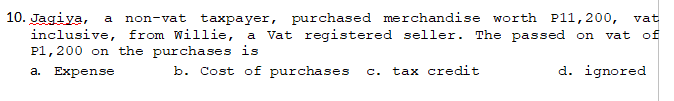

10. Jagiya, a non-vat taxpayer, purchased merchandise worth P11, 200, vat inclusive, from Willie, a Vat registered seller. The passed on vat of P1, 200 on the purchases is a. Expense b. Cost of purchases C. tax credit d. ignored

Q: The Goods in Process Inventory account for the AB Corp. follows: Goods in Process Inventory…

A: This question requires us to calculate the Cost of units transferred to finished goods. Cost of…

Q: Use the following financial information to find the entry you would make on an income statement for…

A: Income statement is prepared by the business organization so as to know how much amount of gross…

Q: The following balances are shown in the shareholders' equity of tamarind company on December 31,…

A: Introduction: Shareholders' equity is owners' equity who has claim over the net assets of the…

Q: Explain the scope of Audit Committee of the company with five valid points?

A: Audit committee plays an vital role in the organisation, where it helps to interact with the…

Q: The following accounts were taken from the Adjusted Trial Balance columns of the work sheet:…

A: Introduction: Net income refers to the amount an individual or business makes after deducting costs,…

Q: Assimilator Corp. is in the business of leasing equipment. Assimilator purchased new equipment on…

A: “Since you have posted a question with many sub-parts, we will solve three sub-parts for you. To get…

Q: A company previously issued $2,000,000, 10% bonds, receiving a $120,000 premium. On the current…

A: During retirement of a bond, if its book value is more than the cash paid to the bond holders it…

Q: Samer Corp. uses a job order cost accounting system. The following is selected information…

A:

Q: Charlie's Indifference curves have the equation y constant/x, where larger constants correspond to…

A: Y = constant/X Constant = Y*X Where constant shows utility, thus Utility = X*Y (5,13)=> utility =…

Q: A company

A: The total cost of production of a good comprises of the total fixed cost of production and the total…

Q: I The company is processing a product in 4 departments A, B, C, and D as the last department. The…

A: The production cost report is prepared in three parts which are as follows:-1. Physical Flow…

Q: ABC Corporation, a foreign corporation sold its 100,000 shares with par value of P 15 per share to…

A: A foreign corporation's capital gains tax rate is 15% of the net capital gains w.r.f April 11th…

Q: Vini was owed RM200 by a debtor, Kelvin. However, Kelvin was declared bankrupt. Vini later received…

A: Current assets are those assets which are held by the business for shorter period of time, say less…

Q: Required information [The following information applies to the questions displayed below.] The…

A: Payroll is the payment that a company is required to pay to its employees for a set period of time…

Q: 4). Usne Millers is considering the acquisition of a new milling machine for their operations. The…

A: Present value: Determination of present value is very useful in analyzing capital budgeting…

Q: Below are four levels of ERP value realization:

A:

Q: 1. Equivalent production for materials is: a. 50,000 b. 45,000 c. 40,000 d. 43,000 2. Equivalent…

A: Units Received - 50000 Units Completed and Transferred - 40000 Units in Process end (60% completed)…

Q: X, a minimum wage earner. In 2018, his salary and overtime pay totaled 200,000 and his hazard pay is…

A: In the context of the given question, we are required to compute the taxable income of X in 2018.…

Q: Your answer is correct. Using time value of money tables, a financial calculator, or Excel…

A: Lease refers to a contract between two parties under which one party who is the real owner of an…

Q: An entity has 100 employees, who are each entitled to five (5) working days of paid sick leave for…

A: This question deals with the IAS 16 "Employees benefits" Employees also get benefits other than the…

Q: 11 A company that has a large investment in property, plant and equipment and that fails to…

A: Investment is a type of process wherein a person puts money into for a specific period of time ,…

Q: At the 15 January 2019 , the amount of Retained earnings reported by Moon Corporation is $ 2.500.000…

A:

Q: A firm has the following expenditure on 4 years-old Machine during 201 () Ordinary Repairs: $100 (i)…

A: Introduction: Machinery is a part of fixed asset for any organization. A fixed asset is an asset…

Q: Jones Supply Services paid $350 cash, the amount owed from the previous month, to a materials…

A: Lets understand the basics. When any supplies sales on credit with a term to receive payment after…

Q: Use the information on the following job cost sheet to determine the total cost of Job 56. (Round…

A: The predetermined overhead rate is calculated as estimated overhead cost divided by estimated direct…

Q: 2. liven : P= P60 V = 4% + 15 find the interest and maturity value

A: Lets understand the basics. For calculating interest and maturity value we need to use below…

Q: a. Equipment with a book value of $79,000 and an original cost of $167,000 was sold at a loss of…

A: Purchases of physical assets, investments in securities, the sale of securities or assets are all…

Q: .Statement 1: Non-resident individual taxpayer are also subject to 15% final tax on their income…

A: The capital gains tax is related to appreciation in the value of capital assets or gains realized on…

Q: QUESTION 4 Which of the following strategies in implementing the Team's Initial Audit is associated…

A: Option 2) Strategy B Is the correct Option

Q: Assuming that a perpetual inventory system is used, what is ending inventory (rounded) under the…

A: Inventory valuation refers to the methods used by the company to determine the value of its…

Q: 1. Depreciation on the company's equipment for the year is computed to be $18,000. 2. The Prepaid…

A: Every business needs to report all incomes, expenses, assets and liabilities accurately. Adjusting…

Q: Required: 1. Complete the schedule of the company's total costs and costs per unit as given in the…

A: Under CVP analysis, variable costs per unit will be the same and the total variable costs will…

Q: During the past year, a plumbing supply house sold 504 faucets. Inventory records for the year are…

A: Introduction: Under FIFO method of inventory, inventory which comes first are sold first. Hence…

Q: The table shows financial data for Purrfect Pets, Incorporated as of June 30, Year 3. Accounts…

A: Balance sheet is a statement that records the company's assets , liabilities and equity on a…

Q: Activity 4 Robinson Machine Shop data for producing 40 parts for Job # 10 as follows: • Raw…

A: The statement of cost of goods manufactured is prepared to record the cost of goods completed during…

Q: Ramos Inc. has total assets of $1,100 and total liabilities of $800 on December 31, 20Y6. Assume…

A: Assets, December 31, 20Y7 = $1,100 + $200 + $1,300 Liabilities, December 31, 20Y7 = $800 - $100 =…

Q: Perform a horizontal analysis for the balance sheet entry "Cash" given below. That is, find the…

A: In Horizontal Analysis, the comparison is made between different periods of the business entity. In…

Q: Included on the balance sheet are O a. income and expenses. O b. assets, liabilities, and owner's…

A: The financial statements of the business includes the income statement and balance sheet. The income…

Q: Sheffield Corp. produces several products that can be sold at the split-off point or processed…

A: Additional revenue = Sales value after further processing - Sales Value at split off

Q: lated as $100,000 m has a Specific Construction Loan of $300,000 at 5 st per annum. voidable…

A: Avoidable Interest: It is the amount of interest cost on loan during the period, which is…

Q: Calculate the quick assets (in $) and acid test ratio for the given company. Round ratios to the…

A: Quick assets includes such current assets that can immediately be converted into cash. It assess…

Q: Based on the following data for the current year, what is the number of days' sales in receivables…

A: Average accounts receivable = (Accounts receivable, beginning of year + Accounts receivable, end of…

Q: Show Depreciation entry for 2018 year On January 2, 2018, McKnight Furniture purchased display…

A: Depreciation- Depreciation is recorded as an expense in accounting because the value of an asset…

Q: Several years ago, Westmont Corporation developed a comprehensive budgeting system for planning and…

A: The variance is the difference between the actual data and standard output of the production. The…

Q: Yolo Corporation experienced financial difficulty in 2020. It decided to go into note receivable…

A: Journal Entries- Journal entries are the visual representation of business transactions. A general…

Q: In a corporate corporation, which of the following is included in the equity section? Investing in…

A: Equity section of a corporation business represents amount attributable to shareholders of the…

Q: question number 4 and number 5 was not answered? 4. How much must your organization have in…

A: Sales dollars to earn desired profit is the estimate of sales amount to generate the required net…

Q: Emily owns three businesses: a dry cleaner, a market, and a candy store. The dry cleaner has revenue…

A: Revenue Recognition: In generally accepted accounting principles (GAAP), "revenue recognition"…

Q: Salmyia bought land, buildings and equipment for a combined cash payment of $800,000. The estimated…

A: Formula: Amount capitalized for Equipment = Combined cash payment x % of Total fair value for…

Q: Montoya Tutoring Service completed the following transactions: Mar. 1 Bought equipment for $5,798…

A: Journal entry: It refers to the recording of company's financial transactions that are entered into,…

Step by step

Solved in 2 steps

- 1. The taxpayer is VAT-registered. He purchased goods from a VAT-supplier for 200,000 price exclusive of VAT. He sold the goods for 448,000 inclusive of VAT. In preparing the journal entry, how much should be debited to "Purchases"? A. 200,000 B. 224,000 2. The taxpayer is VAT-registered. He purchased goods from a VAT-supplier for 200,000 price exclusive of VAT. He sold the goods for 448,000 inclusive of VAT. In preparing the journal entry, how much should be credited to "Sales"? A. 448,000 B. 400,000 3. The taxpayer is NON-VAT-registered. He purchased goods from a VAT-supplier for 200,000 price exclusive of VAT. He sold the goods for 448,000. How much input can he claim? A. 24,000 B. zeroMs. Callie sold goods worth P201,600 (inclusive of vat) to Ms. Dani on account. Ms. Dani purchased goods from Mr. Elise worth P200,000 (exclusive of vat) on account.All of them are VAT registered taxpayers. How much is the balance of input tax of Dani at the end of the period? How much is the balance of Purchases account of Ms. Dani at the end of the period?1. The taxpayer is VAT-registered. He purchased goods from a VAT-supplier for 200,000 price exclusive of VAT. He sold the goods for 448,000 inclusive of VAT. How much is the output VAT? A. 48,000B. 53,760 2. The taxpayer is VAT-registered. He purchased goods from a VAT-supplier for 200,000 price exclusive of VAT. He sold the goods for 448,000 inclusive of VAT. How much is the input VAT? A.24,000B. 26,880 3. The taxpayer is VAT-registered. He purchased goods from a VAT-supplier for 200,000 price exclusive of VAT. He sold the goods for 448,000 inclusive of VAT. How much is the NET VAT Due and payable? A. 26,880 B. 24,000

- 36 ZZZ is engaged in a VAT-business and a non-VAT business. Her records show the following data, no tax included, for the taxable year: Sales From VAT business P 6,000,000 From non-VAT business 4,000,000 Purchases of goods For VAT business from VAT suppliers 3,000,000 For non-VAT business 2,000,000 Purchases from VAT suppliers of supplies used for VAT and non-VAT Business 30,000 Expenses incurred for both VAT and non-VAT business (70% of these expenses were paid to VAT-registered enterprises) 100,000 The VAT payable is:The taxpayer started operating a grocery store during 2015. He submits the following data: Merchandise Inventory P 469,000 Gross sales 2,814,000 Purchases from VAT registered entities (net) 1,563,000 Purchases from non-VAT registered entities 312,000 Determine the following: What is the applicable business tax for the taxpayer? How much is the correct business tax due? Assume the taxpayer is non-VAT registered, how much is the VAT payable for the year? Assume the taxpayer is VAT registered, how much is the VAT payable for the year?Johnson’s Hardware, a registered taxpayer, during the month of December purchased $100 000 of standard rate merchandise. During the same month cutlass costing $300 000 and taxable consulting services amounted to $90 000 was incurred respectively. The total sales inclusive of GCT for the month amounted to $1 500 000. All merchandise purchased was sold with a mark rate of 30%. Required: a. List four (4) obligations of Johnson’s hardware as a registered taxpayer. b. Differentiate between the following terminologies: i. tax avoidance and tax evasion ii. input and output tax iii. standard rated items and zero rated items. c. Compute the following for the month of December 2013 for Johnson’s hardware: i. total input tax ii. output tax iii. tax liability

- [Third Item: Multiple Choice] Yvonne, a non-VAT registered taxpayer, operates a small variety store. Her gross sales or receipts of the preceding taxable year did not exceed P3,000,000. In July, of the current taxable year, the records presented the following data: Gross Sales P250,000 Purchases from a VAT-registered person 180,000 Merchandise Inventory, ending 100,000 The amount of percentage tax due and payable is a. P7,500 b. P8,400 c. P 5,400 d. P30,000[First Item] The following statements are correct relative to a non-VAT registered taxpayer with a gross annual sale of not more than P3,000,000, except: a. The taxpayer is subject to 3% percentage tax. b. The taxpayer may opt to register under the excise tax system based on the value of goods sold at the appropriate tax rate. c. The taxpayer may opt to register under the 12% value -added tax system. d. The taxpayer, once registered under his/her preferred option, shall not be allowed to cancel his/her registration for the next three years1. Jessie is a non-VAT seller of goods. Since he has no official receipts or invoices to support his expenses, he opted for the Optional Standard Deduction (OSD). When he filed his income tax return, he intentionally applied the rate of 20% on his gross sales. In this case, Jaime applied this type of scheme: a. Capitalization b. Shifting c. Evasion d. Avoidance

- 1. The taxpayer is NON-VAT-registered. He purchased goods from a VAT-supplier for 200,000 price exclusive of VAT. In preparing the journal entry, how much should be debited to Purchases? A. 200,000 B. 224,000 2. A VAT taxpayer purchased goods for P900,000 and paid input VAT of P108,000 for the same. He sold the goods directly to a non-resident customer in Indonesia for a total of P1,200,000 equivalent. How much is the excess input VAT? A. 108,000 B. zero 3. A VAT taxpayer purchased goods for P900,000 and paid input VAT of P108,000 for the same. He sold the goods directly to a non-resident customer in Indonesia for a total of P1,200,000 equivalent. How should the excess input VAT be treated? A. As a tax credit (deduction against other output VAT or revenue tax) B. As a tax refund C. either of the two aboveTRUE OR FALSE It is mandatory to register as a VAT Taxpayer once the sales exceed 3M. During Cory Aquino's presidency, 10% VAT was introduced and only selected products was covered by the tax. Internal Financing is subject to voluminous documentation and timing is unpredictable. More transaction costs and subject to pay-out and control restrictions. The name of the account stated in the Purchase Journal is the same as the Chart of Account used in the recording of the transaction. 2550M BIR Form is used for Percentage Tax Remittances also.Assume the following transactions with the corresponding invoice cost, inclusive of Value Added Tax, if applicable: Apol, non-vat taxpayer, sells to LJ, vat taxpayer P89,600LJ, vat taxpayer, sells to Chris, vat taxpayer P134,400Chris, vat taxpayer, sells to Abi P201,600Abi, nonvat taxpayer, exported the goods in Canada P300,000 Required: Determine the following:A Vat payable of ApolB Vat payable of LJC Vat payable of ChrisD Vat payable of Abi