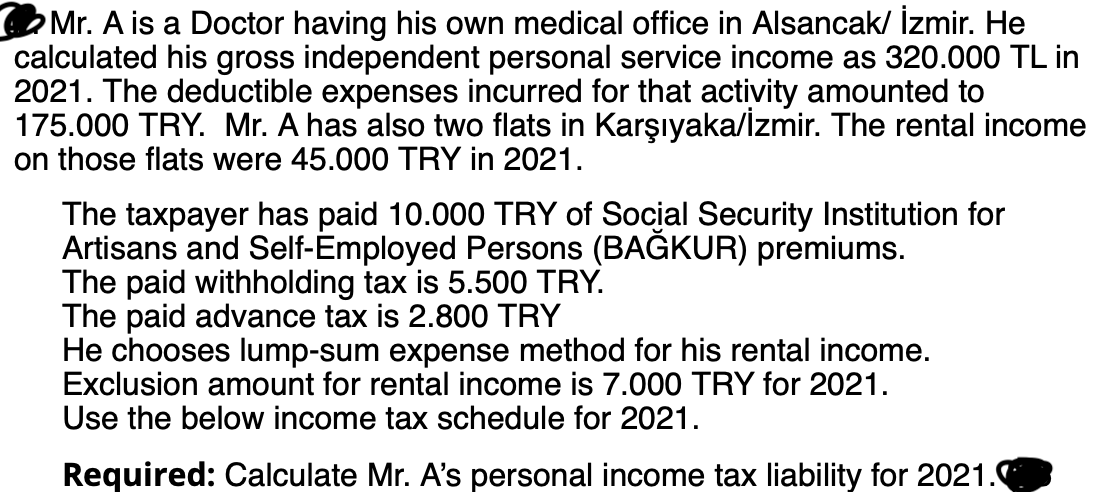

2 Mr. A is a Doctor having his own medical office in Alsancak/ Izmir. He calculated his gross independent personal service income as 320.000 TL in 2021. The deductible expenses incurred for that activity amounted to 175.000 TRY. Mr. A has also two flats in Karşıyaka/İzmir. The rental income on those flats were 45.000 TRY in 2021. The taxpayer has paid 10.000 TRY of Social Security Institution for Artisans and Self-Employed Persons (BAĞKUR) premiums. The paid withholding tax is 5.500 TRY. The paid advance tax is 2.800 TRY He chooses lump-sum expense method for his rental income. Exclusion amount for rental income is 7.000 TRY for 2021. Use the below income tax schedule for 2021. Required: Calculate Mr. A's personal income tax liability for 2021.

2 Mr. A is a Doctor having his own medical office in Alsancak/ Izmir. He calculated his gross independent personal service income as 320.000 TL in 2021. The deductible expenses incurred for that activity amounted to 175.000 TRY. Mr. A has also two flats in Karşıyaka/İzmir. The rental income on those flats were 45.000 TRY in 2021. The taxpayer has paid 10.000 TRY of Social Security Institution for Artisans and Self-Employed Persons (BAĞKUR) premiums. The paid withholding tax is 5.500 TRY. The paid advance tax is 2.800 TRY He chooses lump-sum expense method for his rental income. Exclusion amount for rental income is 7.000 TRY for 2021. Use the below income tax schedule for 2021. Required: Calculate Mr. A's personal income tax liability for 2021.

Chapter4: Gross Income: Concepts And Inclusions

Section: Chapter Questions

Problem 42P: Troy, a cash basis taxpayer, is employed by Eagle Corporation, also a cash basis taxpayer. Tray is a...

Related questions

Question

calculated personal income tax?

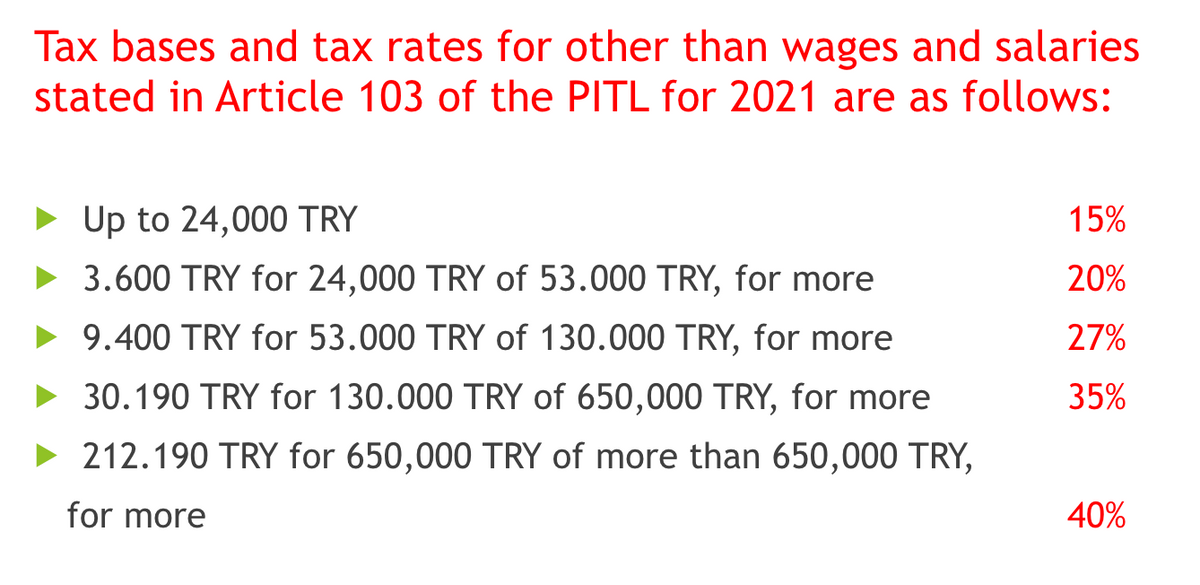

Transcribed Image Text:Tax bases and tax rates for other than wages and salaries

stated in Article 103 of the PITL for 2021 are as follows:

• Up to 24,000 TRY

15%

3.600 TRY for 24,000 TRY of 53.000 TRY, for more

20%

9.400 TRY for 53.000 TRY of 130.000 TRY, for more

27%

30.190 TRY for 130.000 TRY of 650,000 TRY, for more

35%

• 212.190 TRY for 650,000 TRY of more than 650,000 TRY,

for more

40%

Transcribed Image Text:Mr. A is a Doctor having his own medical office in Alsancak/ İzmir. He

calculated his gross independent personal service income as 320.000 TL in

2021. The deductible expenses incurred for that activity amounted to

175.000 TRY. Mr. A has also two flats in Karşıyaka/izmir. The rental income

on those flats were 45.000 TRY in 2021.

The taxpayer has paid 10.000 TRY of Social Security Institution for

Artisans and Self-Employed Persons (BAĞKUR) premiums.

The paid withholding tax is 5.500 TRY.

The paid advance tax is 2.800 TRY

He chooses lump-sum expense method for his rental income.

Exclusion amount for rental income is 7.000 TRY for 2021.

Use the below income tax schedule for 2021.

Required: Calculate Mr. A's personal income tax liability for 2021.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT