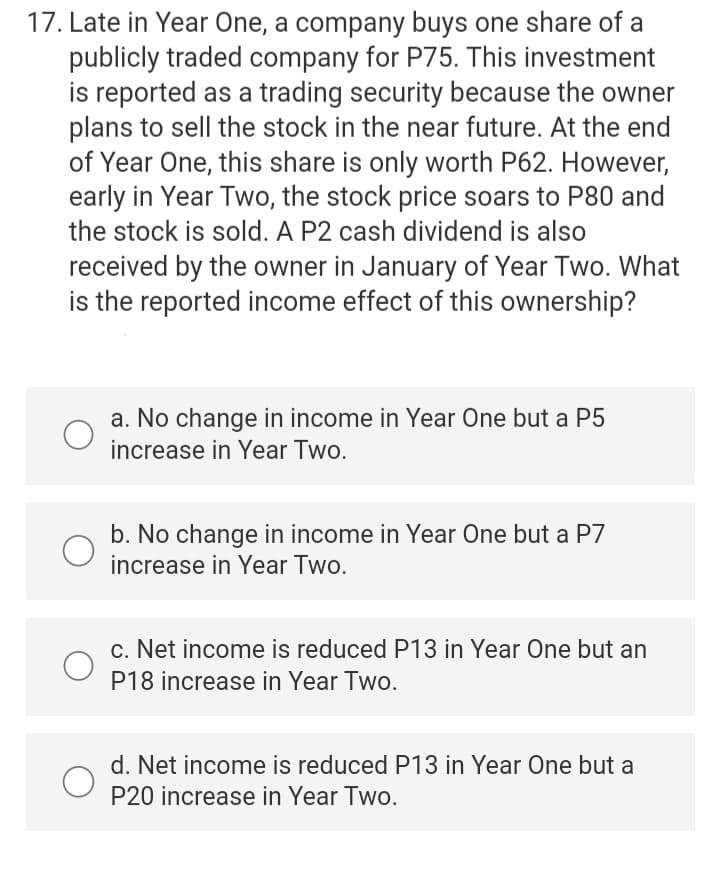

17. Late in Year One, a company buys one share of a publicly traded company for P75. This investment is reported as a trading security because the owner plans to sell the stock in the near future. At the end of Year One, this share is only worth P62. However, early in Year Two, the stock price soars to P80 and the stock is sold. A P2 cash dividend is also received by the owner in January of Year Two. What is the reported income effect of this ownership?

17. Late in Year One, a company buys one share of a publicly traded company for P75. This investment is reported as a trading security because the owner plans to sell the stock in the near future. At the end of Year One, this share is only worth P62. However, early in Year Two, the stock price soars to P80 and the stock is sold. A P2 cash dividend is also received by the owner in January of Year Two. What is the reported income effect of this ownership?

Chapter5: The Cost Of Money (interest Rates)

Section: Chapter Questions

Problem 6PROB

Related questions

Question

Transcribed Image Text:17. Late in Year One, a company buys one share of a

publicly traded company for P75. This investment

is reported as a trading security because the owner

plans to sell the stock in the near future. At the end

of Year One, this share is only worth P62. However,

early in Year Two, the stock price soars to P80 and

the stock is sold. A P2 cash dividend is also

received by the owner in January of Year Two. What

is the reported income effect of this ownership?

a. No change in income in Year One but a P5

increase in Year Two.

b. No change in income in Year One but a P7

increase in Year Two.

c. Net income is reduced P13 in Year One but an

P18 increase in Year Two.

d. Net income is reduced P13 in Year One but a

P20 increase in Year Two.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT