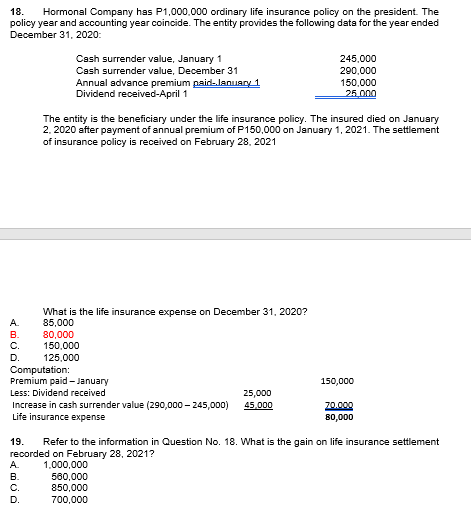

18. Hormonal Company has P1,000.000 ordinary life insurance policy on the president. The policy year and accounting year coincide. The entity provides the following data for the year ended December 31, 2020: Cash surrender value, January 1 Cash surrender value, December 31 Annual sdvance premium paid-lanuary 1 Dividend received-April 1 245,000 290,000 150,000 25.000 The entity is the beneficiary under the life insurance policy. The insured died on January 2, 2020 after payment of annual premium of P150,000 on January 1, 2021. The settlement of insurance policy is received on February 28. 2021 What is the life insurance expense on December 31, 2020? A. 85,000 80,000 150,000 125,000 Computation: Premium paid- January Less: Dividend received B. С. D. 150,000 25,000 Increase in cash surrender value (290,000 - 245,000) 20.000 80,000 45.000 Life insurance expense 19. Refer to the information in Question No. 18. What is the gain on life insurance settlement recorded on February 28, 2021? 1.000,000 560,000 850,000 700,000 A. B. C. D.

18. Hormonal Company has P1,000.000 ordinary life insurance policy on the president. The policy year and accounting year coincide. The entity provides the following data for the year ended December 31, 2020: Cash surrender value, January 1 Cash surrender value, December 31 Annual sdvance premium paid-lanuary 1 Dividend received-April 1 245,000 290,000 150,000 25.000 The entity is the beneficiary under the life insurance policy. The insured died on January 2, 2020 after payment of annual premium of P150,000 on January 1, 2021. The settlement of insurance policy is received on February 28. 2021 What is the life insurance expense on December 31, 2020? A. 85,000 80,000 150,000 125,000 Computation: Premium paid- January Less: Dividend received B. С. D. 150,000 25,000 Increase in cash surrender value (290,000 - 245,000) 20.000 80,000 45.000 Life insurance expense 19. Refer to the information in Question No. 18. What is the gain on life insurance settlement recorded on February 28, 2021? 1.000,000 560,000 850,000 700,000 A. B. C. D.

Chapter20: Corporations And Parterships

Section: Chapter Questions

Problem 45P

Related questions

Question

100%

Pls. answer no. 19, 10 & 11.

Pls answer all the questions I will give you the best rate you deserve. Thank you!

Transcribed Image Text:18.

Hormonal Company has P1,000,000 ordinary life insurance policy on the president. The

policy year and accounting year coincide. The entity provides the following data for the year ended

December 31, 2020:

Cash surrender value, January 1

Cash surrender value, December 31

Annual advance premium paid-lanuary 1

Dividend received-April 1

245,000

290,000

150,000

25.000

The entity is the beneficiary under the life insurance policy. The insured died on January

2. 2020 after payment of annual premium of P150,000 on January 1, 2021. The settlement

of insurance policy is received on February 28, 2021

What is the life insurance expense on December 31, 2020?

A.

85,000

80,000

150,000

125,000

Computation:

Premium paid- January

В.

С.

D.

150,000

Less: Dividend received

25,000

Increase in cash surrender value (290,000 – 245,000)

Life insurance expense

45,000

20.000

80,000

19.

Refer to the information in Question No. 18. What is the gain on life insurance settlement

recorded on February 28, 2021?

1,000,000

560,000

850,000

А.

В.

C.

D.

700,000

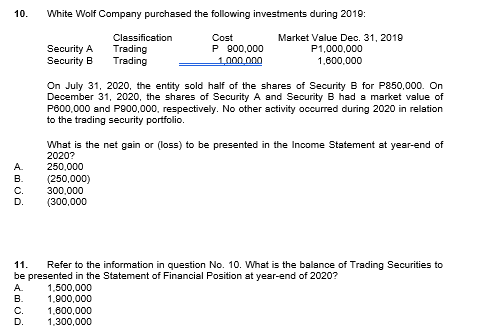

Transcribed Image Text:10.

White Wolf Company purchased the following investments during 2019:

Cost

P 900,000

1000.000

Classification

Security A

Security B

Trading

Trading

Market Value Dec. 31, 2019

P1,000,000

1.600,000

On July 31, 2020, the entity sold half of the shares of Security B for P850,000. On

December 31, 2020, the shares of Security A and Security B had a market value of

P600,000 and P900,000, respectively. No other activity occurred during 2020 in relation

to the trading security portfolio.

What is the net gain or (loss) to be presented in the Income Statement at year-end of

2020?

A.

250,000

(250,000)

300,000

(300,000

В.

C.

D.

11.

Refer to the information in question No. 10. What is the balance of Trading Securities to

be presented in the Statement of Financial Position at year-end of 2020?

A.

В.

C.

D.

1.500,000

1.900,000

1,800,000

1,300,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT