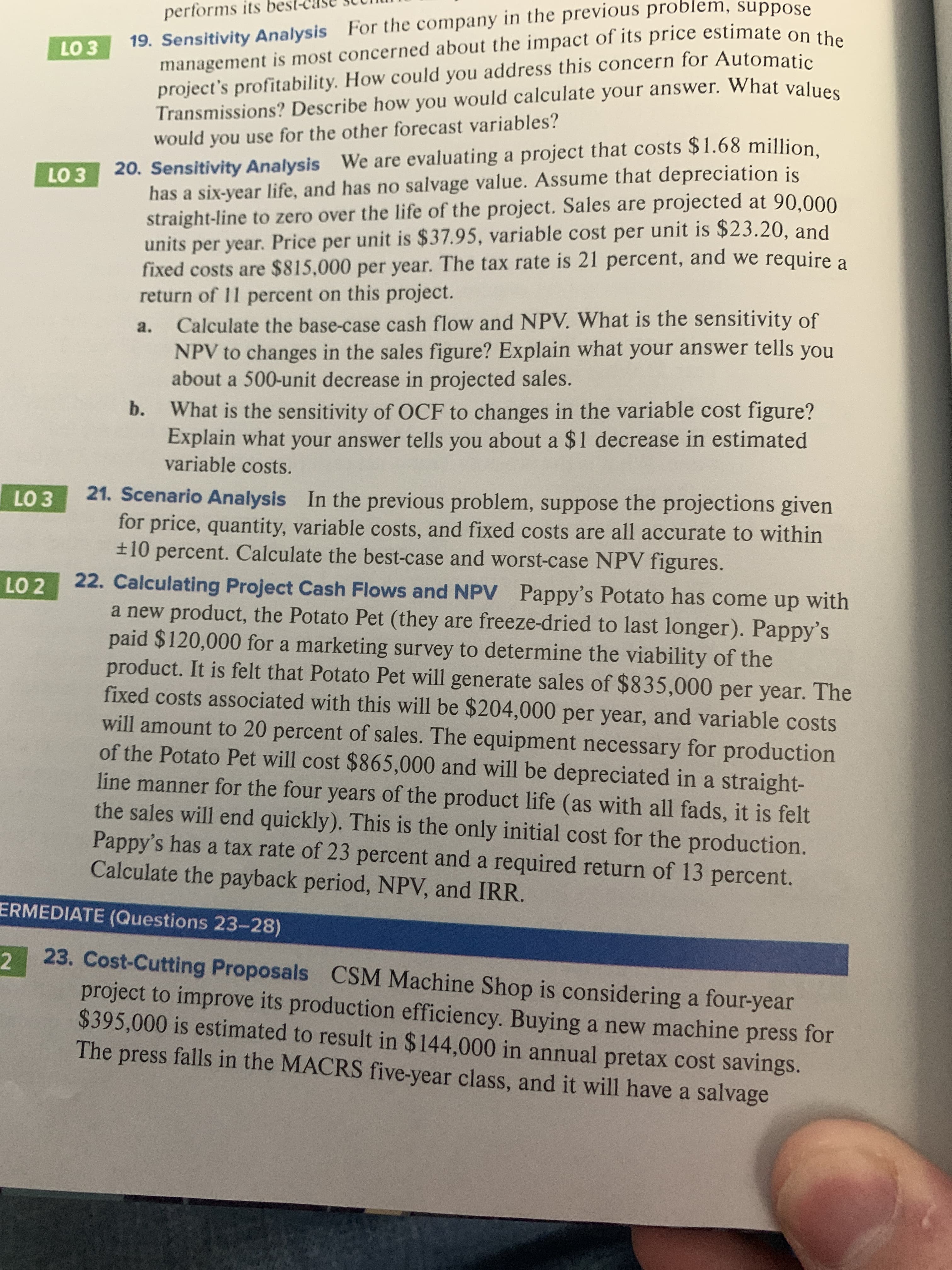

19. Sensitivity Analysis For the company in the previous problem, suppose management is most concerned about the impact of its price estimate on the project's profitability. How could you address this concern for Automatic Transmissions? Describe how you would calculate your answer. What values performs its LO 3 would you use for the other forecast variables? 20. Sensitivity Analysis We are evaluating a project that costs $1.68 million has a six-year life, and has no salvage value. Assume that depreciation is straight-line to zero over the life of the project. Sales are projected at 90,000 units per year. Price per unit is $37.95, variable cost per unit is $23.20, and fixed costs are $815,000 per year. The tax rate is 21 percent, and we require a return of 11 percent on this project. Calculate the base-case cash flow and NPV. What is the sensitivity of NPV to changes in the sales figure? Explain what your answer tells you about a 500-unit decrease in projected sales. LO 3 а. b. What is the sensitivity of OCF to changes in the variable cost figure? Explain what your answer tells you about a $1 decrease in estimated variable costs. 21. Scenario Analysis In the previous problem, suppose the projections given for price, quantity, variable costs, and fixed costs are all accurate to within ±10 percent. Calculate the best-case and worst-case NPV figures. 22. Calculating Project Cash Flows and NPV Pappy's Potato has come up with a new product, the Potato Pet (they are freeze-dried to last longer). Pappy's paid $120,000 for a marketing survey to determine the viability of the product. It is felt that Potato Pet will generate sales of $835,000 per year. The fixed costs associated with this will be $204,000 per year, and variable costs will amount to 20 percent of sales. The equipment necessary for production of the Potato Pet will cost $865,000 and will be depreciated in a straight- line manner for the four years of the product life (as with all fads, it is felt the sales will end quickly). This is the only initial cost for the production. Pappy's has a tax rate of 23 percent and a required return of 13 percent. Calculate the payback period, NPV, and IRR. LO 3 LO 2 ERMEDIATE (Questions 23-28) 2 23. Cost-Cutting Proposals CSM Machine Shop is considering a four-year project to improve its production efficiency. Buying a new machine press for $395,000 is estimated to result in $144,000 in annual pretax cost savings. The press falls in the MACRS five-year class, and it will have a salvage

19. Sensitivity Analysis For the company in the previous problem, suppose management is most concerned about the impact of its price estimate on the project's profitability. How could you address this concern for Automatic Transmissions? Describe how you would calculate your answer. What values performs its LO 3 would you use for the other forecast variables? 20. Sensitivity Analysis We are evaluating a project that costs $1.68 million has a six-year life, and has no salvage value. Assume that depreciation is straight-line to zero over the life of the project. Sales are projected at 90,000 units per year. Price per unit is $37.95, variable cost per unit is $23.20, and fixed costs are $815,000 per year. The tax rate is 21 percent, and we require a return of 11 percent on this project. Calculate the base-case cash flow and NPV. What is the sensitivity of NPV to changes in the sales figure? Explain what your answer tells you about a 500-unit decrease in projected sales. LO 3 а. b. What is the sensitivity of OCF to changes in the variable cost figure? Explain what your answer tells you about a $1 decrease in estimated variable costs. 21. Scenario Analysis In the previous problem, suppose the projections given for price, quantity, variable costs, and fixed costs are all accurate to within ±10 percent. Calculate the best-case and worst-case NPV figures. 22. Calculating Project Cash Flows and NPV Pappy's Potato has come up with a new product, the Potato Pet (they are freeze-dried to last longer). Pappy's paid $120,000 for a marketing survey to determine the viability of the product. It is felt that Potato Pet will generate sales of $835,000 per year. The fixed costs associated with this will be $204,000 per year, and variable costs will amount to 20 percent of sales. The equipment necessary for production of the Potato Pet will cost $865,000 and will be depreciated in a straight- line manner for the four years of the product life (as with all fads, it is felt the sales will end quickly). This is the only initial cost for the production. Pappy's has a tax rate of 23 percent and a required return of 13 percent. Calculate the payback period, NPV, and IRR. LO 3 LO 2 ERMEDIATE (Questions 23-28) 2 23. Cost-Cutting Proposals CSM Machine Shop is considering a four-year project to improve its production efficiency. Buying a new machine press for $395,000 is estimated to result in $144,000 in annual pretax cost savings. The press falls in the MACRS five-year class, and it will have a salvage

Chapter11: Capital Budgeting And Risk

Section: Chapter Questions

Problem 16P

Related questions

Question

Number 22

Transcribed Image Text:19. Sensitivity Analysis For the company in the previous problem, suppose

management is most concerned about the impact of its price estimate on the

project's profitability. How could you address this concern for Automatic

Transmissions? Describe how you would calculate your answer. What values

performs its

LO 3

would you use for the other forecast variables?

20. Sensitivity Analysis We are evaluating a project that costs $1.68 million

has a six-year life, and has no salvage value. Assume that depreciation is

straight-line to zero over the life of the project. Sales are projected at 90,000

units per year. Price per unit is $37.95, variable cost per unit is $23.20, and

fixed costs are $815,000 per year. The tax rate is 21 percent, and we require a

return of 11 percent on this project.

Calculate the base-case cash flow and NPV. What is the sensitivity of

NPV to changes in the sales figure? Explain what your answer tells you

about a 500-unit decrease in projected sales.

LO 3

а.

b. What is the sensitivity of OCF to changes in the variable cost figure?

Explain what your answer tells you about a $1 decrease in estimated

variable costs.

21. Scenario Analysis In the previous problem, suppose the projections given

for price, quantity, variable costs, and fixed costs are all accurate to within

±10 percent. Calculate the best-case and worst-case NPV figures.

22. Calculating Project Cash Flows and NPV Pappy's Potato has come up with

a new product, the Potato Pet (they are freeze-dried to last longer). Pappy's

paid $120,000 for a marketing survey to determine the viability of the

product. It is felt that Potato Pet will generate sales of $835,000 per year. The

fixed costs associated with this will be $204,000 per year, and variable costs

will amount to 20 percent of sales. The equipment necessary for production

of the Potato Pet will cost $865,000 and will be depreciated in a straight-

line manner for the four years of the product life (as with all fads, it is felt

the sales will end quickly). This is the only initial cost for the production.

Pappy's has a tax rate of 23 percent and a required return of 13 percent.

Calculate the payback period, NPV, and IRR.

LO 3

LO 2

ERMEDIATE (Questions 23-28)

2

23. Cost-Cutting Proposals CSM Machine Shop is considering a four-year

project to improve its production efficiency. Buying a new machine press for

$395,000 is estimated to result in $144,000 in annual pretax cost savings.

The press falls in the MACRS five-year class, and it will have a salvage

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning