18. Emma's disability pension is reported as wages and considered earned income for the purposes of the earned income credit.

18. Emma's disability pension is reported as wages and considered earned income for the purposes of the earned income credit.

Chapter8: Taxation Of Individuals

Section: Chapter Questions

Problem 31P

Related questions

Question

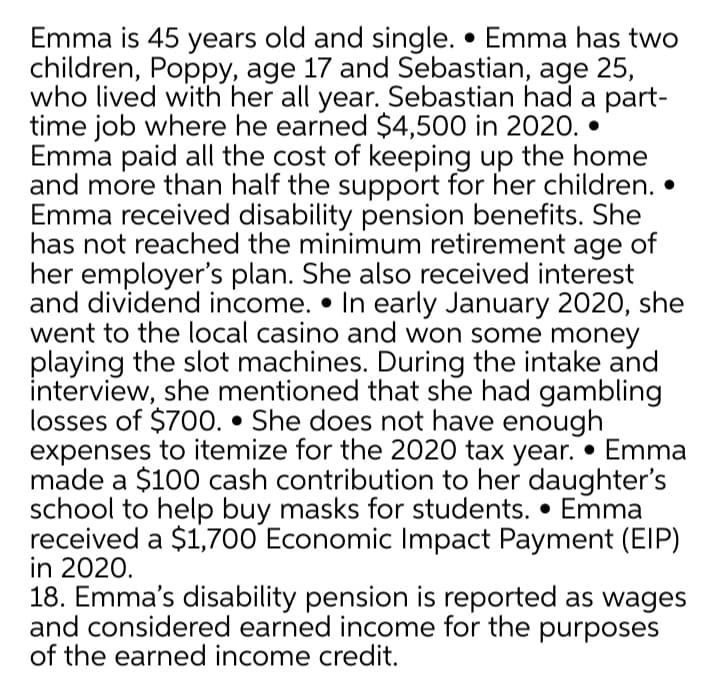

Transcribed Image Text:Emma is 45 years old and single. • Emma has two

children, Poppy, age 17 and Sebastian, age 25,

who lived with her all year. Sebastian had a part-

time job where he earned $4,500 in 2020. •

Emma paid all the cost of keeping up the home

and more than half the support for her children.

Emma received disability pension benefits. She

has not reached the minimum retirement age of

her employer's plan. She also received interest

and dividend income. • In early January 2020, she

went to the local casino and won some money

playing the slot machines. During the intake and

interview, she mentioned that she had gambling

losses of $700. • She does not have enough

expenses to itemize for the 2020 tax year. • Emma

made a $100 cash contribution to her daughter's

school to help buy masks for students. • Emma

received a $1,700 Economic Impact Payment (EIP)

in 2020.

18. Emma's disability pension is reported as wages

and considered earned income for the purposes

of the earned income credit.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT