11.1.11 Return on investment (ROI) is computed in the following manner ROI is equal to turnover multiplied by earnings as a percent of sales Turnover is sales divided by total investment Total investment is current assets (inventories, accounts receivable. and cash) plus fixed assets Earnings equal sales minus the cost of sales The cost of sales consists of variable production costs, selling expenses, freight and delivery, and administrative costs. Complete parts a and b a. Construct an influence diagram that relates these variables. Choose the correct diagram below Cirak huTO to view initence diagram B) Click here to view influence diagram C Click here to view influence diagram D. Click here to view influence diagram A. b. Develop a mathematical model using the symbols defined on the left E Earnings ROI = T Turnover T = VE S. Sales TI= C. Cost of Sales TI Total Investment CA. Current Assets FA Fixed Assets PC Prod Costs SC Sales Expense FC Freight and Delivery AC Admin Costs

11.1.11 Return on investment (ROI) is computed in the following manner ROI is equal to turnover multiplied by earnings as a percent of sales Turnover is sales divided by total investment Total investment is current assets (inventories, accounts receivable. and cash) plus fixed assets Earnings equal sales minus the cost of sales The cost of sales consists of variable production costs, selling expenses, freight and delivery, and administrative costs. Complete parts a and b a. Construct an influence diagram that relates these variables. Choose the correct diagram below Cirak huTO to view initence diagram B) Click here to view influence diagram C Click here to view influence diagram D. Click here to view influence diagram A. b. Develop a mathematical model using the symbols defined on the left E Earnings ROI = T Turnover T = VE S. Sales TI= C. Cost of Sales TI Total Investment CA. Current Assets FA Fixed Assets PC Prod Costs SC Sales Expense FC Freight and Delivery AC Admin Costs

Financial & Managerial Accounting

14th Edition

ISBN:9781337119207

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter20: Variable Costing For Management Analysis

Section: Chapter Questions

Problem 20.15EX: Segment profitability analysis The marketing segment sales for Caterpillar, Inc., for a year follow:...

Related questions

Question

100%

3) see pic

Transcribed Image Text:11.1.11

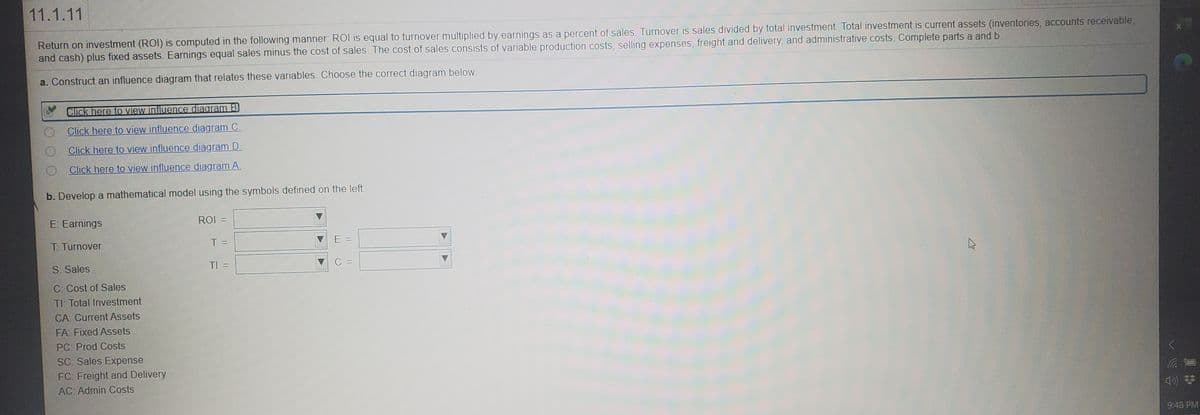

Return on investment (ROI) is computed in the following manner: ROI is equal to turnover multiplied by earnings as a percent of sales. Turnover is sales divided by total investment. Total investment is current assets (inventories, accounts receivable,

and cash) plus fixed assets. Earnings equal sales minus the cost of sales. The cost of sales consists of variable production costs, selling expenses, freight and delivery, and administrative costs. Complete parts a and b.

a. Construct an influence diagram that relates these variables. Choose the correct diagram below.

Click here to view influence diagram B)

Click here to view influence diagram C.

Click here to view influence diagram D.

Click here to view influence diagram A.

b. Develop a mathematical model using the symbols defined on the left.

E: Earnings

ROI =

T: Turnover

T =

E =

S: Sales

TI =

C: Cost of Sales

TI: Total Investment

CA: Current Assets

FA: Fixed Assets

PC: Prod Costs

SC: Sales Expense

FC: Freight and Delivery

AC: Admin Costs

9:48 PM

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning