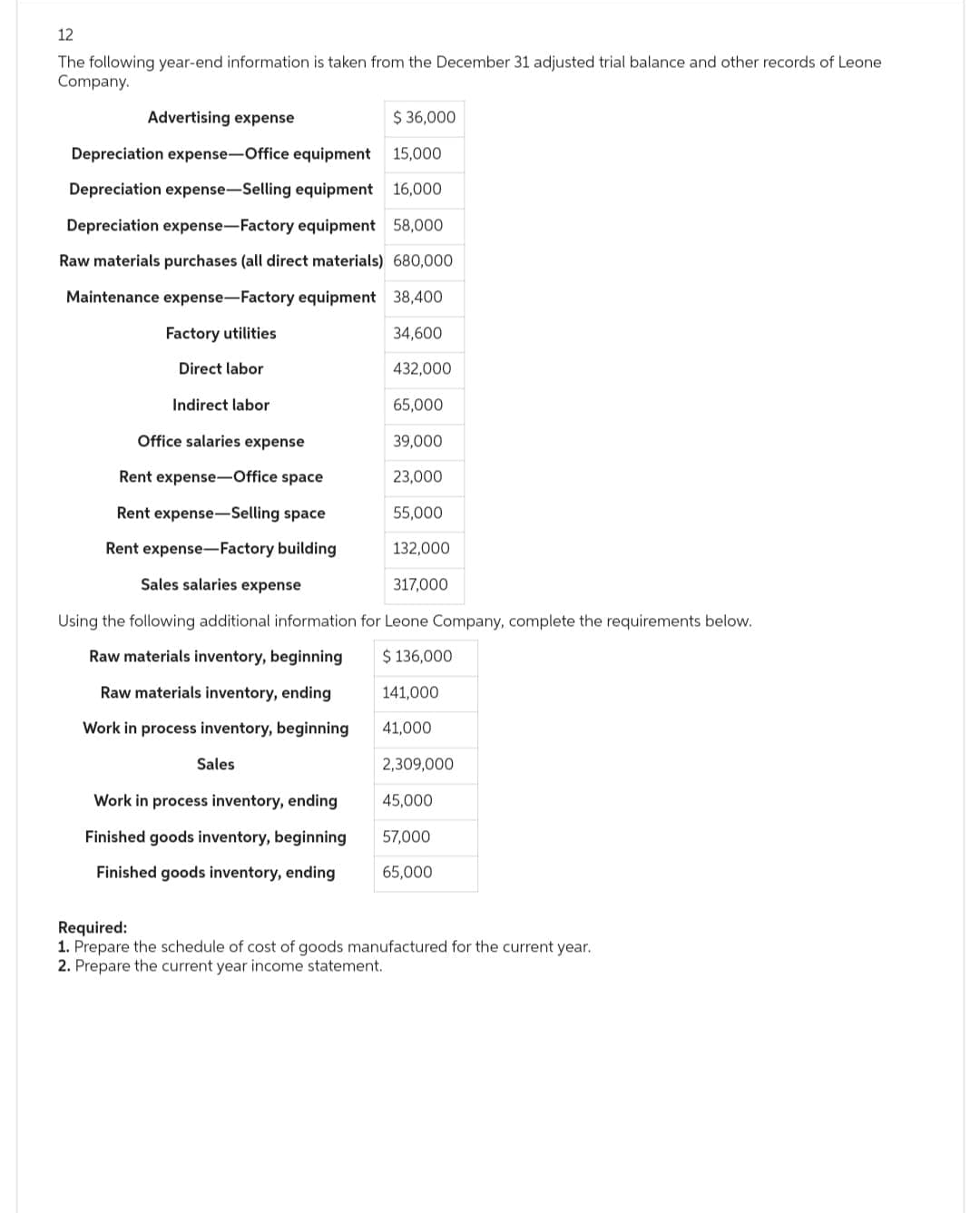

12 The following year-end information is taken from the December 31 adjusted trial balance and other records of Leone Company. $36,000 15,000 Depreciation expense-Office equipment Depreciation expense-Selling equipment 16,000 Depreciation expense-Factory equipment 58,000 Raw materials purchases (all direct materials) 680,000 Maintenance expense-Factory equipment 38,400 Factory utilities 34,600 Direct labor 432,000 Indirect labor 65,000 Office salaries expense 39,000 Rent expense-Office space 23,000 Rent expense-Selling space 55,000 Rent expense-Factory building 132,000 Sales salaries expense 317,000 Using the following additional information for Leone Company, complete the requirements below. Raw materials inventory, beginning $ 136,000 Raw materials inventory, ending 141,000 Work in process inventory, beginning 41,000 2,309,000 45,000 57,000 65,000 Advertising expense Sales Work in process inventory, ending Finished goods inventory, beginning Finished goods inventory, ending Required: 1. Prepare the schedule of cost of goods manufactured for the current year. 2. Prepare the current year income statement.

12 The following year-end information is taken from the December 31 adjusted trial balance and other records of Leone Company. $36,000 15,000 Depreciation expense-Office equipment Depreciation expense-Selling equipment 16,000 Depreciation expense-Factory equipment 58,000 Raw materials purchases (all direct materials) 680,000 Maintenance expense-Factory equipment 38,400 Factory utilities 34,600 Direct labor 432,000 Indirect labor 65,000 Office salaries expense 39,000 Rent expense-Office space 23,000 Rent expense-Selling space 55,000 Rent expense-Factory building 132,000 Sales salaries expense 317,000 Using the following additional information for Leone Company, complete the requirements below. Raw materials inventory, beginning $ 136,000 Raw materials inventory, ending 141,000 Work in process inventory, beginning 41,000 2,309,000 45,000 57,000 65,000 Advertising expense Sales Work in process inventory, ending Finished goods inventory, beginning Finished goods inventory, ending Required: 1. Prepare the schedule of cost of goods manufactured for the current year. 2. Prepare the current year income statement.

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter12: Financial Statements, Closing Entries, And Reversing Entries

Section: Chapter Questions

Problem 4PB: The following accounts appear in the ledger of Sheldon Company on January 31, the end of this fiscal...

Related questions

Question

Please do not give solution in image format thanku

Transcribed Image Text:12

The following year-end information is taken from the December 31 adjusted trial balance and other records of Leone

Company.

Advertising expense

$ 36,000

Depreciation expense-Office equipment 15,000

Depreciation expense-Selling equipment 16,000

Depreciation expense-Factory equipment 58,000

Raw materials purchases (all direct materials) 680,000

Maintenance expense-Factory equipment 38,400

Factory utilities

34,600

Direct labor

432,000

65,000

39,000

23,000

55,000

132,000

317,000

Indirect labor

Office salaries expense

Rent expense-Office space

Rent expense-Selling space

Rent expense-Factory building

Sales salaries expense

Using the following additional information for Leone Company, complete the requirements below.

Raw materials inventory, beginning

$ 136,000

Raw materials inventory, ending

Work in process inventory, beginning

Sales

Work in process inventory, ending

Finished goods inventory, beginning

Finished goods inventory, ending

141,000

41,000

2,309,000

45,000

57,000

65,000

Required:

1. Prepare the schedule of cost of goods manufactured for the current year.

2. Prepare the current year income statement.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning