12. On June 1, P16,000 of goods are sold with credit terms of 1/10, n/30. On June 3 the customer returned P2,000 of the goods. How much should the seler expect to recelve if the buyer pays on June 8? P13,840 P13,860 C. P14,000 d. P15,840 a. b.

12. On June 1, P16,000 of goods are sold with credit terms of 1/10, n/30. On June 3 the customer returned P2,000 of the goods. How much should the seler expect to recelve if the buyer pays on June 8? P13,840 P13,860 C. P14,000 d. P15,840 a. b.

Chapter7: Accounting Information Systems

Section: Chapter Questions

Problem 12MC: On January 1, Incredible Infants sold goods to Babies Inc. for $1,540, terms 30 days, and received...

Related questions

Question

Transcribed Image Text:assroom.google.com/u/1/c/MjkzNLJN

DM2N

om

AliExpress

Lazada a Agoda.com

Open with Google Docs

ntermediate Accounting 1.docx

b. 350,000

d. 450,000

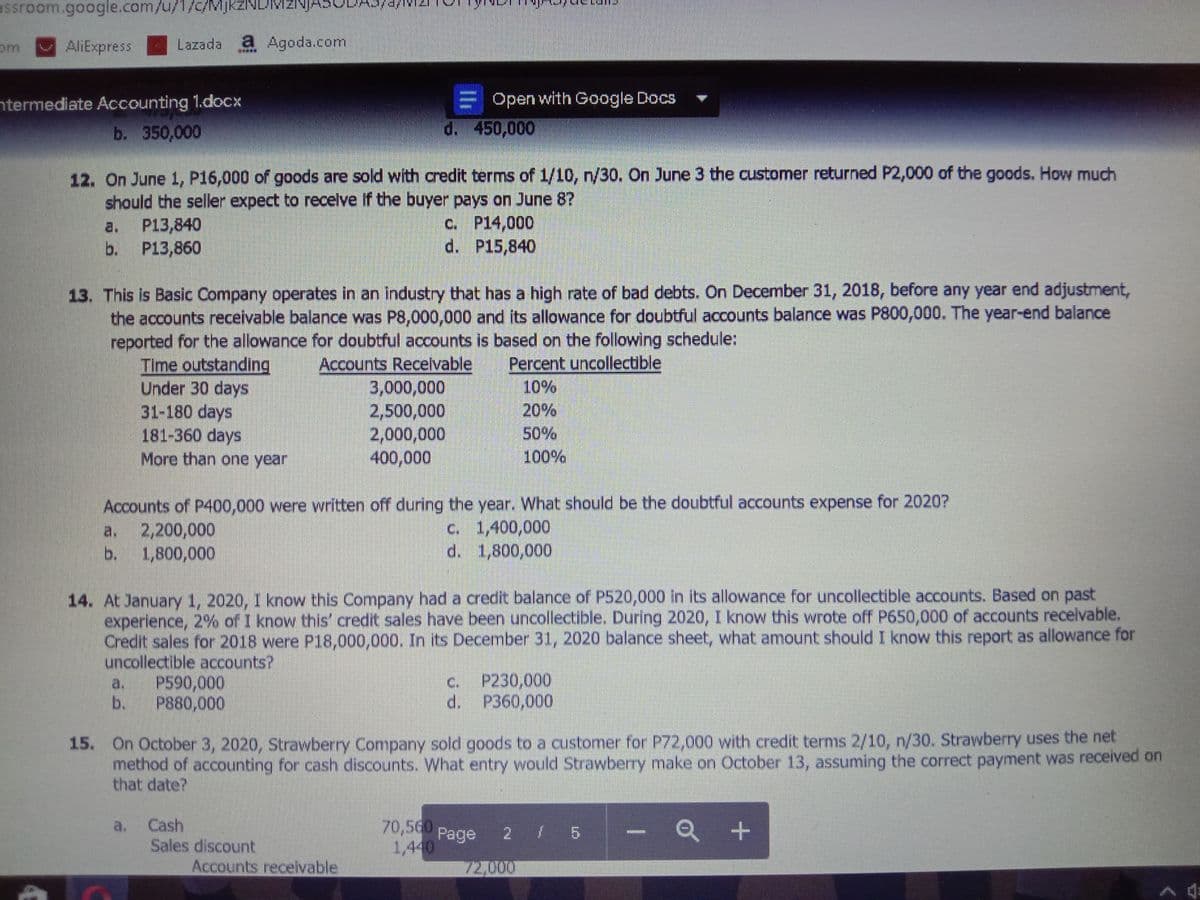

12. On June 1, P16,000 of goods are sold with credit terms of 1/10, n/30. On June 3 the customer returned P2,000 of the goods. How much

should the seller expect to recelve if the buyer pays on June 8?

c. P14,000

d. P15,840

a.

P13,840

b. P13,860

13. This is Basic Company operates in an industry that has a high rate of bad debts. On December 31, 2018, before any year end adjustment,

the accounts receivable balance was P8,000,000 and its allowance for doubtful accounts balance was P800,000. The year-end balance

reported for the allowance for doubtful accounts is based on the following schedule:

TIme outstanding

Under 30 days

31-180 days

181-360 days

More than one year

Accounts Recelvable

Percent uncollectible

3,000,000

2,500,000

2,000,000

400,000

10%

20%

50%

100%

Accounts of P400,000 were written off during the year. What should be the doubtful accounts expense for 2020?

2,200,000

b. 1,800,000

C. 1,400,000

d. 1,800,000

a.

14. At January 1, 2020, I know this Company had a credit balance of P520,000 in its allowance for uncollectible accounts. Based on past

experience, 2% of I know this' credit sales have been uncollectible. During 2020, I know this wrote off P650,000 of accounts recelvable.

Credit sales for 2018 were Pl18,000,000. In its December 31, 2020 balance sheet, what amount should I know this report as allowance for

uncollectible accounts?

C. P230,000

d. P360,000

a.

P590,000

b.

P880,000

15. On October 3, 2020, Strawberry Company sold goods to a customer for P72,000 with credit terms 2/10, n/30. Strawberry uses the net

method of accounting for cash discounts. What entry would Strawberry make on October 13, assuming the correct payment was received on

that date?

Cash

Sales discount

70,560

a.

Page

1,440

Accounts recelvable

72,000

li

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College