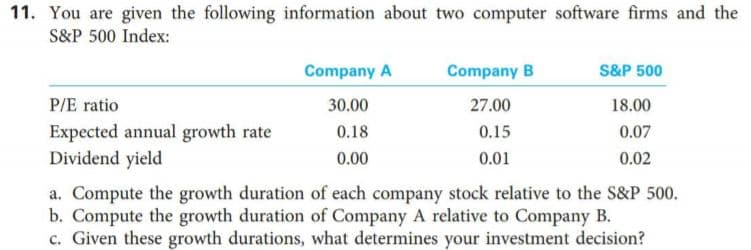

11. You are given the following information about two computer software firms and the S&P 500 Index: Company A Company B S&P 500 18.00 P/E ratio 30.00 27.00 Expected annual growth rate Dividend yield 0.15 0.18 0.07 0.00 0.01 0.02 a. Compute the growth duration of each company stock relative to the S&P 500. b. Compute the growth duration of Company A relative to Company B. c. Given these growth durations, what determines your investment decision?

11. You are given the following information about two computer software firms and the S&P 500 Index: Company A Company B S&P 500 18.00 P/E ratio 30.00 27.00 Expected annual growth rate Dividend yield 0.15 0.18 0.07 0.00 0.01 0.02 a. Compute the growth duration of each company stock relative to the S&P 500. b. Compute the growth duration of Company A relative to Company B. c. Given these growth durations, what determines your investment decision?

Chapter14: Investing In Stocks And Bonds

Section: Chapter Questions

Problem 1DTM

Related questions

Question

Transcribed Image Text:11. You are given the following information about two computer software firms and the

S&P 500 Index:

Company A

Company B

S&P 500

18.00

P/E ratio

30.00

27.00

Expected annual growth rate

Dividend yield

0.15

0.18

0.07

0.00

0.01

0.02

a. Compute the growth duration of each company stock relative to the S&P 500.

b. Compute the growth duration of Company A relative to Company B.

c. Given these growth durations, what determines your investment decision?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning