150 Cost Accounting Problem 9 Miracle Company provides you with the following information January 1 lanuary 31 Inventories: Materials Work in process Finished goods January transactions: P ? 80,000 60,000 P 50,000 95,000 78,000 Purchases of materials, P 46,000 Factory overhead (75% of direct labor cost) P 63,000 Selling and adm, Expenses (12.5% of sales, P 25,000 Factory overhead control, P 62,800 Net income for January, P 25,200 Indirect materials used, P 1,000 Requirements: 1. Materials inventory, January 1 2. Cost of goods manufactured 3. Cost of goods sold (normal) for the month of January of the current year Problem 10

150 Cost Accounting Problem 9 Miracle Company provides you with the following information January 1 lanuary 31 Inventories: Materials Work in process Finished goods January transactions: P ? 80,000 60,000 P 50,000 95,000 78,000 Purchases of materials, P 46,000 Factory overhead (75% of direct labor cost) P 63,000 Selling and adm, Expenses (12.5% of sales, P 25,000 Factory overhead control, P 62,800 Net income for January, P 25,200 Indirect materials used, P 1,000 Requirements: 1. Materials inventory, January 1 2. Cost of goods manufactured 3. Cost of goods sold (normal) for the month of January of the current year Problem 10

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

Transcribed Image Text:150

Cost Accounting

151

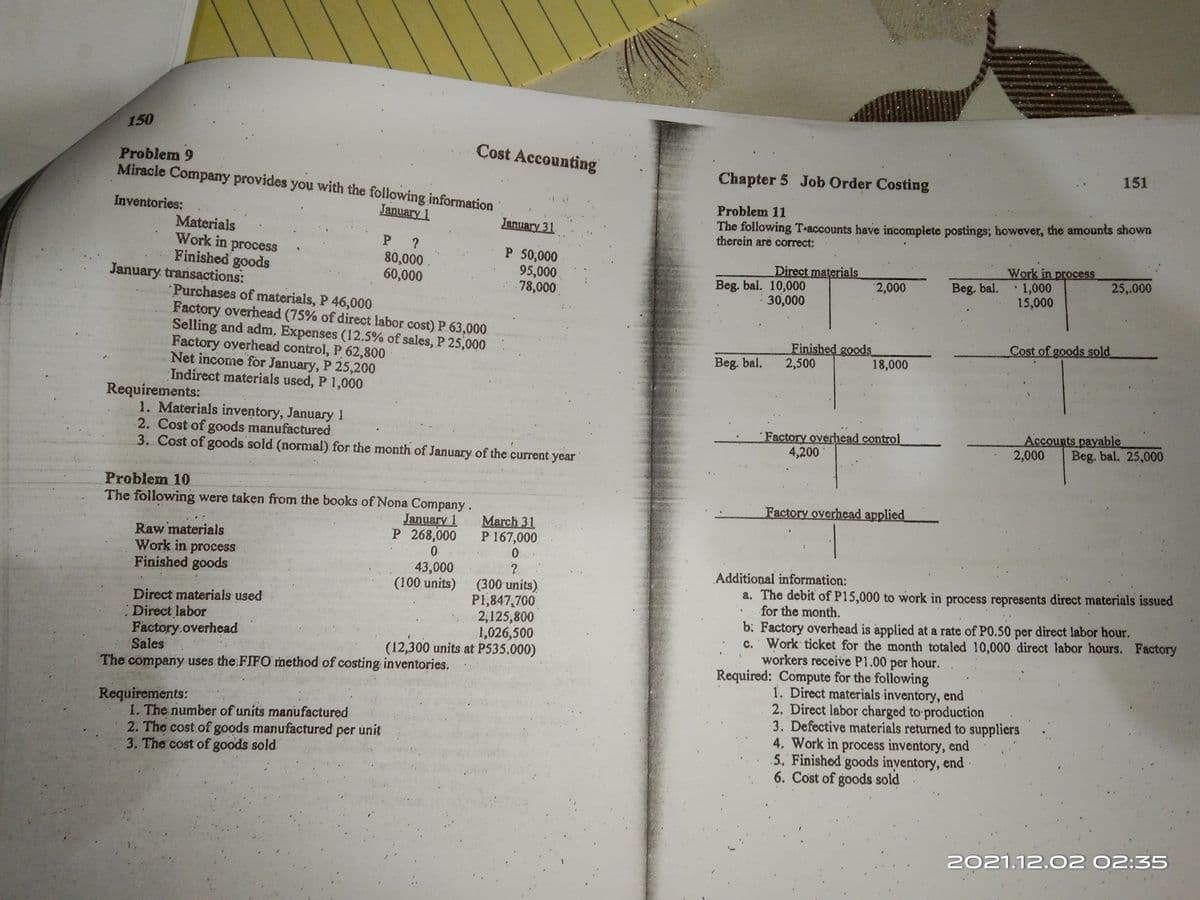

Problem 9

Miracle Company provides you with the following information

Chapter 5 Job Order Costing

Problem 11

The following T-accounts have incomplete postings; however, the amounts shown

therein are correct:

Inventories:

January 1

January 31

Materials

Work in process

Finished goods

January. transactions:

P ?

80,000 .

60,000

P 50,000

95,000.

78,000

Work in process

1,000

15,000

Direct materials

Beg. bal.

25,.000

Beg. bal. 10,000

30,000

2,000

Purchases of materials, P 46,000

Factory overhead (75% of direct labor cost) P 63,000

Selling and adm, Expenses (12.5% of sales, P 25,000

Factory overhead control, P 62,800

Net income for January, P 25,200

Indirect materials used, P 1,000

Cost of goods sold

Finished goods

2,500

Beg. bal.

18,000

Requirements:

1. Materials inventory, January 1

2. Cost of goods manufactured.

3. Cost of goods sold (normal) for the month of January of the current year

´Factory overhead control

4,200

Accounts payable

2,000

Beg. bal. 25,000

Problem 10

Factory overhead applied

The following were taken from the books of Nona Company.

January 1

P 268,000

March 31

P 167,000

Raw materials

Work in process

Finished goods

Additional information:

a. The debit of P15,000 to work in process represents direct materials issued

for the month.

43,000

(100 units) (300 units)

P1,847,700

2,125,800

1,026,500

(12,300 units at P535.000)

Direct materials used

Direct labor

Factory.overhead

Sales

b: Factory overhead is applied at a rate of P0.50 per direct labor hour.

Work ticket for the month totaled 10,000 direct labor hours. Factory

workers receive P1.00 per hour.

The company uses the.FIF0 method of costing inventories.

Required: Compute for the following

Requirements:

1. The number of units manufactured

2. The cost of goods manufactured per unit

3. The cost of goods sold

1. Direct materials inventory, end

2. Direct labor charged to production

3. Defective materials returned to suppliers

4, Work in process inventory, end

5, Finished goods inventory, end·

6. Cost of goods sold

2021.12.02 02:35

Transcribed Image Text:2021.12.02 02:34

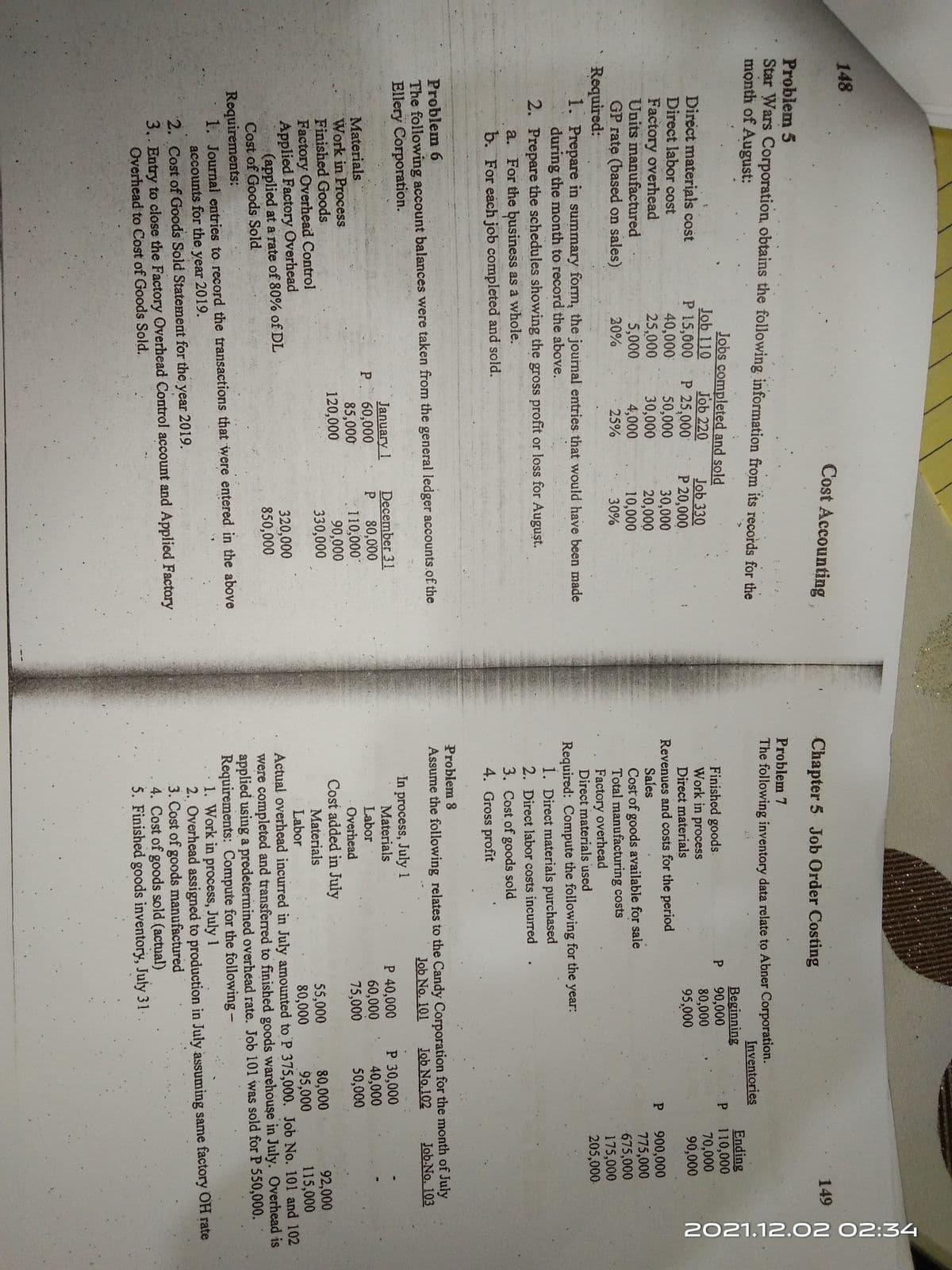

148.

Cost Accounting

Chapter 5 Job Order Costing

149

Problem

Star Wars Corporation, obtains the following information from its records for the

month of August:

Problem 7

The following inventory data relate to Abner Corporation.

Inventories

Jobs completed and sold

Job 110

P 15,000

40,000

25,000

5,000

20%

Beginning

90,000

80,000

95,000

Ending

P 110,000

70,000

90,000

Finished goods.

Work in process

Direct materials

P.

Job 220

P 25,000

50,000

30,000

4,000

25%

Job 330

P 20,000

30,000

20,000

10,000

30%

Direct materials cost

Direct labor cost

Factory overhead

Units manufactured

GP rate (based on sales)

Required:

1. Prepare in summary form, the journal entries that would have been made

during the month to record the above.

2. Prepare the schedules showing the gross profit or loss for August.

Revenues and costs for the period

Sales

Cost of goods available for sale

Total manufacturing costs

Factory overhead

Direct materials used

900,000

775,000

675,000

175,000

205,000-

Required: Compute the following for the year:

1. Direct materials purchased

2. Direct labor costs incurred

a. For the business as a whole.

b. For each job completed and sold.

3. Cost of goods sold

4. Gross profit

Problem 8

Problem 6

The following account balances were taken from the general ledger accounts.of the

Ellery Corporation.

Assume the following relates to the Candy Corporation for the month of July

Job No. 101

Job No.102

Job.No. 103

January 1

P 60,000

85,000

120,000

December 31

P.

80,000

110,000

90,000

330,000

In process, July 1

Materials

Labor

P 40,000

60,000

75,000

P 30,000

40,000

50,000

Materials

Work in Process

Finished Goods

Factory Overhead Control

Applied Factory Overhead

(applied at a rate of 80% of DL

Cost of Goods Sold

Requirements:

1. Journal entries to record the transactions that were entered in the above

accounts for the year 2019.

2. Cost of Goods Sold Statement for the year 2019.

3.. Entry to close the Factory Overhead Control account and Applied Factory

Overhead to Cost of Goods Sold.

Overhead

Cost added in July

55,000

80,000

80,000

95,000

92,000

115,000

Materials

Labor

320,000

850,000

Actual overhead incurred in July amounted to P 375,000. Job No. 101 and 102

were completed and transferred to finished goods warehouse in July. Overhead is

applied using a predetermined overhead rate. Job 101 was sold for P 550,000.

Requirements: Compute for the following -

1. Work in process, July 1

2. Overhead assigned to production in July assuming same factory OH rate

3. Cost of goods manufactured

4. Cost of goods sold (actual)

5. Finished goods inventory, July 31

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education