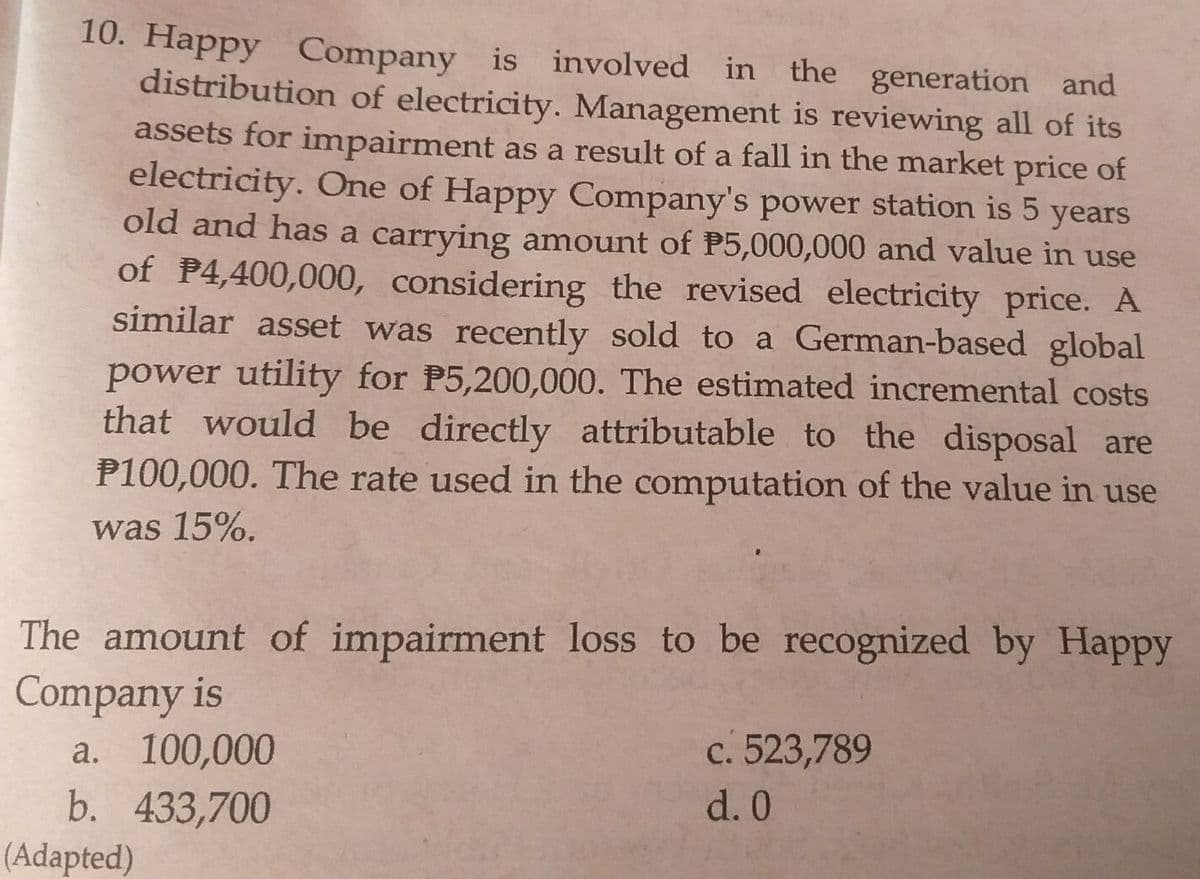

10. Happy Company is involved in the generation and distribution of electricity. Management is reviewing all of its assets for impairment as a result of a fall in the market price of electricity. One of Happy Company's power station is 5 years old and has a carrying amount of P5,000,000 and value in use of P4,400,000, considering the revised electricity price. A similar asset was recently sold to a German-based global power utility for P5,200,000. The estimated incremental costs that would be directly attributable to the disposal are P100,000. The rate used in the computation of the value in use was 15%. The amount of impairment loss to be recognized by Happy Company is a. 100,000 b. 433,700 c. 523,789 d. 0

10. Happy Company is involved in the generation and distribution of electricity. Management is reviewing all of its assets for impairment as a result of a fall in the market price of electricity. One of Happy Company's power station is 5 years old and has a carrying amount of P5,000,000 and value in use of P4,400,000, considering the revised electricity price. A similar asset was recently sold to a German-based global power utility for P5,200,000. The estimated incremental costs that would be directly attributable to the disposal are P100,000. The rate used in the computation of the value in use was 15%. The amount of impairment loss to be recognized by Happy Company is a. 100,000 b. 433,700 c. 523,789 d. 0

Auditing: A Risk Based-Approach (MindTap Course List)

11th Edition

ISBN:9781337619455

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Chapter12: Auditing Long-lived Assets And Merger And Acquisition Activity

Section: Chapter Questions

Problem 28RQSC

Related questions

Question

Transcribed Image Text:10. Happy Company is involved in the generation and

distribution of electricity. Management is reviewing all of its

assets for impairment as a result of a fall in the market price of

electricity. One of Happy Company's power station is 5 years

old and has a carrying amount of P5,000,000 and value in use

of P4,400,000, considering the revised electricity price. A

similar asset was recently sold to a German-based global

power utility for P5,200,000. The estimated incremental costs

that would be directly attributable to the disposal are

P100,000. The rate used in the computation of the value in use

was 15%.

The amount of impairment loss to be recognized by Happy

Company is

a. 100,000

b. 433,700

(Adapted)

c. 523,789

d. 0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning