A: Anjani's Annual Pay = $ 68350 Uniform Allowance ( $2...

Q: Vaughn Manufacturing incurs the following costs to produce 10,400 units of a subcomponent: Cost Info...

A: Acceptance of special offer has to be done after evaluating the existing costs and comparing with th...

Q: At the start of the year, the balance on Sara's capital account was $55.689. During the year Sara ma...

A: Lets understand the basics. For calculating ending balance of capital account, we will need to use b...

Q: In the late 1980s and the 1990s the number of banks declined as a result of failures and mergers. Tr...

A: Mergers and Failures were the reasons for decline in the number of banks in late 1980s and 1990s.

Q: Interest earned during the month O a. Subtract from the bank side O b. Add to the book side O c. Add...

A: Bank reconciliation: It is a statement drawn up by the business to verify the cash book balance with...

Q: Depreciation OMR 12000 Net Profit OMR 148000 The following accounts decreased during 2020 Accounts r...

A: Introduction: Statement of cash flows: All cash in and out flows are shown in cash flow statements. ...

Q: Haughton Company uses a job costing system for its production costs and a predetermined factory over...

A: It is already given that the overhead rate is applied on the basis of direct labour. Therefore the p...

Step by step

Solved in 2 steps with 1 images

- Before liquidation, the following is the financial position of the partnership W, X, Y and Z: W, capital 275,000 W, loan 50,000 X, capital 225,000 Y, capital 257,500 Z, capital 342,500 P&L ratio is 4:3:2:1, respectively. 300,000 was received from certain assets are sold and are distributed to partners. What cash amount should Z receive? a. 300,000 b. 0 c. 135,834 d. 166,166The statement of financial position for the partnership of AA, BB and CC who share profits in the ratio of 2:1:1, shows the following balances just before the liquidation: Cash P12,000 Other assets 59,500 Liabilities 49,000 AA, capital 22,000 BB, capital 15,500 CC, capital (15,000) On the first instalment of the liquidation, a gain of P8,525 was realized from the sale of certain assets. Liquidation expenses of P1,000 was paid, and additional liquidation expenses are anticipated. Liabilities paid amounted to P34,000. Remaining book value of other assets is P1,550. On the first payment to partners, AA receives P6,250. How much is the amount of cash withheld for anticipated liquidation expenses and unpaid liabilities?A balance sheet for the partnership of A, B, and C, who share profits 2:1:1, shows the following balances just before liquidation: Cash: P48,000Other assets: 238,000Liabilities: 80,000A, Capital: 88,000B, Capital: 62,000C, Capital: 56,000 On the first month of liquidation, certain non-cash assets were sold resulting to a loss of P23,000. Liquidation expenses of P4,000 were paid, and additional liquidation expenses of P3,200 are withheld to anticipate payment before liquidation is completed. After creditors were paid, partner B received P13,000 on the initial installment. Determine the total book value of the non-cash assets on the first month.

- Partners E, F, and G who share profits and losses in the ratio of 2: 2: 1, respectively decided to liquidate. The condensed statement of financial position immediately prior to the liquidation shows the following: Cash P 400,000 Non-cash Assets 1,600,000 Liabilities 560,000 E, Loan 40,000 E, Capital 180,000 F, Capital 420,000 G, Capital 800,000 After paying liabilities to partnership creditors, cash of P830,000 is available for distribution to partners. Any…10 As of December 31, 2020, the books of ABC partnership showed capital balances of: A, P60,000; B, P30,000 and C, P5,000. The partnership's profit or loss ratio was 5:3:2, respectively. The partners decided to liquidate and they sold all non-cash assets for P40,000. After the settlement of all liabilities amounting to P10,000, they still have cash of P20,000 left for distribution. Assuming that any capital debit balance is uncollectible, determine payment to partner B at the end of the liquidation.The ABC Partnership is to be liquidated. The ledger shows the following: Cash $ 70,000 Noncash Assets 220,000 Liabilities 90,000 A, Capital 85,000 B, Capital 90,000 C, Capital 25,000 A,B, and C's income ratios are 5:3:2, respectively. The non-cash assets are sold for $170,000. Instructions Prepare a schedule of liquidation using the following chart: Cash NC assets Liabilities A, Cap B, Cap C, Cap Beg Balance Sale of assets Balance Pay liabilities Balance Distribute cash End Balance Prepare the 4…

- A balance sheet for the QRS Partnership, which shares profits and losses in the ratio of 5:3:2 shows the following balances just before liquidation: Cash, P30,000; Other assets, P148,750; Liabilities, P50,000; Q, Capital, P55,000; R, Capital, P38,750; and S Capital, P35,000. On the first month of liquidation, certain assets are sold for P80,000. Liquidation expenses of P2,500 is paid, and additional expenses are anticipated. Liabilities are paid amounting to P13,500, and sufficient cash is retained to ensure payment to creditors before making payment to partners. On the payments to partners, Q receives P15,625. Calculate the amount of cash withheld for anticipated liquidation expenses.5. In January 1, 2009, partners AAA, BBB and CCC, who share profits and losses in the ratio of 5:3:2, respectively, decided to liquidate their partnership. On this date, the partnership’s condensed balance sheet was as follows: Cash P 50,000 Other assets 250,000 P 300,000 Liabilities P 60,000 AAA, capital 80,000 CCC, capital 90,000 BBB, capital 70,000 Total P 300,000 On June 15, 2009, the first cash sale of other assets with a carrying amount of P150,000 realized P120,000. Safe…The accounts of the partnership of R, S and T at the end of its fiscal year on November 30, 2021 are as follows:Cash 103,750 Loan from S 20,000 Other Non cash assets 707,500 R, Capital (30%) 266,250Loan to R 15,000 S, Capital (50%) 136,250Liabilities 262,500 T, Capital (20%) 141,250S received P50,000 in settlement of his equity. 13. Which of the following statements is incorrect? a. Total amount distributed to partners is P336,250. b. Total amount paid to creditors is P262,500. c. Total amount realized from the non-cash assets is P598,750. d. R received an amount equal to P187,500

- As of December 31, 2021, the books of GOV Partnership showed the following balances: G – P400,000; O – P250,000; V – P50,000; Liabilities – P500,000; Cash – P55,000. The noncash assets include Accounts Receivable – V for P20,000. The partners share profits and losses in the ratio of 3:1:2. The partners decided to liquidate by installment after unfavorable results of operation for the last three years. Before the liquidation starts, the bookkeeper discovered unpaid bills amounting to P15,000 they scheduled payment immediately. In the first month, 50% of the noncash assets were realized for P500,000. Liquidation expenses of P10,000 and P350,000 of liabilities were paid. At the end of the first month, the available cash was paid to partners after setting aside P5,000 for contingencies. How much cash was available to partners?1. As of December 31, 2022, the books of AME Partnership showed capital balances of A, P40,000; M, P25,000; E P50,000. The partner’s profit and loss ratio was 3:2:1, respectively. The partners decided to liquidate and they sold all non-cash assets for P37,000. After settlement of all liabilities amounting to P12,000, they still have cash of P28,000 left for distribution. Assuming that any capital debit balance is uncollectible, the share of A in distribution of the P28,000 cash would be: A. P18,000 B. P0 C. P19,000 D. P17,800 2. Cloe, Doe and Lida are partners with capital balances on December 31, 2021 of P300,000, P300,000 and P200,000 respectively. Profits are shared equally. Lida wishes to withdraw and it is agreed that she is to take certain furniture and fixtures with second hand value of P50,000 which are carried on the books at P65,000. Brand new, the furniture and fixtures may cost, P80,000. How much is the value of the note that Lida will get from the…35. The statement of financial position for the partnership of BBB, CCC and DDD who share profits in the ratio of 2:1:1, shows the following balances just before the liquidation: Cash P12,000Other assets 59,500Liabilities 49,000BBB, capital 22,000CCC, capital 15,500DDD, capital (15,000) On the first installment of the liquidation, a gain of P8,525 was realized from the sale of certain assets. Liquidation expenses of P1,000 was paid, and additional liquidation expenses are anticipated. Liabilities paid amounted to P34,400. Remaining book value of other assets is P1,550. On the first payment to partners, CCC receives P6,250. The amount of cash withheld for anticipated liquidation expenses and unpaid liabilities is: a. 11,475b. 14,600c. 26,075d. 29,200