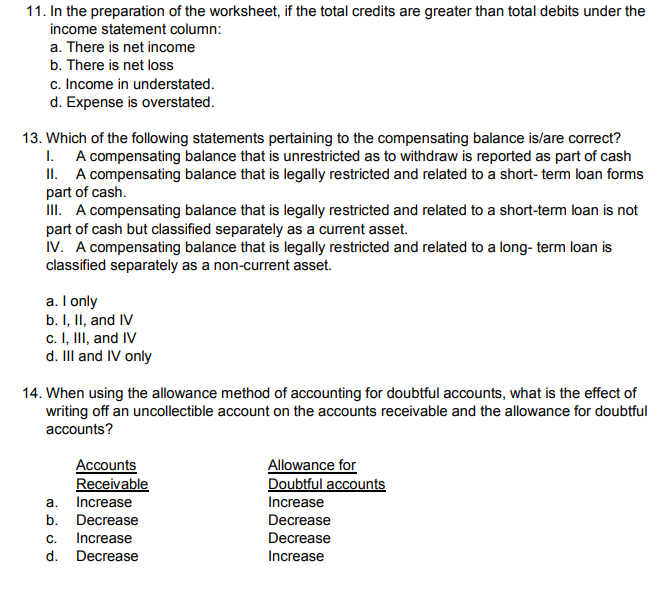

11. In the preparation of the worksheet, if the total credits are greater than total debits under the income statement column: a. There is net income b. There is net loss c. Income in understated. d. Expense is overstated.

11. In the preparation of the worksheet, if the total credits are greater than total debits under the income statement column: a. There is net income b. There is net loss c. Income in understated. d. Expense is overstated.

Chapter3: Analyzing And Recording Transactions

Section: Chapter Questions

Problem 26MC: What is the impact on the accounting equation when an accounts receivable is collected? A. both...

Related questions

Question

Answer pleaase

I need asap

Transcribed Image Text:11. In the preparation of the worksheet, if the total credits are greater than total debits under the

income statement column:

a. There is net income

b. There is net loss

c. Income in understated.

d. Expense is overstated.

13. Which of the following statements pertaining to the compensating balance islare correct?

1. A compensating balance that is unrestricted as to withdraw is reported as part of cash

II. A compensating balance that is legally restricted and related to a short- term loan forms

part of cash.

ilII. A compensating balance that is legally restricted and related to a short-term loan is not

part of cash but classified separately as a current asset.

iv. A compensating balance that is legally restricted and related to a long- term loan is

classified separately as a non-current asset.

a. I only

b. I, II, and IV

c. I, II, and IV

d. Il and IV only

14. When using the allowance method of accounting for doubtful accounts, what is the effect of

writing off an uncollectible account on the accounts receivable and the allowance for doubtful

accounts?

Accounts

Receivable

Increase

Allowance for

Doubtful accounts

а.

Increase

b. Decrease

Decrease

C.

Increase

Decrease

d. Decrease

Increase

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College