2 of the VLN, how do you determine the annuity cash flow (the bond interest payment) from an annual bond? Group of answer choices A. Bond payable x stated rate B. Bond liability x stated rate C. Bond payable x market rate D. Bond liability x market rate

2 of the VLN, how do you determine the annuity cash flow (the bond interest payment) from an annual bond? Group of answer choices A. Bond payable x stated rate B. Bond liability x stated rate C. Bond payable x market rate D. Bond liability x market rate

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter9: Long-term Liabilities

Section: Chapter Questions

Problem 52BE

Related questions

Question

From page 9-2 of the VLN, how do you determine the annuity cash flow (the bond interest payment) from an annual bond?

Group of answer choices

A. Bond payable x stated rate

B. Bond liability x stated rate

C. Bond payable x market rate

D. Bond liability x market rate

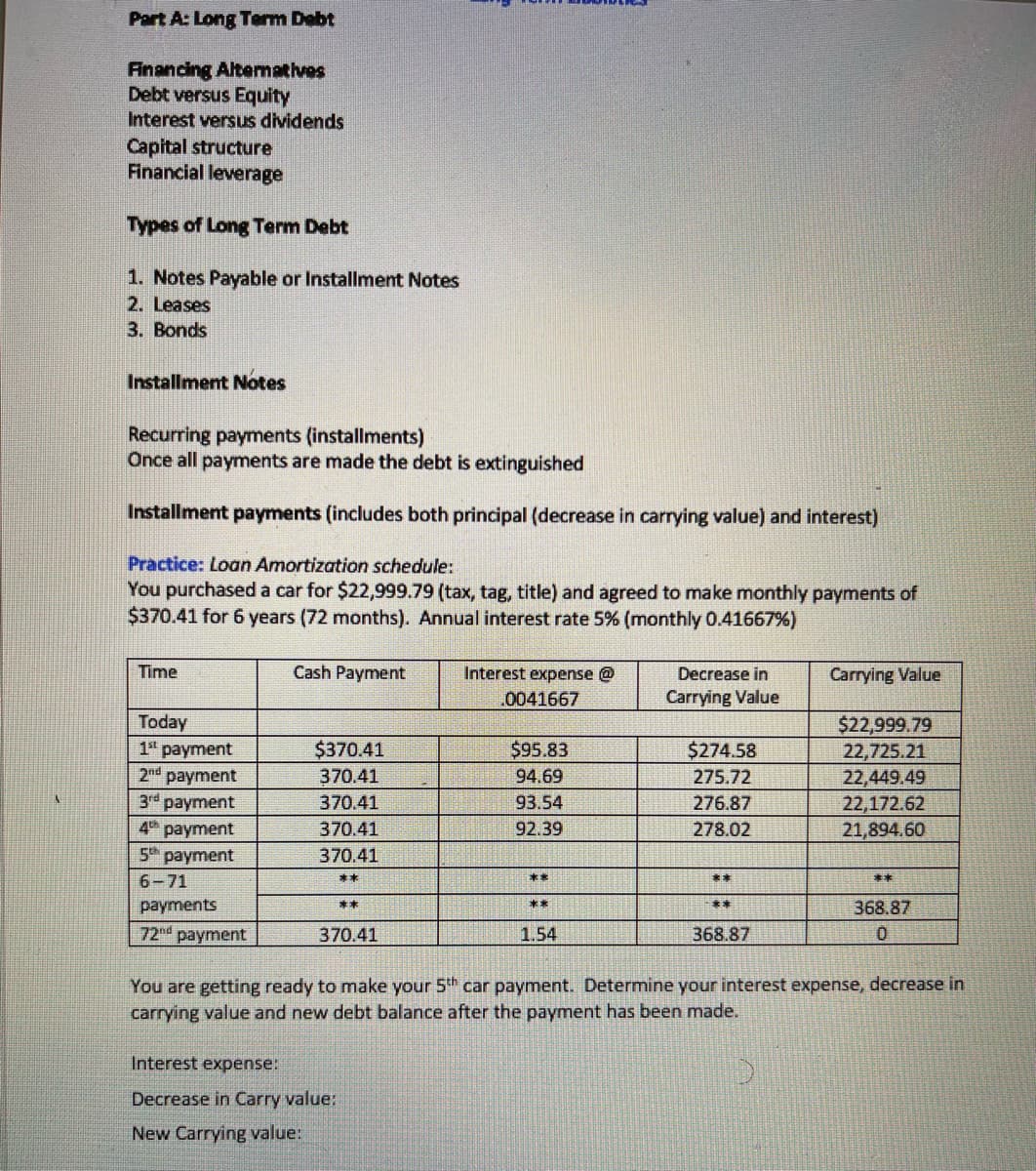

Transcribed Image Text:Part A: Long Term Debt

Anancing Altematives

Debt versus Equity

Interest versus dividends

Capital structure

Financial leverage

Types of Long Term Debt

1. Notes Payable or Installment Notes

2. Leases

3. Bonds

Installment Notes

Recurring payments (installments)

Once all payments are made the debt is extinguished

Installment payments (includes both principal (decrease in carrying value) and interest)

Practice: Loan Amortization schedule:

You purchased a car for $22,999.79 (tax, tag, title) and agreed to make monthly payments of

$370.41 for 6 years (72 months). Annual interest rate 5% (monthly 0.41667%)

Time

Cash Payment

Interest expense @

Decrease in

Carrying Value

.0041667

Carrying Value

Today

1" payment

2nd payment

3rd payment

4th payment

5th payment

$22,999.79

22,725.21

22,449.49

22,172.62

21,894.60

$274.58

$370.41

370.41

370.41

$95.83

94.69

275.72

93.54

276.87

370.41

92.39

278.02

370.41

6-71

本本

**

**

**

payments

368.87

**

**

**

72nd payment

370.41

1.54

368.87

You are getting ready to make your 5th car payment. Determine your interest expense, decrease in

carrying value and new debt balance after the payment has been made.

Interest expense:

Decrease in Carry value:

New Carrying value:

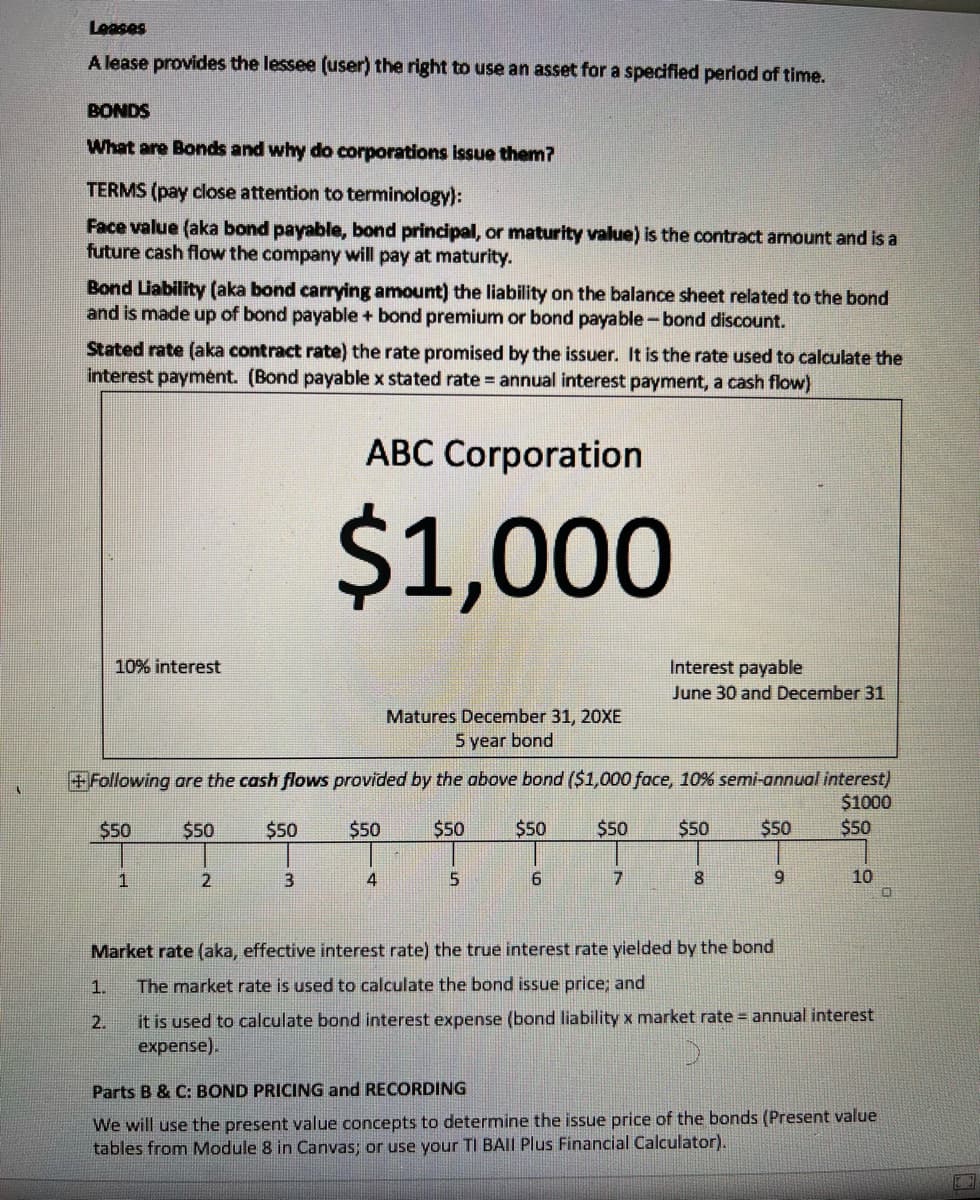

Transcribed Image Text:Leases

A lease provides the lessee (user) the right to use an asset for a specified period of time.

BONDS

What are Bonds and why do corporations issue them?

TERMS (pay close attention to terminology):

Face value (aka bond payable, bond principal, or maturity value) is the contract amount and is a

future cash flow the company will pay at maturity.

Bond Liability (aka bond carrying amount) the liability on the balance sheet related to the bond

and is made up of bond payable + bond premium or bond payable-bond discount.

Stated rate (aka contract rate) the rate promised by the issuer. It is the rate used to calculate the

interest paymént. (Bond payable x stated rate = annual interest payment, a cash flow)

ABC Corporation

$1,000

10% interest

Interest payable

June 30 and December 31

Matures December 31, 20XE

5 year bond

+Following are the cash flows provided by the above bond ($1,000 face, 10% semi-annual interest)

$1000

$50

$50

$50

$50

$50

$50

$50

$50

$50

$50

1

4

8.

9.

10

Market rate (aka, effective interest rate) the true interest rate yielded by the bond

1.

The market rate is used to calculate the bond issue price; and

it is used to calculate bond interest expense (bond liability x market rate annual interest

expense).

2.

Parts B & C: BOND PRICING and RECORDING

We will use the present value concepts to determine the issue price of the bonds (Present value

tables from Module 8 in Canvas; or use your TI BAII Plus Financial Calculator).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning