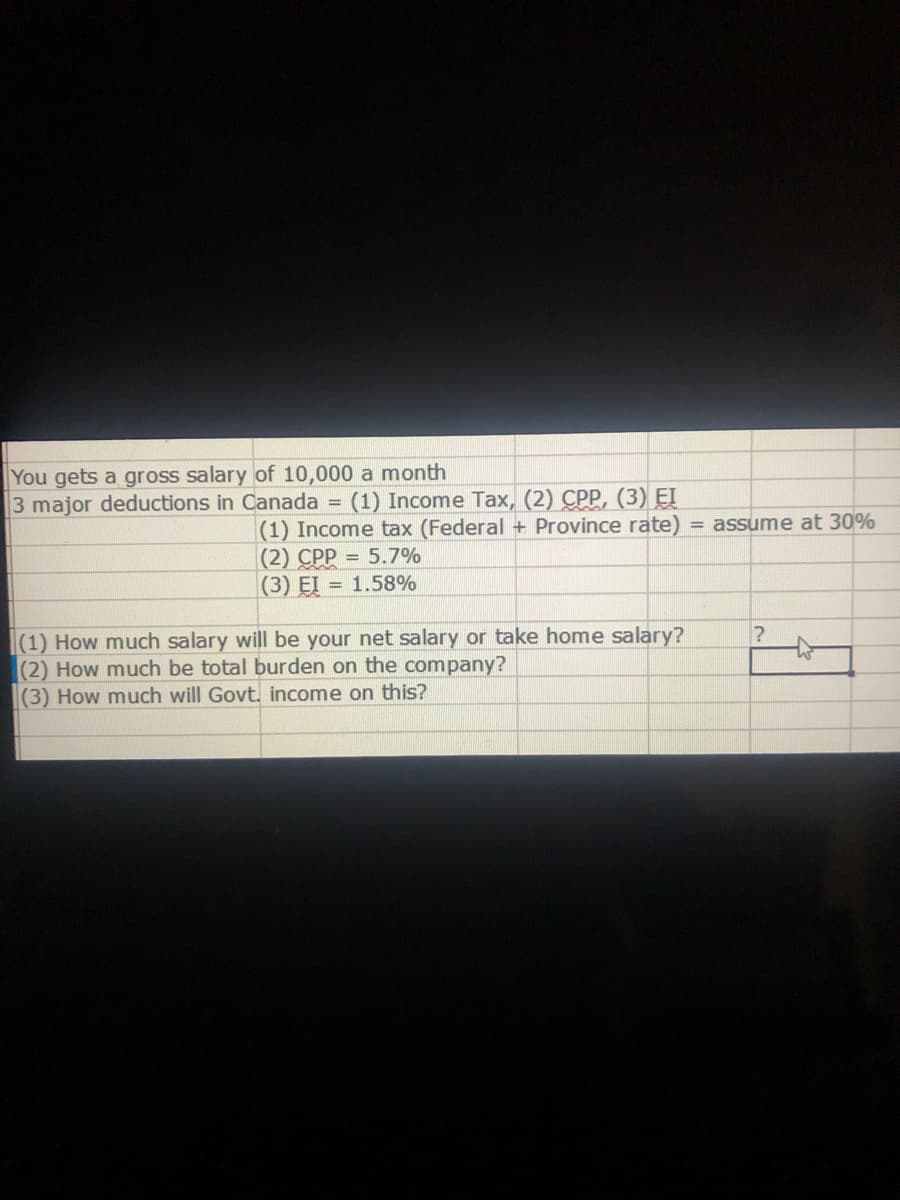

(2) CPP = 5.7% (3) EI = 1.58% much salary will be your net salary or take home salary? much be total burden on the company? w much will Govt. income on this?

Q: sets amount of current liabilities is 00 500 00

A: Ans D is correct

Q: If there is a provision for division of profits but not losses in the partnership agreement, it is…

A: According to Partnership Act 1932, in the absence of any agreement between partners profit and loss…

Q: On October 20, 2020, Corporation H entered a contract to receive two million Argentinian pesos on…

A: The parties to the future agreement are the vendor and the buyer. The vendor consents to sell a good…

Q: Kane Candy Company sells candy bars for $1 each. In addition, Kane offers its customers a coffee mug…

A: “Since you have posted a question with multiple sub-parts, we will solve the first three sub-parts…

Q: Consider the following information. 1. On September 1, 2022, a US firm contracts to buy equipment…

A:

Q: April 2 Garcia invested $38,000 cash and computer equipment worth $11,400 in the company in exchange…

A: Journal entry: It refers to the recording of company's financial transactions in it's primary book…

Q: One Stop Electrical Shop are merchandisers of household fixtures & fittings. The business began the…

A: A system of inventory accounting known as last in, first out (LIFO) registers sales of the most…

Q: nsaction in which only statements of Alex Greenway Co. Indicate in which financial statement(s) the…

A: Retained earnings refer to the number of earnings which is kept aside by the businesses as a part of…

Q: On November 30, P Corporation purchased inventory from a Chinese supplier. The Chinese company…

A: Accounts payable is an obligation which is to paid off by the entity to its creditors or suppliers…

Q: a.Which of the following statement/s regarding the method of consolidation is true: (1)…

A: As per the Honor code of Bartleby we are bound to given the answer question only, Please post the…

Q: 4. Manufacturing equipment has a capital cost of $86,000 with an asset life of 3 years. Compute the…

A: Modified accelerated cost recovery system was a depreciation system introduced by the revenue…

Q: * Enter the opening balances in the ledger accounts as at Oct 1, Write "Balance" in the expla-…

A: Negative sign in balance column indicates credit balance and positve sign indicates debit balance…

Q: JOINT PRODUCTS: Machintosh Company produces two products from a common input. Common Input Question…

A: Split Off Point :— It is the separation point of joint products. Common cost is incurred for the…

Q: Kearney, Inc., makes kitchen tools. Company management believes that a new model of coffee grinder…

A: Introduction:- Selling price=$ 66 Operating profit=20% of manufacturing cost Selling…

Q: The owner of the business, Roger Lightfoot, has stated that his objective is to cut back on his tax…

A: There are a number of reasons why it is important to have accurate inventory valuation methods.…

Q: The Flint Company issued $330.000 of 7% bonds on January 1, 2020. The bonds are due January 1, 2025,…

A: Bonds :— It is one of the source of capital that pays periodic interest and face value at the end of…

Q: Andrew and Rachel occasionally use an online rental platform to advertise and rent their personal…

A: As per the general rules a taxpayer must report all rental income on their tax return. In general,…

Q: Problem 3-7 (Algo) Balance sheet preparation; errors [LO3-2, 3-3] The following balance sheet for…

A: Balance Sheet :— It is one of the financial statement that shows list of final balances of assets,…

Q: The development department shows financial results of the following for the month of June: Actual…

A: variance refers to the difference that arrives between the budgeted expenses and the actual…

Q: What is a multinational organization that is publicly traded on a U.S. stock exchange and uses the…

A: Multinational national organization also called multinational corporation(MNC). Multinational…

Q: Assume that the current ratio for Arch Company is 3.5, its acid-test ratio is 2.0, and its working…

A: Current assets are the assets which can be liquidated within a year. Current liabilities are the…

Q: 30 Paid the staff $5,000 salary for the month. Instructions a) Journalize the transactions,…

A: Journal Entry In accordance with the double-entry accounting method, journal entries are created in…

Q: Cheyenne Company has budgeted the following information for June: Cash receipts Beginning cash…

A: Interest paid is the amount paid on borrowing for the period it has been used. It is calculated on…

Q: In 2020, Henry and Eva paid $2,500 of qualified domestic adoption expenses. The adoption did not…

A: There are adoption credit available based on the income and they are paid in the year in which it is…

Q: what amount of taxes and/or early distribution penalties will Javier be required to pay on this…

A: The amount that must be paid by Javier will be (b)$3,000 income tax; $0 early distribution penalty

Q: Take me to the text Sleiger Spa has a net accounts receivable opening balance of $223,000 and and…

A: a. Days sales outstanding = 160 days Days sales outstanding = (Average receivables / total…

Q: 1. Prepare all appropriate Journal entries related to the Investment during 2021. 2. What amount…

A: If a company purchases another company's shares with its own funds, the following rules apply: The…

Q: Solare Company acquired mineral rights for $647,400,000. The diamond deposit is estimated at…

A: DEPLETION Depletion method is specially suited to mines, oil wells, Quarries, Sandpits, and…

Q: Compute how much money you need to invest each month in order to be able to have enough money at…

A: Given that, Interest rate = 6.22% Time period = 40 years U = 12 No. of months = u +28 Find: Amount…

Q: Xtra Processes is involved with innovative approaches to finding energy reserves. Xtra recently…

A: The journal entry of above question are as follows

Q: Question: What is the source documents for cash collection by business X. option: a) invoice…

