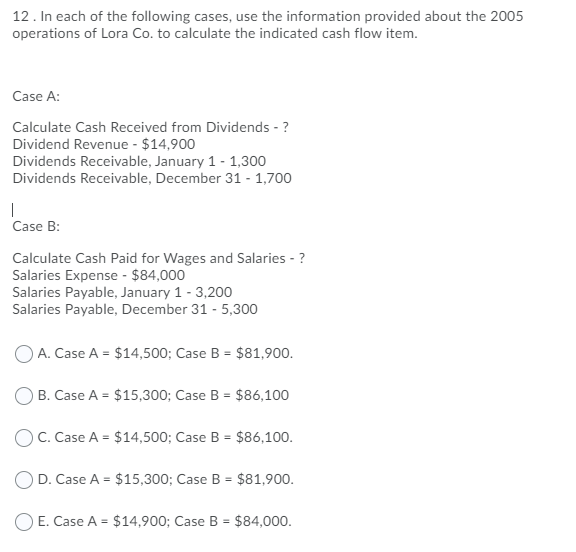

12. In each of the following cases, use the information provided about the 2005 operations of Lora Co. to calculate the indicated cash flow item. Case A: Calculate Cash Received from Dividends - ? Dividend Revenue - $14,900 Dividends Receivable, January 1 - 1,300 Dividends Receivable, December 31 - 1,700 Case B: Calculate Cash Paid for Wages and Salaries - ? Salaries Expense - $84,000 Salaries Payable, January 1 - 3,200 Salaries Payable, December 31 - 5,300 O A. Case A = $14,500; Case B = $81,900. B. Case A = $15,300; Case B = $86,100 OC. Case A = $14,500; Case B = $86,100. O D. Case A = $15,300; Case B = $81,900. O E. Case A = $14,900; Case B = $84,000.

12. In each of the following cases, use the information provided about the 2005 operations of Lora Co. to calculate the indicated cash flow item. Case A: Calculate Cash Received from Dividends - ? Dividend Revenue - $14,900 Dividends Receivable, January 1 - 1,300 Dividends Receivable, December 31 - 1,700 Case B: Calculate Cash Paid for Wages and Salaries - ? Salaries Expense - $84,000 Salaries Payable, January 1 - 3,200 Salaries Payable, December 31 - 5,300 O A. Case A = $14,500; Case B = $81,900. B. Case A = $15,300; Case B = $86,100 OC. Case A = $14,500; Case B = $86,100. O D. Case A = $15,300; Case B = $81,900. O E. Case A = $14,900; Case B = $84,000.

Century 21 Accounting General Journal

11th Edition

ISBN:9781337680059

Author:Gilbertson

Publisher:Gilbertson

Chapter22: End-of-fiscal-period Work For A Corporation

Section: Chapter Questions

Problem 3AP

Related questions

Question

Transcribed Image Text:12. In each of the following cases, use the information provided about the 2005

operations of Lora Co. to calculate the indicated cash flow item.

Case A:

Calculate Cash Received from Dividends - ?

Dividend Revenue - $14,900

Dividends Receivable, January 1 - 1,300

Dividends Receivable, December 31 - 1,700

Case B:

Calculate Cash Paid for Wages and Salaries - ?

Salaries Expense - $84,000

Salaries Payable, January 1 - 3,200

Salaries Payable, December 31 - 5,300

O A. Case A = $14,500; Case B = $81,900.

B. Case A = $15,300; Case B = $86,100

%3D

OC. Case A = $14,500; Case B = $86,100.

D. Case A = $15,300; Case B = $81,900.

O E. Case A = $14,900; Case B = $84,000.

%3D

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning