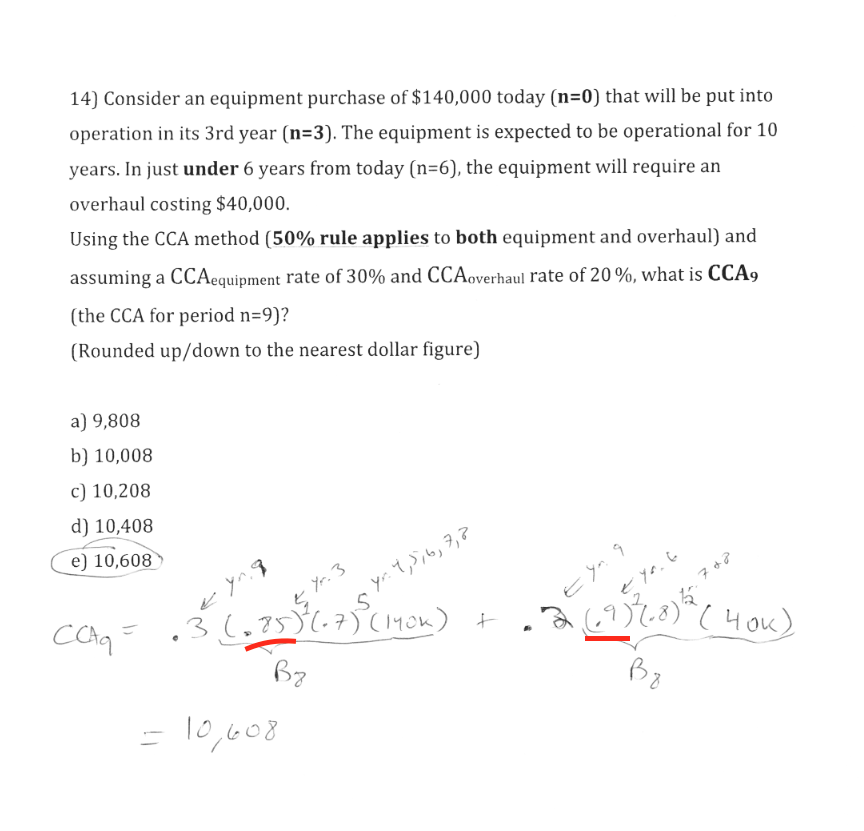

14) Consider an equipment purchase of $140,000 today (n=0) that will be put into operation in its 3rd year (n=3). The equipment is expected to be operational for 10 years. In just under 6 years from today (n=6), the equipment will require an overhaul costing $40,000. Using the CCA method (50% rule applies to both equipment and overhaul) and assuming a CCAequipment rate of 30% and CCAoverhaul rate of 20 %, what is CCA9 (the CCA for period n=9)? (Rounded up/down to the nearest dollar figure) a) 9,808 b) 10,008 c) 10,208 d) 10,408 e) 10,608 Yr. 3 Eya 9 36,75)(.7)(14on) + '(4ou) Bz

14) Consider an equipment purchase of $140,000 today (n=0) that will be put into operation in its 3rd year (n=3). The equipment is expected to be operational for 10 years. In just under 6 years from today (n=6), the equipment will require an overhaul costing $40,000. Using the CCA method (50% rule applies to both equipment and overhaul) and assuming a CCAequipment rate of 30% and CCAoverhaul rate of 20 %, what is CCA9 (the CCA for period n=9)? (Rounded up/down to the nearest dollar figure) a) 9,808 b) 10,008 c) 10,208 d) 10,408 e) 10,608 Yr. 3 Eya 9 36,75)(.7)(14on) + '(4ou) Bz

Chapter19: Lease And Intermediate-term Financing

Section: Chapter Questions

Problem 9P

Related questions

Question

how to get numbers underlined in red?

Transcribed Image Text:14) Consider an equipment purchase of $140,000 today (n=0) that will be put into

operation in its 3rd year (n=3). The equipment is expected to be operational for 10

years. In just under 6 years from today (n=6), the equipment will require an

overhaul costing $40,000.

Using the CCA method (50% rule applies to both equipment and overhaul) and

assuming a CCAequipment rate of 30% and CCAoverhaul rate of 20%, what is CCA9

(the CCA for period n=9)?

(Rounded up/down to the nearest dollar figure)

a) 9,808

b) 10,008

c) 10,208

d) 10,408

e) 10,608

Yr. 3

yr. 4,5,6,7,2

E yn

36,75)(.7)(140n)

t

(4ou)

= 10,608

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning