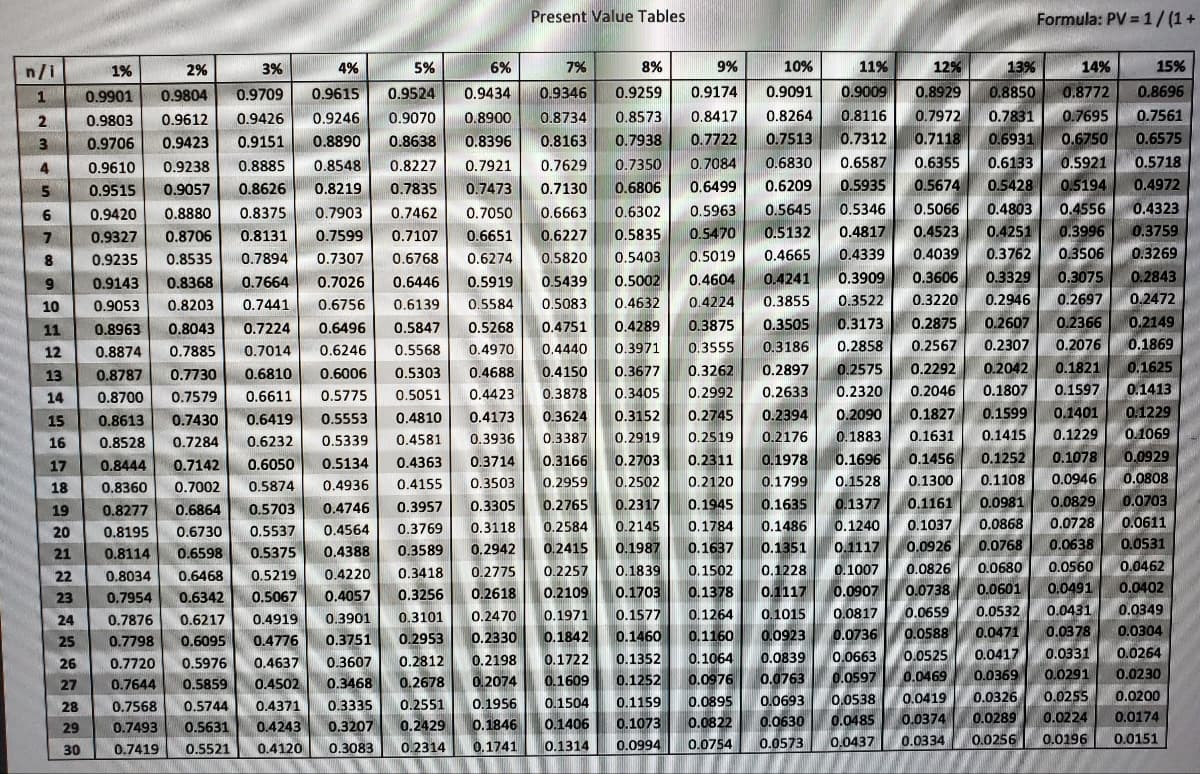

1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 11% 12% 13% 0.9901 0.9804 0.9709 0.9615 0.9524 0.9434 0.9346 0.9259 0.9174 0.9091 0.9009 0.8929 0.8850 0.8264 0.8116 0.7831 0.7972 0.7118 0.9803 0.9612 0.9426 0.9246 0.9070 0.8900 0.8734 0.8573 0.8417 0.9706 0.9423 0.9151 0.8890 0.8638 0.8396 0.8163 0.7938 0.7722 0.7513 0.7312 0.6931 0.9610 0.9238 0.8885 0.8548 0.8227 0.7921 0.7629 0.7350 0.7084 0.6830 0.6587 0.6355 0.6133 0.9515 0.9057 0.8626 0.8219 0.7835 0.7473 0.7130 0,6806 0.6499 0.6209 0.5935 0.5674 0.5428 0.5066 0.4803 0.4251 0.9420 0.8880 0.8375 0.7903 0.7462 0.7050 0.6663 0,6302 0.5963 0.5645 0.5346 0.9327 0.8706 0.8131 0.7599 0.7107 0.6651 0.6227 0.5835 0.5470 0.5132 0.4817 0.4523 0.9235 0.8535 0.7894 0.7307 0.6768 0.6274 0.5820 0.5403 0.5019 0.4665 0.4339 0.4039 0.3762 0.9143 0.8368 0.7664 0.7026 0.6446 0.5919 0.5002 0.4604 0.4241 0.3909 0.3606 0.3329 0.5439 0.7441 0.6756 0.6139 0.5083 0.4632 0.4224 0.3855 0.3522 0.3220 0.2946 0.9053 0.8203 0.5584 0.8963 0.8043 0.7224 0.6496 0.5847 0.5268 0.4751 0.4289 0.3875 0.3505 0.3173 0.2875 0,2607 0.2567 O 2207

1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 11% 12% 13% 0.9901 0.9804 0.9709 0.9615 0.9524 0.9434 0.9346 0.9259 0.9174 0.9091 0.9009 0.8929 0.8850 0.8264 0.8116 0.7831 0.7972 0.7118 0.9803 0.9612 0.9426 0.9246 0.9070 0.8900 0.8734 0.8573 0.8417 0.9706 0.9423 0.9151 0.8890 0.8638 0.8396 0.8163 0.7938 0.7722 0.7513 0.7312 0.6931 0.9610 0.9238 0.8885 0.8548 0.8227 0.7921 0.7629 0.7350 0.7084 0.6830 0.6587 0.6355 0.6133 0.9515 0.9057 0.8626 0.8219 0.7835 0.7473 0.7130 0,6806 0.6499 0.6209 0.5935 0.5674 0.5428 0.5066 0.4803 0.4251 0.9420 0.8880 0.8375 0.7903 0.7462 0.7050 0.6663 0,6302 0.5963 0.5645 0.5346 0.9327 0.8706 0.8131 0.7599 0.7107 0.6651 0.6227 0.5835 0.5470 0.5132 0.4817 0.4523 0.9235 0.8535 0.7894 0.7307 0.6768 0.6274 0.5820 0.5403 0.5019 0.4665 0.4339 0.4039 0.3762 0.9143 0.8368 0.7664 0.7026 0.6446 0.5919 0.5002 0.4604 0.4241 0.3909 0.3606 0.3329 0.5439 0.7441 0.6756 0.6139 0.5083 0.4632 0.4224 0.3855 0.3522 0.3220 0.2946 0.9053 0.8203 0.5584 0.8963 0.8043 0.7224 0.6496 0.5847 0.5268 0.4751 0.4289 0.3875 0.3505 0.3173 0.2875 0,2607 0.2567 O 2207

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter4: Bond Valuation

Section: Chapter Questions

Problem 9P: Bond Valuation and Interest Rate Risk The Garraty Company has two bond issues outstanding. Both...

Related questions

Question

100%

Whats the present value of these three options? I attached an image of a present value chart.

Thanks for your help!

Transcribed Image Text:Present Value Tables

Formula: PV = 1/(1+

n/i

1%

2%

3%

4%

5%

6%

7%

8%

9%

10%

11%

12%

13%

14%

15%

0.9901

0.9804

0.9709

0.9615

0.9524

0.9434

0.9346

0.9259

0.9174

0.9091

0.9009

0.8929

0.8850

0.8772

0.8696

0.7831

0.6931

0.9803

0.9612

0.9426

0.9246

0.9070

0.8900

0.8734

0.8573

0.8417

0.8264

0.8116

0.7972

0.7695

0.7561

3

0.9706

0.9423

0.9151

0.8890

0.8638

0.8396

0.8163

0.7938

0.7722

0.7513

0.7312

0.7118

0.6750

0.6575

0.9610

0.9238

0.8885

0.8548

0.8227

0.7921

0.7629

0.7350

0.7084

0.6830

0.6587

0.6355

0.6133

0.5921

0.5718

4

0.9515

0.9057

0.8626

0.8219

0.7835

0.7473

0.7130

0.6806

0.6499

0.6209

0.5935

0.5674

0,5428

0.5194

0.4972

0.4803

0.4251

0.4556

0.3996

0.3506

6

0.9420

0.8880

0.8375

0.7903

0.7462

0.7050

0.6663

0.6302

0.5963

0.5645

0.5346

0,5066

0.4323

7.

0.9327

0.8706

0.8131

0.7599

0.7107

0.6651

0.6227

0.5835

0.5470

0.5132

0.4817

0.4523

0.3759

0.5403

0.4039

0.3762

0.3269

8.

0.9235

0.8535

0.7894

0.7307

0.6768

0.6274

0.5820

0.5019

0.4665

0.4339

0.7664

0.7026

0.6446

0.5919

0.5002

0.4604

0.4241

0.3909

0.3606

0.3329

0,3075

0.2843

9.

0.9143

0.8368

0.5439

0.8203

0.7441

0.6756

0.6139

0.5584

0.5083

0.4632

0.4224

0.3855

0.3522

0.3220

0.2946

0.2697

0.2472

10

0.9053

0.2149

0.1869

0.8963

0.8043

0.7224

0.6496

0.5847

0.4751

0.4289

0.3875

0.3505

0.3173

0.2875

0.2607

0.2366

11

0.5268

0.7014

0.5568

0.4970

0.3971

0.3555

0.3186

0.2858

0.2567

0.2307

0.2076

12

0.8874

0.7885

0.6246

0.4440

0.6006

0.5303

0.4688

0.3677

0.3262

0.2897

0.2575

0.2292

0.2042

0.1821

0.1625

13

0.8787

0.7730

0.6810

0.4150

0.5775

0.4423

0.3878

0.3405

0.2992

0.2633

0.2320

0.2046

0.1807

0.1597

0.1413

14

0.8700

0.7579

0.6611

0.5051

0.4810

0.4173

0.3152

0.2745

0.2394

0.2090

0.1827

0.1599

0.1401

0.1229

15

0.8613

0.7430

0.6419

0.5553

0.3624

0.4581

0.3936

0.3387

0.2919

0.2519

0.2176

0.1883

0.1631

0.1415

0.1229

0.1069

16

0.8528

0.7284

0.6232

0.5339

0.1978

0.1696

0.1456

0.1252

0.1078

0.0929

0.2311

0.2120

17

0.8444

0.7142

0.6050

0.5134

0.4363

0.3714

0.3166

0.2703

0.7002

0.5874

0.4936

0.4155

0.3503

0.2959

0.2502

0.1799

0.1528

0.1300

0.1108

0.0946

0.0808

18

0.8360

0.5703

0.4746

0.3957

0.3305

0.2765

0.2317

0.1945

0.1635

0.1377

0.1161

0.0981

0.0829

0.0703

19

0.8277

0.6864

0.0728

0.0611

0.2145

0.1987

20

0.8195

0.6730

0.5537

0.4564

0.3769

0.3118

0.2584

0.1784

0.1486

0.1240

0.1037

0.0868

0.0638

0.0560

0.1117

0.0768

0.0531

0.1637

0.1502

0.8114

0.6598

0.4388

0.3589

0,2942

0.2415

0.1351

0.0926

21

0.5375

0.1839

0.1228

0.1007

0.0826

0.0680

0.0462

22

0.8034

0.6468

0.5219

0.4220

0.3418

0.2775

0.2257

0.0601

0.0402

0.0491

0.0431

0.0378

0.0331

23

0.7954

0.5067

0.4057

0.3256

0.2618

0.2109

0.1703

0.1378

0.1117

0.0907

0.0738

0.6342

0.4919

0.2470

0.1971

0.1577

0.1264

0.1015

0.0817

0.0659

0.0532

0.0349

24

0.7876

0.6217

0.3901

0.3101

0.0736

0.0663

0.0597

0.7798

0.3751

0.2953

0.2330

0.1842

0.1460

0.1160

0.0923

0.0588

0.0471

0.0304

25

0.6095

0.4776

0.0417

0.0264

0.1064

0.0976

0.2812

0.2198

0.1722

0.1352

0.0839

0.0525

0.5976

0.5859

26

0.7720

0.4637

0.3607

0.0369

0.0326

0.0289

0.4502

0,3468

0.2678

0.2074

0.1609

0.1252

0.0763

0.0469

0.0291

0.0230

27

0.7644

0.0255

0.0200

0.0693

0.0630

0.0573

0.3335

0.1956

0.1504

0.1159

0.0895

0.0538

0.0419

28

0.7568

0.5744

0.4371

0.2551

0.0485

0.0374

0.0224

0.0174

0.1073

0.0994 0.0754

0.2429

0.0822

0.1846

0.1741

29

0.7493

0.5631

0.4243

0.3207

0.1406

0.0437

0.0334

0.0256

0.0196

0.0151

30

0.7419

0.5521

0.4120

0.3083

0.2314

0.1314

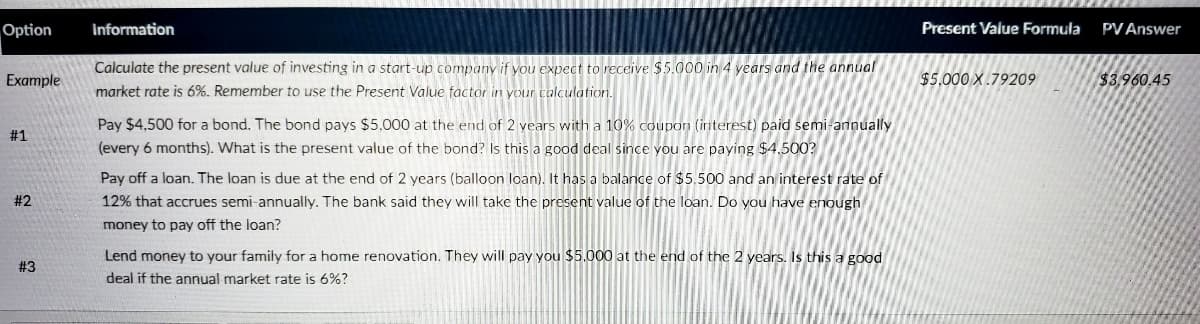

Transcribed Image Text:Option

Information

Present Value Formula

PV Answer

Calculate the present value of investing in a start-up company if you expect to receive $5.000 in 4 years and the annual

market rate is 6%. Remember to use the Present Value factor in your calculation.

Example

$5,000 X.79209

$3,960.45

Pay $4,500 for a bond. The bond pays $5,000 at the end of 2 years with a 10% coupon (irnterest) paid semi-annually

#1

(every 6 months). What is the present value of the bond? Is this a good deal since you are paying $4.500?

Pay off a loan. The loan is due at the end of 2 years (balloon loan). It has a balance of $5.500 and an interest rate of

# 2

12% that accrues semi-annually. The bank said they will take the present value of the loan. Do you have enough

money to pay off the loan?

Lend money to your family for a home renovation. They will pay you $5.000 at the end of the 2 years. Is this a good

#3

deal if the annual market rate is 6%?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning