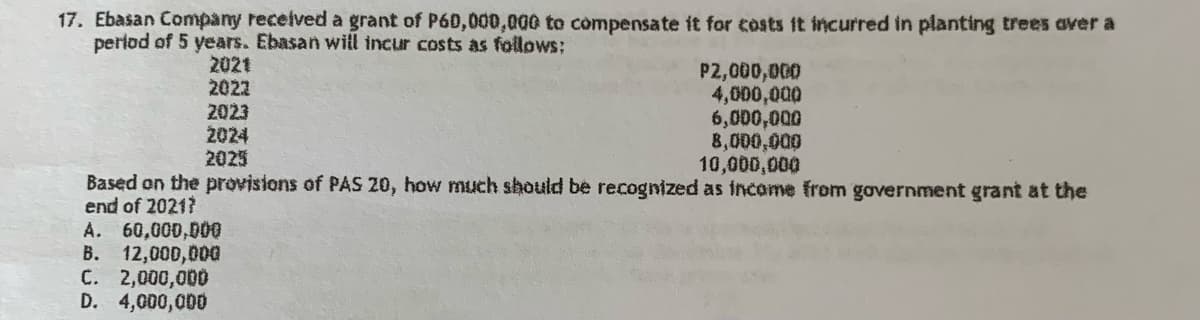

17. Ebasan Company received a grant of P60,000,000 to compensate it for costs it incurred in planting trees over a period of 5 years. Ebasan will incur costs as follows: 2021 2022 P2,000,000 4,000,000 2023 6,000,000 2024 8,000,000 2025 10,000,000 Based on the provisions of PAS 20, how much should be recognized as income from government grant at the end of 2021? A. 60,000,000 B. 12,000,000 C. 2.000.000

Q: Which financial statement reports the changes in owner's equity (legal ownership of the company) for…

A: Solution: There are various financial statements which reports the results of the transactuions of a…

Q: Mr. Ramos, a non-resident citizen, sold shares of stocks of a domestic corporation directly to a…

A: Capital gains refer to profit earned on the sale of capital assets. Ordinary income and capital…

Q: Golden Enterprises started the year with the following: Assets $111,000; Liabilities $39,000, Common…

A: Retained earnings are a company's current profits less any dividends or other payments made to…

Q: Liam bought shares of stock of a publicly-listed domestic company in 1997 at a cost of P200,000. In…

A: The capital gain is the gain that is received by the company from selling the assets, land, and…

Q: Why is planning in an audit important? Under which standard in VSA that auditors are required to…

A: The answers for the theory questions on role of planning in auditing are discussed hereunder : What…

Q: 28-Which of the following is the best example of a natural monopoly? A) owning the only licensed…

A: Answer : B .United States postal services 1.The word ‘Monopoly’ means “alone to sell”. Monopoly is a…

Q: For the next two (2) questions: Selected balances related to the accounts receivable of ABC Company…

A: Ratio analysis: It is a way of determining a company's liquidity, profitability, and efficiency.…

Q: Compare and contrast the early historical accounting for postretirement health care and life…

A: Historical cost accounting is an important technique that records assets on a statement of financial…

Q: 16. Cooperatives are primarily established to promote the quality of life of its members. True or…

A: Cooperatives: These are the organizations or enterprises owned, controlled and run by the…

Q: On January 1, 2023, Flips Company is authorized to issue 100,000 P100 par value ordinary shares. The…

A: Balance of retained earnings at year-end will be Net income minus dividend declared

Q: 2. On January 1, 2021, Entity A received land with fair of 200,000 from the government conditioned…

A: a) The income from government gran tin 2021 and 2022 is 2021 - 200,000 2022 - 0 Note :- The…

Q: Annual depreciation on equipment at Charmed, Inc.is $2,100. The adjusting entry to record one…

A: There are three golden rules in accounting for recording the transaction : Debit what comes in ,…

Q: In order to increase production capacity, Global Industries is considering replacement an existing…

A: Working capital is a term used to describe an organization's financial situation in the short term.…

Q: Es Tri Company provided the following information from a comparative statement of financial…

A: Formula: Number of outstanding shares = Number of shares issued - No. of Treasury shares where,…

Q: 2. Vince's financial budget is as follows: the percentage budgeted for his retirement account is…

A: Financial budget: It is the budget to prepare by the enterprises or persons for long term and short…

Q: The net assets of Fragrance, a cash generating unit (CGU), are: $ Property, plant and equipment…

A: The requirement is to compute the value of Fragrance's property, plant, and equipment after the…

Q: Ann purchased a property for $1,000,000. She bought the property at a 7.00% cap rate. She finances…

A: Weighted average cost of capital, is the average cost which has to be incurred to raise money. It is…

Q: On the December 31, 2020 statement of financial position, the amount of these notes payable that ABC…

A: Short term obligation is a financial Liability that to be repaid within one year. Subsequent Event:…

Q: Find the time required for an investment of Php 5000 to grow to 7900 pesos at an interest rate of…

A: The amount of interest collected on a quarterly basis on an account or investment that is also…

Q: Which of the following journal entries correctly reflect settlement date accounting? Select one: a.…

A: Journal entries should not be used to record routine transactions such as customer billings and…

Q: Q25 C Limited is a stock broking firm in the business of buying and selling shares on the JSE…

A: The amount that should be recorded as gain on fair value adjustment in the statement of profit or…

Q: What are the different parts of notes to financial statements? Briefly describe each section.

A: Notes to the financial statement constitute part of the financial statement. The notes to the…

Q: 6. Consider a bank account with the following transactions for the month of June 2021: No. of Days…

A: Bank: It is a financial institution that accept deposits from and provide loan to public. This…

Q: Q7 How are transaction costs associated with the acquisition of financial assets recognized in the…

A: The transaction costs associated with the acquisition of financial assets depends on the…

Q: Office salaries, depreciation expense on office equipment, and office supplies expense are examples…

A: Under functional expense classification, expenses are aggregated and reported by the activities for…

Q: TRUE OR FALSE 10. Cooperatives are expected to conduct their affairs in accordance with Filipino…

A: The correct answer for the above mentioned question is given in the following steps for your…

Q: Gross profit minus total operating expenses is called ____________. Group of answer choices income…

A: Gross Profit: After deducting all of the expenditures that are associated with the production and…

Q: On the Balance Sheet, what would the Total Current Assets be for Lion Consulting? (Note: I am…

A: Total assets includes both Current assets and Non current assets. Current assets: Current assets are…

Q: 27. At breakeven point i. ii. iii. iv. a) b) total revenue equals total cost total revenue> total…

A: Variable cost means he cost which vary with the level of output and fixed cost remain fixed what…

Q: When a sale is made and sales tax is collected from the customer, the sales tax is recorded as a/an…

A: Sales tax is collected by the business owner for the government from the customer .

Q: A. Find the employer's FICA deductions for each of the following employ B. Find the amounts of the…

A: This question is based on the real time interest rate for social security, Medicare and FUTA. Total…

Q: Mira Gordon assets and liabilities are listed below in random order: Bank balance $856.25; Bank Loan…

A: Assets are the resources of business which have potential of generating revenue. Liabilities are the…

Q: ross income from the practice of profession, P1,590,000 Gross income from business, P3,500,000…

A: The gross income is the amount of income from all possible sources of income after deduction of…

Q: required: preparing the lists of the financial position for the years 2008,2009 and conducting…

A: Based on the data for the financial position of the company horizontal analysis is to be conducted.…

Q: Revenue from sources other than the primary operating activity of a business like interest expense…

A: The Multistep income statement categories the different revenues and expenses incurred during the…

Q: Banana Company reports current year E&P of $1,300,000 and accumulated E&P at the beginning of the…

A: The answer has been mentioned below. Note: Attempting the first three subparts of the…

Q: When merchandise is sold, the cost of merchandise sold (COMS) is a type of ___________ to the…

A: An Asset is something that is owned and controlled by an entity having some future economic…

Q: For each of the following situations, determine the amount of Producer Surplus generated a. Paul…

A: Paul lists his old iPod for sale on an online auction. He sets a minimum acceptable price, known as…

Q: On the Income Statement, what would the Gross Profit be for Lion Consulting? Lion Consulting…

A: Income from operation means operating income. Operating income means profit earned from the primary…

Q: Use the following information for the next four (4) questions: On January 1, 2023, Flips Company is…

A: The shareholder's equity gets increased by issuance of shares, net income and decrease by net loss,…

Q: The planned production for July is 120,000 cars. Sales are forecasted at 90,000 toy cars for June…

A:

Q: Vanishing Games Corporation (VGC) operates a massively multiplayer online game, charging players a…

A: The question you have posted is asking to record the journal entries of the transactions given.…

Q: estions have been posed to you by clients for which your manager requires What is the difference…

A: Explanation of the concept IFRS- International Financial Reporting Standards are standards which…

Q: Allen Green is a single taxpayer with an AGI (and modified AGI) of $217,000, which includes $173,500…

A: Given, Allen Green is a Single Tax Payer:- Net Investment = Interest Income + Dividends + Long term…

Q: Jamestown, Inc. is family-owned C-corporation whose stock is not traded on an exchange. Jamestown,…

A: In the context of the given question, we are required to compute the number of stocks deemed to own…

Q: ider s transactions for his credit card with statement Hollowing Die shows a April 30. The credit…

A: The credit card imposes a 2% monthly interest for unpaid balances and current purchases. Requires a…

Q: Danny owns an electronics outlet in Dallas. In 2021, he paid $620 to register for a four-day course…

A: A cost is a reduction in the asset's value as a result of its use to generate income. Depreciation…

Q: 2. Analyze transactions (a)-(e) to determine their effects on the accounting equation. (Enter any…

A: Point (e) is a not a transaction that is required to be recorded.

Q: Annual depreciation on equipment at Charmed, Inc.is $2,100. The adjusting entry to record one…

A: Formula: Depreciation per month = Annual Depreciation expense / Number of months in a year

Q: Cash balance per books, September 30 Deposits in transit Notes receivable with interest collected by…

A: Introduction: Bank Reconciliation statement: To Reconcile the difference between Cash book balance…

Step by step

Solved in 2 steps

- 5. On January 1, 20X2, ABC Company received a consolidated grant of P40,000,000. Three-fourths of the grant will be utilized to purchase a college building for students from underdeveloped or developing countries. The balance of the grant is for subsidizing the tuition costs of those students for 4 years from the date of the grant. The building was purchased in January 20X2 and is to be depreciated using the straight-line method over 10 years. How much income from the grant should be recognized for 20X2?On January 1, 2014, Valiant Company received a Government grant of P60,000,000 to compensate for the cost to be incurred in planting trees over a period of 5 years. Valiant Company will incur such cost at P2,000,000 for 2014, P4,000,000 for 2015, P6,000,000 for 2016, P8,000,000 for 2017, and P10,000,000 for 2018. What amount of income from the government grant is recognized for 2015?On January 1, 2011, Sagada Company received a grant of P25,000,000 from the American government in order to defray safety and environmental costs within the area where the entity is located. The safety and environmental costs are expected to be incurred over four years, respectively, P4,000,000, P3,000,000, P5,000,000 and P8,000,000. How much income from the government grant should be recognized in 2011? A. 20,000,000 B. 4,000,000 C. 30,000,000 D. 6,000,000

- On january 2 2021 brand company received a grant of P60,000,000 to compensate it for costs it incurred i planting trees over a period of five years. Brand company will incur such cost in this manner: 2021 2,000,000 2022 4,000,000 2023 6,000,000 2024 8,000,000 2025 10,000,000 actual costs incurred in the planting trees showed 2,000,000 and 4,000,000 in years 2021 and 2022, respectively. However in 2023 and 2024 the company has stopped planting trees. Due to the non fulfillment of its obligation, the government is demanding an immediate repayment of the grant in the amount of 50,000,000 which is considered reasonable. What is the grant income for the year 2021?On Jan. 1, 2021, Microsoft Company received a consolidated grant of P12,000,000. Three-fourths of the grant will be utilized to purchase a college building for students from underdeveloped or undeveloped countries. The balance of the grant is for subsidizing the tuition costs of those students for five years from the date of grant. The building was purchased in Jan. 1, 2021 and is to be depreciated using straight-line method over 10 years. The tuition costs paid in 2021 amounted to P600,000. How much income from government grant should be recognized for 2021? a. P 1,500,000b. P 3,000,000c. P 1,900,000d. P 1,650,0007. Karen Company purchased a varnishing machine for P3,000,000 on January 1, 2019. The entity received a government grant of P500,000 in respect of this asset. The accounting policy is to depreciate the asset over 4 years on a straight line basis and to treat the grant as deferred income. How much deferred income from the government grant will be presented in the statement of financial position for 2019?

- 1. Patriotic Company purchased a machine for P6,000,000 on January 1, 2019, and received a government grant of P600,000 toward the asset cost. The accounting policy is to treat the grant as a reduction in the cost of the asset. The machine is to be depreciated on a straight-line basis over 10 years with a residual value of P500,000. On January 1, 2021, the grant becomes fully repayable because of noncompliance with conditions. What is the depreciation for 2019? What is the depreciation for 2021? What is the carrying amount of the machinery at the end of 2021? What is the depreciation for 2022?On January 1, 2021, Bongbong Company received a consollidated grant of P 12,000,000. three-fourths of the grant will will be utilized to purchase a college building for students from underdeveloped countries. The balance of the grant is for subsidizing the tuition cost of those students for four years from date of grant. The building was purchased in January 2021 and is to be depreciatedusing the straight-line method over 10 years. the tuition costs paid in 2021 amounted to P 600,000. How much income from government grant should be recognized for 2021?On January 1, 2021, ALI Inc. received P2,000,000 from national government on the condition that the company will construct an environmentally-friendly building with a cost of P13,000,000 and useful life of 10 years and residual value of P1,000,000. On January 1, 2023, the government grant became repayable as a result of ALI Inc.’s failure to comply with the environmentally-friendly specification requirement of the government grant condition. __________1. Loss on repayment of government grant on January 1, 2023 if the company accounts for the government grant as deferred income__________2. Depreciation expense for the year ended December 31, 2023, if the company accounts for the government as deduction from the cost of the asset

- On January 1, 2019, Munich Co. received a grant of P10,000,000 from the government of USA for the construction of a building that will be used as a laboratory and research facility with an estimated cost of P15,000,000 and useful life of 10 years. The facility was completed on January 1, 2020. How much is the balance of deferred income from government grant on December 31, 2020 under the gross method (deferred income approach)?ABC corporation received P10,000,000 from the City of Caloocan in relation to defraying its research expenses in relation to COVID-19 for the next 5 years. The research expenses will be incurred by the entity as follows: 1st year 2nd • year 3rd year Ath year 5th year P2.000.000 1,000.000 3.000.000 4.000.000 2 500.000 P12,500,000 The grant income to be recognized in the second year should be?A company receives a government grant of $500,000 on 1 April 20X7 to facilitate purchase on the same day of an asset which costs $750,000. The asset has a five year useful life and is depreciated on a 30% reducing balance basis. Company policy is to account for all grants received as deferred income. What amount of income will be recognised in respect of the grant in the year to 31 March 20X9?