A: The source document is a document in which evidence of financial transactions has been done between…

Q: ement 1. Compute cost of goods sold and gross profit using the FIFO inventory costing method. by…

A: FIFO states that the inventory purchased first would be sold first. Whereas, LIFO states that the…

Q: What is the overhead cost assigned to Product XO under activity-based costing? (Round your…

A: The overhead costs consists of indirect costs incurred for production process. The overhead costs…

Q: Construct a cost-volume-profit chart indicating the break-even sales for last year. Verify your…

A: INCOME FROM LAST YEAR SALES Per Unit No.of Units Total Sales $200 2000 $400,000 Less :…

Q: Use the 2016 marginal tax rates to compute the tax owed by the following person. A head of household…

A: Tax Liability: The entire amount of unpaid taxes owing to the government by a person, company, or…

Q: Dueplo Construction has agreed to build an addition for an office building for a contract price of…

A: Generally, When the revenue is recognized over time, the revenue is distributed over the years in a…

Q: 02) On 30 June 2010 Parent owns 80% of the share capital of Subsidiary. The non-controlling interest…

A: Explanation:- At the time of acquisition = $1,300,000 % Post acquisition = (5,600,000– 4,700,000) x…

Q: 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 Chapter 7: Applying Excel Data…

A: An income statement is a financial report that indicates the revenue and expenses of a business. It…

Q: Revenue (200,000 units) $1,600,000…

A: Preparing a budgeted income statement can be helpful in many ways, firstly, it can help individuals…

Q: Use the accounting equation to answer each of the following questions. (a) The liabilities of Alli…

A: Accounting equation is the equation which is used to represent the asset, liabilities and owner's…

Q: The subsequent period in an audit is the time extending from the balance sheet date to the date of…

A:

Q: 4. At the end of May, the following adjustment data were assembled. Analyze and use these data to…

A: ADJUSTED JOURNAL ENTRY Adjusted Journal Entries are recorded at the end of the Year. Adjusting…

Q: I need the graph chart for this equation/ answe

A: Break even point is the production level where total revenue equal to total expenses. Means no…

Q: Question 11 A married couple filed their income taxes jointly. The marginal tax rate for their…

A: A tax bill refers to the money that is required by the government which is paid by the people on the…

Q: Adjusting Entries- Round to two decimal places The annual interest rate on the mortgage payable was…

A: A journal entry is a form of accounting entry that is used to report a business transaction in a…

Q: Sales $ 300,000 $ 40 Variable expenses 120,000 16 Contribution margin 180,000 $ 24 Fixed expenses…

A: Commission will be paid on units sold above the break-even point. So first, break-even point needs…

Q: Each of the four Independent situations below describes a finance lease in which annual lease…

A: Table Values:- Present value factor for n = 10 and i = 12% is 0.3220 Present value of annuity due…

Q: Use the 2016 marginal tax rates to compute the income tax owed by the following person. Unmarried…

A: According to the given question, we are required to compute the income tax owed. According to the…

Q: Melay company had 150,000 equity shares in issue on January 1, 20B. On July 1, 20B it issued 30,000…

A: For calculating the Basic Earnings Per Share, we use the weighted average no. of shares outstanding.…

Q: I'm sorry but when i submitted my question I stated that the transactions are recorded unde the…

A: The transactions are recorded in the books so that financial statements can be prepared at the end…

Step by step

Solved in 4 steps with 4 images

- 1. In 2020, X Corporation had the following data: Sales of 1M and cost /expenses of 500,000. Can we apply the 8% rate in the computation of income tax? 2. A, Canadian citizen living in Manila, has the following income in 2019: interest income from loan granted to resident of Cebu amounting to 50,000; salary for services rendered in Italy of 100,000; sale of personal property with gain of 300,000 (located in Manila); rental income from properties located in Japan of 100,000. What is the income tax due of A under the GTR? 3. Asta, non-resident alien not engaged in business in the Philippines, has the following income for 2019: Business income in USA of 7,000,000 and; Other income of 2,000,000 earned in the Philippines. How much is the income tax due of Asta? 4. In 2019, A, employee of MCDO Corp, has an annual salary of 2.5M only. Can A avail the 8%?How to calculate oasdi and HI tax with these $3,100 per month $30,000 per year $280 per week $350 per week $240 per week1. Jonas Brown is employed as a mechanic in Country A. His emoluments is $40,000 per week . He receives a tax-free travelling allowance of $5,000 per week. Calculate his annual deductions assuming the following:a. The annual income tax threshold is $1,000,000 per year. b. Housing Contribution Rate 3% for the employer 2% for the employee. c. John contributes 10% per month to an approved pension scheme and his employer provides a matching contribution.d. National Insurance is 3% for the employer and 3% for the employee.e. The income tax rate is 25%. f. Number of weeks is 52

- You received $5,000 in interest revenue during the year. Your federal marginal tax rate was 26% and average tax rate was 20%. How much federal income taxes did you pay? Select one: a. $1,300 b. $1,650 c. $950 d. $1,450 e. $3,300Give typing answer with explanation and conclusion Louise Gendron’s monthly gross income is $4,800. Her employer withholds $720 in federal and provincial income taxes, $210.68 towards the Canada Pension Plan, and $68.67 for EI contributions. Louise contributes $180 per month to her RRSP. Her monthly credit payments for Visa and MasterCard are $83 and $73, respectively. Her monthly payment on an automobile loan is $465. a. What is Louise’s debt-payments-to-income ratio? (Round your answer to 2 decimal places. Omit "%" sign in your response.) Debt payments–to–income ratio % b. Is Louise living within her means?You are working as a treasurer for a Toronto-based long-term healthcare company. Your company has $10,000,000 of excess cash and you notice that, on June 29, 2023 the Canadian overnight REPO rate average (CORRA) is 4.75%. If you consider depositing your company's excess cash ($10,000,000) for 14 consecutive days in this overnight rate, calculate the after-tax interest income assuming that the tax rate on interest income is 40%. Also, assume that there is no transaction cost

- 1. A, resident citizen, has the following income for year 2019: Compensation income of 1,000,000 and Other income of 200,000. What is the income tax due? 2.The minimum wage in Marawi City is 550 per day. A, a laborer, earns 900 per day. He worked for 280 days in 2019. How much is the ANNUAL income tax due of A? 3. Asta, non-resident citizen has the following income for 2019: Business income in USA of 7,000,000 and; Compensation income of 2,000,000 earned in the Philippines. How much is the income tax due of Asta?Calculate the Value Added Tax (VAT) payable to / refundable by the South African Revenue Services (SARS) using the following information Sales R 10 000 Cost of sales R 4 000 Machine purchased R 30 000 Salaries and wages R2 500 Round off to the nearest rand and assume a VAT rate of 15% where applicable For every transaction clearly indicate whether VAT is applicable or not.1. Suppose the gross sales of Lukah’s Coffee Shop for the month of April is Php 50,000. How much is its gross profit? A. 50,000 B. 32,000 C. 20,500 D. 38,500 2. How about its income before tax? A. 50,000 B. 32,000 C. 20,500 D. 38,500 3. Suppose the government imposes a 5% income tax on all businesses earning an income worth Php 50,000 and below. Solve for the income after tax of Lukah’s Coffee Shop. A. 30,400 B. 32,000 C. 20,000 D. 19,475 4. Now, suppose the rent expense increased from Php 3,500 to Php 4,000. What is now the income before tax of Lukah’s Coffee Shop? A. 30,400 B. 32,000 C. 20,000 D. 19,475 5. Given the change in the gross profit due to an increase in the cost of rental space, how much, then, is the income after tax of Lukah’s Coffee Shop? A. 30,400 B. 32,000 C. 20,000 D. 19,000

- 1. An employee earns 35,000 a month. He receives his salary every 15th and 30th of the month. His conrtibutions and tax is being deducted fairly every cut-off. A. How much is his gross earnings per cut-off? B. How much is his withholding tax per cut-off? C. Compute for his SSS, Philhealth, and PagIBIG every cut off. D. How much is his net earnings every cut-off?A company wants to pay a bonus to an employee so that the net pay is $10,000. The federal income tax rate is 15%, the state income tax rate is 4%, the FICA rate is 7.65%, and the company's state unemployment tax rate is 3%. Which of the following is the formula used to determine this payroll calculation? Select one: a. $13,449.90 b. $14,214.64 c. $13,633.27 d. $7,713.07 e. $7,895.78Your gross annual pay is $19 163. Employment insurance premiums are deducted at a rate of 2.25% and Canada Pension Plan premiums are 3.75% based on total earnings. You pay income taxes at a rate of 17% on all amounts over $8131. What is your Net Pay for the year? A) $16 137.78 B) $15 137.78 C) $16 317.78 D) $17 137.78 E) $18 237.78