14. Given: Bank ending balance of 6250, deposits in transil of 560, outstanding checks of 340, book ending balance of 5028, dividend revenue of 550, a company cost of 470, interest revenue of 622, service charge of 29, NSF of 29, and an EFT payment of 142 What is the correct cash balance? HINT: company cost is added on the book side. Book Bank Ending Balance Ending Balance Dividend Revenue Deposits in Transit Company Cost Outstanding Checks Interest Revenue Adjusted Balance Service Charge NSF EFT Payment Adjusted Balance

14. Given: Bank ending balance of 6250, deposits in transil of 560, outstanding checks of 340, book ending balance of 5028, dividend revenue of 550, a company cost of 470, interest revenue of 622, service charge of 29, NSF of 29, and an EFT payment of 142 What is the correct cash balance? HINT: company cost is added on the book side. Book Bank Ending Balance Ending Balance Dividend Revenue Deposits in Transit Company Cost Outstanding Checks Interest Revenue Adjusted Balance Service Charge NSF EFT Payment Adjusted Balance

Financial Accounting

14th Edition

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Carl Warren, Jim Reeve, Jonathan Duchac

Chapter8: Sarbanes-oxley, Internal Control, And Cash

Section: Chapter Questions

Problem 19E

Related questions

Question

7

Transcribed Image Text:The Paue

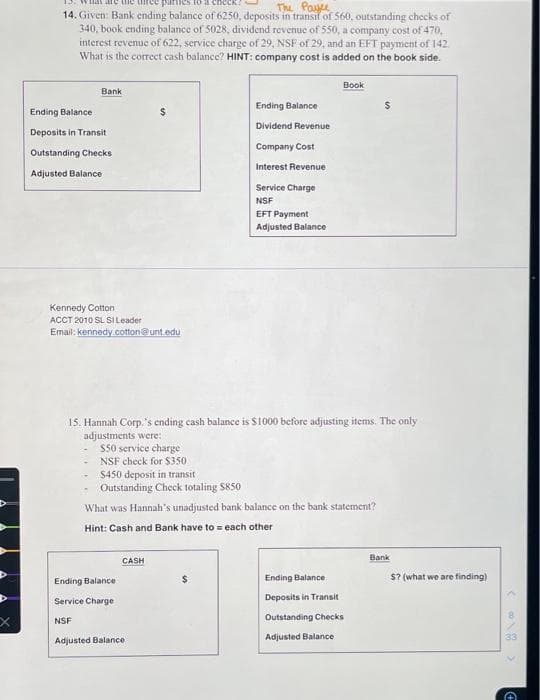

14. Given: Bank ending balance of 6250, deposits in transif of 560, outstanding checks of

340, book ending balance of 5028, dividend revenuc of 550, a company cost of 470,

interest revenue of 622, service charge of 29, NSF of 29, and an EFT payment of 142.

What is the correct cash balance? HINT: company cost is added on the book side.

Book

Bank

Ending Balance

Ending Balance

2$

Dividend Revenue

Deposits in Transit

Company Cost

Outstanding Checks

Interest Revenue

Adjusted Balance

Service Charge

NSF

EFT Payment

Adjusted Balance

Kennedy Cotton

ACCT 2010 SL SILeader

Email: kennedy .cotton@unt.edu

15. Hannah Corp.'s ending cash balance is S1000 before adjusting items. The only

adjustments were:

S50 service charge

NSF check for $350

S450 deposit in transit

Outstanding Check totaling S850

What was Hannah's unadjusted bank balance on the bank statement?

Hint: Cash and Bank have to = each other

Bank

CASH

Ending Balance

Ending Balance

$? (what we are finding)

Deposits in Transit

Service Charge

Outstanding Checks

NSF

Adjusted Balance

Adjusted Balance

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning