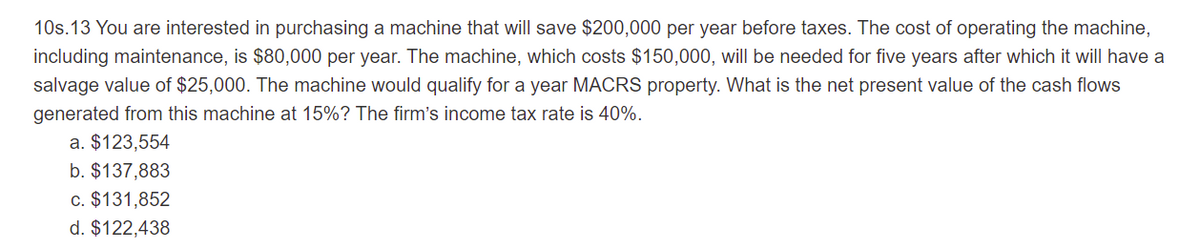

10s.13 You are interested in purchasing a machine that will save $200,000 per year before taxes. The cost of operating the machine, including maintenance, is $80,000 per year. The machine, which costs $150,000, will be needed for five years after which it will have a salvage value of $25,000. The machine would qualify for a year MACRS property. What is the net present value of the cash flows generated from this machine at 15%? The firm's income tax rate is 40%. a. $123,554 b. $137,883 c. $131,852 d. $122,438

10s.13 You are interested in purchasing a machine that will save $200,000 per year before taxes. The cost of operating the machine, including maintenance, is $80,000 per year. The machine, which costs $150,000, will be needed for five years after which it will have a salvage value of $25,000. The machine would qualify for a year MACRS property. What is the net present value of the cash flows generated from this machine at 15%? The firm's income tax rate is 40%. a. $123,554 b. $137,883 c. $131,852 d. $122,438

Chapter10: Project Cash Flows And Risk

Section: Chapter Questions

Problem 5PROB

Related questions

Question

100%

Attached is question, USE EXCEL AS ITS REQUIRED

WILL DOWNVOTE IF WORK NOT SHOWN IN EXCEL!

Transcribed Image Text:10s.13 You are interested in purchasing a machine that will save $200,000 per year before taxes. The cost of operating the machine,

including maintenance, is $80,000 per year. The machine, which costs $150,000, will be needed for five years after which it will have a

salvage value of $25,000. The machine would qualify for a year MACRS property. What is the net present value of the cash flows

generated from this machine at 15%? The firm's income tax rate is 40%.

a. $123,554

b. $137,883

c. $131,852

d. $122,438

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning