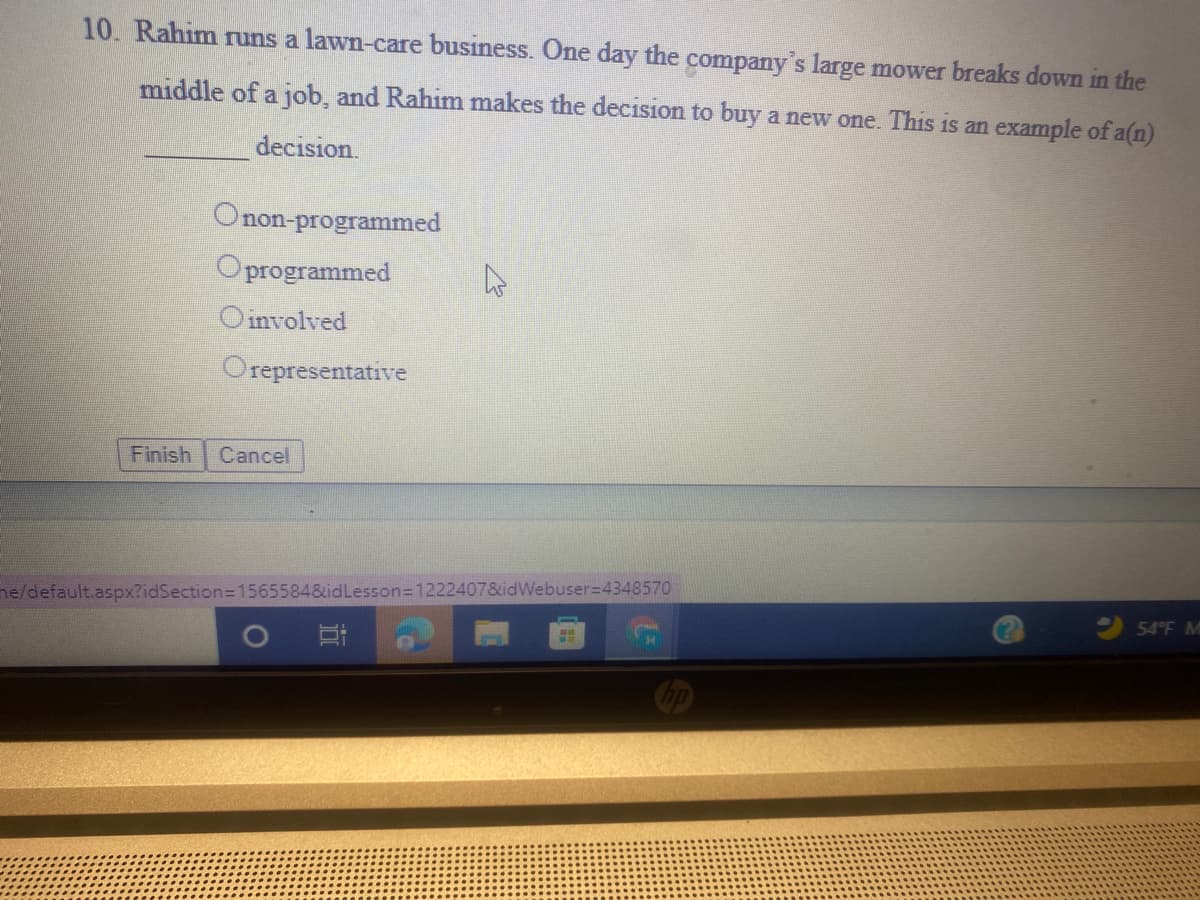

10. Rahim runs a lawn-care business. One day the company's large mower breaks down in the middle of a job, and Rahim makes the decision to buy a new one. This is an example of a(n) decision. Onon-programmed Oprogrammed Oinvolved Orepresentative

Q: I don't understand how to get the percentage for the Sales to start off.... Income statement inf...

A: For vertical analysis of income statement, the accounts of income statement are compared with the sa...

Q: Espresso Express operates a number of espresso coffee stands in busy suburban malls. The foxed weekd...

A: Average cost per cup of coffee served is = (fixed cost + total variable cost) / total number of cup ...

Q: eith bought a desktop computer and a laptop computer. Before finance charges, the laptop cost wo dif...

A: Given

Q: This month, a company receives $6,000 from a regular customer, of which $4,000 is for products deliv...

A: Under the accrual basis of accounting, the revenue recognition principle of accounting states that t...

Q: An annuity-immediate has 3 annual payments of $200, followed by a perpetuity of $300 starting in the...

A: solution given cash flow diagram Year Cash flow Beginning of year 1 200 Beginning of...

Q: An inventory count shows that teaching supplies costing $2.800 are available at year-end. Note: Ente...

A: Adjustment for teaching supplies expense = Unadjusted teaching supplies - Closing inventory count ...

Q: For a defined benefit pension plan, pension expense consists of five components, for which the formu...

A: Defined Benefit Pension Plan: As opposed to directly relying on individual investment performance, a...

Q: ! Required information Use the following information to answer questions. (Algo) [The following info...

A: 1. DIRECT LABOR USED : = TOTAL FACTORY PAYROLL - INDIRECT LABOR = $250,000 - $57,500 = $192,500 ...

Q: The company sold machines 1/1 / 20X5 in X for 163,350 € which will be paid 31.12.20X6. A charged X w...

A: Effective interest rate is nothing but compunding of the interest. As compared to...

Q: An annuity-immediate has 3 annual payments of $200, followed by a perpetuity of $300 starting in the...

A: solution given cash flow diagram Year Cash flow Beginning of year 1 200 Beginning of...

Q: Manufacturing Overhead (2) 9,000 (2) 167,000 (3) 15,000 (4) 80,000 (5) 30,000 (6) 25,000 159,000 167...

A: Lets understand the meaning of overapplied and underapplied overhead. When actual overhead is more t...

Q: Use the following information for Exercises 16-18 below. [The following information applies to the q...

A: Net income = Consulting fees earned - Rent expense - Salaries expense - Telephone expense - Miscella...

Q: Total Liabilities amounts to P500,000. Total owner's equity is thrice the liabilities. How much is t...

A: Accounting Equation: accounting equation is the basis of accounting which is Total Asset = Total Deb...

Q: Select and "X" in the column that corresponds to the cost classification for each of the following s...

A: Sunk Cost: In accounting and business, a sunk cost is a cost that has already been incurred and that...

Q: luna Company sold 700,000 boxes of “puto” mix under a new sales promotional program. Each box contai...

A: Liability is the obligation for the owner of the entity in which certain amounts are to be paid back...

Q: K Jan 21: Payroll costs were incurred as follows: $18,000 for stitching assembly workers, $9,000 for...

A: A ledger is a log or list of accounts that keep track of account transfers.

Q: Cumulative shares : Select one: a. Is a type of common shares that allows certain shareholders to ow...

A: Preference shares are those shares that are given preference for dividends over the common stockhold...

Q: Does buying and selling of debt instruments maturing in one year or less, a characteristic of money ...

A: Money markets issue and trade debt securities with maturities of one year or less. Capital markets a...

Q: Jeremy earned $100,500 in salary and $6,250 in interest income during the year. Jeremy’s employer wi...

A: The Child Tax Credit is a tax benefit allowed to taxpayers for each dependent child. The tax law all...

Q: You have a team of engineers working on your project. Two of the engineers have frequent disagreemen...

A: In a nutshell, the two engineers are having constant disagreements. Even after many attempts, they a...

Q: The Bread Company is planning to purchase a new machine that it will depreciate on straight-line bas...

A: The Accounting rate of retrun is calculated with the help of following formula ARR = Average Annual ...

Q: QS 1-7 a. Total assets of Charter Company equal $700,000 and its equity is $420,000. What is the amo...

A: The accounting equation states that assets equals to sum of liabilities and shareholders equity.

Q: Ann Corporation reported pretax book income of $1,000,000. Included in the computation were favorabl...

A: Book equivalent of taxable income = Pre Tax Book Income (+/-) Temporary Differences Total Income Tax...

Q: P6-2. LMVL Co., a publicly listed company, reported earnings for the year amounting to Php25 Million...

A: P:E Ratio = Market value per share / Earnings per share where, Earnings per share = (Net income - Pr...

Q: talented painters. Last year, they started painting postcards which they gave to their friends as a ...

A: EBIT is Sales- variable cost - fixed cost other then interest and taxes Required unit sale for des...

Q: Determine the missing amount from each of the separate situations given below. Assets Liabilities %3...

A: A company's total assets equal the sum of its liabilities and shareholders' equity, according to the...

Q: Diane’s Designs is a small business run out of its owner’s house. For the past 6 months, the company...

A: Variance analysis is one of the technique of management accounting, under which actual data is compa...

Q: k split includes a: Select one: a. None of the available choices b. Credit to the associated shares ...

A: A stock split is a decision taken by a company's board of directors to increase the number of shares...

Q: Use the following information to answer questions. (Algo) [The following information applies to the ...

A: The journal entries are prepared to keep the record of day to day transactions of the business. The...

Q: Jeffrey secured a 3-year car lease at 5.60% compounded annually that required her to make payments o...

A: Solution Given Rate of interest 5.60% compounded annually Number of period 3 year Pa...

Q: a. An analysis of WTI' Insurance policies shows that $2,400 of coverage has expired. b. An Inventory...

A: Adjusted trial balance is prepared by management for its own use. It is not part of financial statem...

Q: During 2019 (its first year of operations) and 2020, Fieri Foods used the FIFO inventory costing met...

A: The income statement is one of the important financial statement of the business which is prepared t...

Q: Peter Corp acquired the net identifiable assets of Simon Corp by issuing its own 5,000 ordinary shar...

A: In the Acqusition cost of equity the expenses like legal and brokerage fees, due diligence, audit fe...

Q: asing revisions their cos for Project A and Project B, as outlined below. Project A Pr Project A's r...

A: Internal rate of return (IRR) is rate at which the NPV is zero . In other words where the present va...

Q: It costs a company 14 of variable and 6 of fixed cost to produce a product Z200 that sells for 35. A...

A: Fixed cost is not considered whenever there is unused capacity.

Q: Tomlison Corporation is a manufacturer that uses job-order costing. The company has supp following d...

A: Given, Cost of goods sold = $1,517,000 The cost of goods manufactured is transferred to Finished ...

Q: The shareholders’ equity section of Corporation’s statement of financial position as of December 31,...

A: Share Premium Share premium is the additional amount which are raised by the entity after issuing th...

Q: Use the following information for the Exercises below. (Algo) [The following information applies to ...

A: The total cost of producing a product, including raw materials and operating costs, is detailed in a...

Q: In the standard cost formula Y = a + bX, what does the "Y" represent? total cost variable cost per u...

A: Variable cost: Variable cost refers to that cost which gets increased with the increase in the volum...

Q: Total assets of SanaOl Co. amounts to P2,550,000 with equal liabilities and equity amounts. How much...

A: The accounting equation states that assets equals to sum of liabilities and shareholders equity.

Q: Project A as well as project B require an initial investment of $1,050,000, have a 6-year life, and ...

A: The cash payback period refers to the capital budgeting technique which tells in how many years/peri...

Q: 19. On January 5, 2020, Purpose Corporation purchased 70% of Showtime Company's P10 par ordinary sha...

A: 1. Purpose Corporation is the holding company and Showtime Company is the subsidiary company. 2. Sha...

Q: I need the answer as soon as possible

A: In this question, we have to do journal entries For recording the material used For assigning fact...

Q: Explain how the consideration to be paid should be accounted for in our consolidated financial state...

A: solution concept The accounting for the consideration to be paid is little complex and shall be acco...

Q: For a liability to exist a. There must be a past transaction or event b. The exact amount must be k...

A: Solution: A liability is a present obligation as a result of past event that requires outflow of eco...

Q: conceptual framework of accounting

A: Conceptual framework is developed by FASB to act as a fundamental check to develop accounting standa...

Q: 15. Francis Company issued 1,300 shares of its outstanding shares of Zamora Company. The shares are ...

A: (Note - Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the questi...

Q: Alibaba Manufacturing manufactures widgets for distribution. The standard costs for the manufacture ...

A: 1 Rate at which Total factory overhead applied =Budgeted factory overhead / Estimated widget produce...

Q: ined the following: Accounts payable $ 107,500 Note payable $157,000 Accounts receivable ...

A: Solution: Non current liabilities are those liabilities which are not due to be paid within next one...

Q: Table 4: The Financial Determinants of Zaharah Sdn. Bhd. Cash Conversion Cycle for 2013 to 2020. Jad...

A: Cash Conversion Cycle(CCC): When a corporation converts its investments in inventory and other resou...

A manager's programmed decisions are those that he or she has made before. Despite being well-organized and following preset rules in the decision-making process, programmed decisions might also be repeated if the outcome was successful previously. As a result, when presented with a business-related programmed decision, it does not take a supervisor long to reach a conclusion because the difficulty is not new. As a result, programmed decisions allow a manager to make streamlined and consistent decisions.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- 1. You are a commercial lines broker, working for an insurance company, explain why you would recommend a commercial named-peril policy. James, a new client, left his last insurance company as he was disgruntled that he had to pay an extra $10,000 to remove the wreckage from one of his warehouses that was damaged in a fire. James' policy did not have enough insurance available to cover the cost of debris removal after the lass was paid. course- C12 insurance on property14. Carla is not happy with her present job, she resigned and started her own business. The business requires her to travel so she used her car for the purpose. Assume that A started her business on April 1 and that the uses the car for business 70% of the time. Assuming total expenses for the year for the use of the car is P300,000, the deductible expense is:* a. 210,000 b. 225,000 c. 300,000 d. 157,500Jane is an employee of Rohrs Golf Emporium. The shop allows employees to purchase equipment at significant discount. This year Jane purchased several new items to improve her game. Model FMV Dealer Cost Employee Price Driver $ 610 $ 440 $ 498 Irons $ 1,180 $ 740 $ 864 Balls $ 104 $ 95 $ 86 Bag $ 270 $ 195 $ 220 If the employer's average gross profit percentage is 20 percent, what amount must Jane include in income?

- ASAP Peter operates a dental office in his home. The office occupies 250 square feet of his residence, which is a total of 1,500 square feet. During 2021, Peter pays rent for his home of $12,000, utilities of $4,800, and maintenance expenses of $1,200. What amount of the total expenses should be allocated to the home office? a.$3,000 b.$2,500 c.$2,000 d.$0 e.None of these choices are correct.What is the VC for this please? I came up with 1.44 but getting a message this is incorrect. After graduating from dental school two years ago, Dr. Lauren Farish purchased the dental practice of a long-time dentist who was retiring. In January of this year, she had to replace the outdated autoclave equipment she inherited from the previous dentist. Now, as she is preparing her budget for next year, she is concerned about understanding how her cost for sterilizing her dental instruments has changed. She has gathered the following information from her records: Month Number of instruments used Total autoclave cost January 850 $7,600 February 750 6,800 March 920 8,200 April 950 8,600 May 1,150 9,900 June 900 8,100 July 1,050 9,600 August 975 8,700 (a) Partially correct answer icon Your answer is partially correct. Identify the high…Which one of the following statements is false? Group of answer choices A.Bill drives 20 each way between his home to his office – 40 miles round trip each day. During the day he drives to a client site. He drives a total of 63 miles that day. He may deduct the cost of 43 miles. B.Commuting expenses may be deductible if you are transporting tools. C.A consultant works out of her home. She may deduct the cost of driving to a client’s place of business. D.The expenses of driving between your regular job and a second job are deductible.

- ,pppPeter operates a dental office in his home. The office occupies 250 square feet of his residence, which is a total of 1,500 square feet. During 2021, Peter pays rent for his home of $12,000, utilities of $4,800, and maintenance expenses of $1,200. What amount of the total expenses should be allocated to the home office? a.$3,000 b.$2,500 c.$2,000 d.$0 e.None of these choices are correct.5. Mr. Anthony, an owner of a well-known appliance’s establishment in Koronadal City, bound himself to deliver to Ma’am Jenny, a faculty in a prestigious education institution, a (1) 39-inch 2023 Samsung 8K Quality TV Set and (2) iPhone 14 Pro Max rose gold 256 GB, which Ma’am Jenny saw in Mr. Anthony’s establishment, and (3) to repair Ma’am Jenny’s piano and laptop. However, Mr. Anthony did none of these things. Can Ma’am Jenny compel Mr. Anthony to deliver the 39-inch 2023 Samsung 8K Quality TV Set, iPhone 14 Pro Max rose gold 256 GB and repair the piano and laptop? 6. May a third person compel the creditor to accept payment or performance of an obligation? 7. When is demand by the creditor not necessary in order that delay may exist? 8. As a Business Administration Student why is it important for you to study obligation and contracts?In January 2006, Mary Jane Bowers was reviewing her plans for the April 1 opening of a garden center in Lynchburg, Virginia. She had selected Lynchburg as the town for a new home, after deciding to leave the large, northern city where she had both worked for the past 10 years. Bowers had a degree in horticulture and had worked for a large chemical company in its agricultural herbicide division. Along with the decision to move, Bowersdecided to change her work status as well. She wanted to devote her working days to something she enjoyed and was passionate about. Thus, she decided to go into business for herself, starting a retail garden store selling plants, trees, and shrubs. Bowers accumulated information on upscale retail garden stores from a number of sources, talkedto suppliers, looked at potential locations, and established a banking relationship with the Campbell National Bank. She wanted to make sure that she had enough money to get thebusiness off to a good start. Mary Jane…

- 1. During 2004, farmer Seema, who reared pigs, was charged water rates at $210.00 per quarter, even though she used less water during certain months of the year. a. State the names of this type of cost, and the reason for your answer? 2. Farmer Seema paid Dr. Marie for veterinary services on three occasions during 2004 when a few of her pigs were ill. a. What type of cost was this? State a reason for your answer.PPPeter operates a dental office in his home. The office occupies 250 square feet of his residence, which is a total of 1,500 square feet. During 2021, Peter pays rent for his home of $12,000, utilities of $4,800, and maintenance expenses of $1,200. What amount of the total expenses should be allocated to the home office? a.$3,000 b.$2,500 c.$2,000 d.$0 e.None of these choices are correct.On September 1st, 2018, Mr. Payton moves from Sudbury to Ottawa (Ottawa is 484 kilometers from Sudbury) for a new job. He lived in a rented apartment in Sudbury and purchased a house in Ottawa. The total cost of the actual move, including the costs of moving his personal possessions, was $16,500. He paid $500 to the cleaners to clean the rented home and hand it over to the landlord as per his tenancy contract. He spent $750 on a house hunting trip to Ottawa, but he did not decide on a house until his return to Sudbury. He also incurred a $2,000 penalty for breaking his lease in Sudbury. He also incurred $150 of mail forwarding cost to his new address. He also paid $200 expenses for various utilities connections at his new address in Ottawa. During the year, his salary totaled $60,000, of which $45,000 was earned in Sudbury and the remaining $15,000 was earned in Ottawa. As Payton is hired at a junior level, his new employer is not reimbursing any of the moving expenses.…