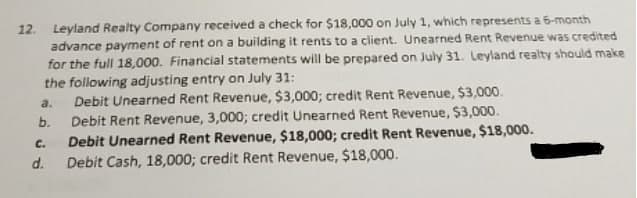

12. Leyland Realty Company received a check for $18,000 on July 1, which represents a6-Ma advance payment of rent on a building it rents to a client. Unearned Rent Revenue was credited for the full 18,000. Financial statements will be prepared on July 31. Leyland realty should make the following adjusting entry on July 31: Debit Unearned Rent Revenue, $3,000; credit Rent Revenue, $3,000. Debit Rent Revenue, 3,000; credit Unearned Rent Revenue, $3,000. Debit Unearned Rent Revenue, $18,000; credit Rent Revenue, $18,000. Debit Cash, 18,000; credit Rent Revenue, $18,000. a. b. C. d.

12. Leyland Realty Company received a check for $18,000 on July 1, which represents a6-Ma advance payment of rent on a building it rents to a client. Unearned Rent Revenue was credited for the full 18,000. Financial statements will be prepared on July 31. Leyland realty should make the following adjusting entry on July 31: Debit Unearned Rent Revenue, $3,000; credit Rent Revenue, $3,000. Debit Rent Revenue, 3,000; credit Unearned Rent Revenue, $3,000. Debit Unearned Rent Revenue, $18,000; credit Rent Revenue, $18,000. Debit Cash, 18,000; credit Rent Revenue, $18,000. a. b. C. d.

Chapter4: The Adjustment Process

Section: Chapter Questions

Problem 6EB: On September 1, a company received an advance rental payment of $12,000, to cover six months rent on...

Related questions

Question

Transcribed Image Text:12. Leyland Realty Company received a check for $18,000 on July 1, which represents a 6-month

advance payment of rent on a building it rents to a client. Unearned Rent Revenue was credited

for the full 18,000. Financial statements will be prepared on July 31. Leyland realty should make

the following adjusting entry on July 31:

Debit Unearned Rent Revenue, $3,000; credit Rent Revenue, $3,000.

Debit Rent Revenue, 3,000; credit Unearned Rent Revenue, $3,000.

Debit Unearned Rent Revenue, $18,000; credit Rent Revenue, $18,000.

Debit Cash, 18,000; credit Rent Revenue, $18,000.

a.

b.

C.

d.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning