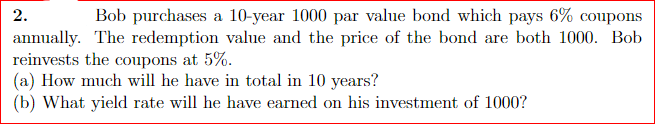

2. Bob purchases a 10-year 1000 par value bond which pays 6% coupons annually. The redemption value and the price of the bond are both 1000. Bob reinvests the coupons at 5%. (a) How much will he have in total in 10 years? (b) What yield rate will he have earned on his investment of 1000?

Q: The purchase price of an acre of land in the Louisiana purchase in 1803 was about 4 cents. Suppose…

A: Price of 1 Acre of land in 1803 is 4 cents Interest rate is 4.9% Compounded annually To Find: Worth…

Q: greg owes two debt payments - a payment of $5328 that was due in 11 months ago and a payment of…

A: First debt payment of $5328 in 11 months ago Second debt payment of $1810 in 7 months The interest…

Q: Assume that both portfolios A and B are well diversified, that E(rA) = 22%, and E(rB) = 17%. If the…

A: Expected return of A , ErA is 22% Expected return of A , ErB is 17% Beta of A is 1.5 Beta of B is…

Q: Chris invested $300K to buy a farmland. The expected yearly revenue is assessed as $67K if farmland…

A: Internal rate of return is the rate of return where present value of cash inflows is equal to…

Q: Find the monthly payment (in $) and the total interest (in $) for a mortgage of $48,000 at 5 1/4%…

A: The monthly payment for a mortgage is made is such a way that the mortgage amortizes to zero by the…

Q: Click on the icon in order to copy its contents into a spreadsheet) Calculate the missing…

A: Break-even point is that point at which total revenue is equal to total costs. Profits start…

Q: Franki finances a motor home for $44,700 by taking out an installment loan for 36 months. The…

A: Loan payoff refers to an amount that is being paid in total for satisfying the mortgage terms and…

Q: Determine how much is in each account on the basis of the indicated compounding after the specified…

A: initial Principal Value is 7200 The interest rate is 2.5% The time period is 1 year To Find:…

Q: Barclay wants to buy a car. The dealer offers a financing package consisting of a 6% APR compounded…

A: Monthly loan payment refers to the periodic repayment of loans. The monthly payment amount includes…

Q: Find the effective yield on a discount loan with the given discount rate r and the time. (Round your…

A: We have to find the effective yield on a discount loan.

Q: A large grocery chain is reevaluating its bonds since it is planning to issue a new bond in the…

A: Note:- Earlier bond is selling at par which means price of the bond is equal to $1,000 and the…

Q: ong 4 calls with strike price 91.0 and price 21.717 Short 0 calls with strike price 91.0 and price…

A: Call options gives you the opportunity to buy the stocks on the maturity but there is no obligations…

Q: Davis Corporation reported the following financial data for one of its divisions for the year;…

A: Financial ratios such as asset turnover, total asset turnover, or asset turns measure how well a…

Q: IBM stock currently sells for 49 dollars per share. Over 12 months the price will either go by 11.5…

A: Option delta is also known as hedge ratio. It helps to create risk neutral portfolio. The formula…

Q: elling Price of Home Down Payment Rate of Interest Years $ 190,000.00 $ 50,000.00 7% 25 Required:…

A: Here, Corrected Table 15.1:

Q: Stubborn Motors, Inc., is asking a price of $87 million to be purchased by Rubber Tire Motor Corp.…

A: Net present value is a capital budgeting technique used to analyze investment profitability87. It is…

Q: Stock price 50 55 Day 0 Day 1 the 1-day mark-to-market profit. Put premium 2.5 2 Put delta -0.5 -0.3

A: Put option give you opportunity to sell the stock on the expiration of period by payment of small…

Q: Scarlet Company received an invoice for $66,000.00 that had payment terms of 3/5 n/30. If it made a…

A: Invoice The list that shows the items purchased by the buyer along with the amount due is known as…

Q: The Zinn Company plans to issue $10,000,000 of 20-year bonds in June to help finance a new research…

A: An approach for reducing the risks associated with financial assets is hedging. It employs market…

Q: A $1,000 par value bond was issued five years ago at a 10 percent coupon rate. It currently has 25…

A: The current price of a bond is the discounted value of future cash flows from the bond.

Q: QUESTION 4 You are considering starting a new factory producing small electric heaters. Each unit…

A: We have to conduct a scenario analysis on the NPV of the project. Input parameters are given.

Q: 2. Procter and Gamble Corporation will pay an annual dividend of $0.65 one year from now. Analysts…

A: The dividend next year, D1 is $0.65 The growth rate is 12% till 5th year The constant growth rate is…

Q: If the price of silver in England is £6.81 per ounce, what is the expected price of silver in the…

A: Price in England = 6.81 Spot exchange rate = 0.5173 Price of silver in United States = ?

Q: Calculating the Number of Payments. You're prepared to make monthly payments of $250, beginning at…

A: Monthly payments of $250 The annuity type is Beginning of the month The interest rate is 8%…

Q: current balance of home is 43,000 at 6.5 % how much is needed to pay off in 11 years ?

A: The current Balance is $40,000 The interest rate is 6.5% The time period is 11 years To Find:…

Q: Apolonia Place is an office building that has recently been put up for sale. It is rented by one…

A: Capital budgeting The method of helping investors to make long-term decisions in investments…

Q: Ying Import has several bond issues outstanding, each making semiannual interest payments. The bonds…

A:

Q: .) From the data below, determine the Microsoft Corporation's - (a) Find arithmetic average return…

A: year Return(%) 2011 18% 2012 21% 2013 16% 2014 11% 2015 19% 2016 22% 2017 12% 2018…

Q: plans to purchase a vehicle, and she is working with two bank offers. . Bank One Loan Offer:…

A: When you take a loan from bank then you have to make fixed monthly payments. The amount of monthly…

Q: Jefferson Products Inc. is considering purchasing a new automatic press brake, which costs $320,000…

A: Honor Code: Since you have posted a question with multiple sub-parts, we will solve the first three…

Q: (5) Case Study: ABC Bank is interested in knowing the risk exposure of their assets for various…

A: Solution:- Value at Risk (VaR) means the amount at stake. It represents the maximum amount of…

Q: Simpson Inc. stock provided a return of 8.0%, 15% and -8% returns in the past three years. What is…

A: Expected return on the stock is the average rate of return earned on the investment and is the…

Q: Suppose you take a 10-year mortgage for a house that costs $276,341. Assume the following: • The…

A: A loan is a form of debt or money borrowed from the bank by an individual. It is an agreement…

Q: If an employee skims sales from a customer, which of the following will likely occur? a. The stolen…

A: Skimming sales is the unethical practice of theft of money from a debtor before the sales have been…

Q: 7. A 25-year, $10,000 strip bond was issued at a market rate of 9.4% compounded semi-annually. What…

A: A financial instrument known as a "strip bond" is one that sells the principal as well as the…

Q: The market value of a home in Boston, MA. is $330,000. The assessment rate is 30%. What is the…

A: The market Value of Boston is $330,000 The assessment rate is 30% To Find: Assessed Value

Q: ABC Company is conducting a project with an up-front cost at t = 0 of $1,100,000. The project's…

A: We have to find the NPV under two situations here. All the cash flows and probabilities are known.

Q: The credit risk on a 5-year $100 par value 6% annual coupon payment corporate bond can be expressed…

A: Credit spread is the difference in yield of a corporate and treasury bond. Credit valuation…

Q: An investor has just obtained the following quotes for a European call option on a non-dividend…

A: Arbitrage opportunity are the risk free opportunity that exist in the market by buying and selling…

Q: 4. A loan of 12 000 euros with an interest rate of 4,5 % a year is compounded semi-annually. If 260…

A: A loan is an agreement between two parties where one party forwards an amount to the other party on…

Q: You have just been employed as an investment analyst in an investment bank. You took over from…

A: Honor Code: Since you have posted a question with multiple sub-parts, we will solve the first three…

Q: For which of the following reasons might the US federal government offer insurance coverage? (Select…

A: The value of the potential loss is too important for the private insurance industry. This might be…

Q: Juliana invested $5000 in a fund at the beginning of every three months for five years. The fund was…

A: Future value refers to the current value of the investment at some future date affected by interest…

Q: Landon Wallin is an auto mechanic who wishes to start his own business. He will need $4900 to…

A: A loan is an agreement where a party forwards an amount to the other party in exchange for the…

Q: A major manufacturer is reevaluating its bonds since it is planning to issue a new bond in the…

A: Note:- Earlier bond is selling at par which means price of the bond is equal to $1,000 and the…

Q: What is the discounted value of $1513.00 paid at the end of every month for 7 years if interest is…

A: Present value The current worth of future cash flow is known as the present value. The present value…

Q: QUESTION 2 You are considering starting a new factory producing small electric heaters. Each unit…

A: Net present value . It is calculated by deducting initial cost from present value of cash inflows.

Q: 51. Comparing Cash Flow Streams. You have your choice of two investment accounts. Investment A is a…

A: Future value of the annuity is the amount that was being deposited over the period of time and…

Q: How much payment Z should he make on the exact time after the last regular payment has been made to…

A: We have to find the payment Z to be made on the exact time after the last regular payment has been…

Q: Prove the loan payment formula, shown below. PMT=Prn1−1+rn−nt Question content area bottom…

A: We have an equation given. We have to derive the equation for PMT.

Please don't answer in handwritten ..thanku

Step by step

Solved in 3 steps

- Consider a six-year, 10% coupon bond (yearly coupon payments) with a face value of $1000 that John bought for $950. (a). What is the yield to maturity of this bond? (b). Suppose after holding it for one year, (and receiving one coupon payment), John sells it for $1050. What is the return John got from holding this bond for one year?Mark buys a 10-year bond of face (and redemption) amount of $1000, with 10% annual coupons at a price to yield an annual effective rate of 10%. The coupons are immediately reinvested at an annual effective rate of 8% once received. Immediately after receiving and reinvesting the 4th coupon, Mark sells the bond to Jeno for a price that will yield an annual effective rate of 12% to Jeno. Calculate the yield rate that Mark actually earns on his investment.Bob uses 19481 to purchase a 10-year par-value bond (i.e. redeems at face-value). Coupons are paid out annually (end of the year) and each coupon is equal to 2% of the face-value of the bond. If each coupon payment is invested into an account that earns an effective annual interest rate of 2.4%, then what is the face-value of the bond if Bob realizes an overall yield of 3.36% per year effective over the 10 year period? Give your answer rounded to the nearest whole number (i.e. X).

- Mike buys a corporate bond with a face value of $1000 for $800. The bond matures in 10 years and pays a coupon interest rate of 5%. Interest is paid every quarter. (a) Determine the effective rate of return if Mike holds the bond to maturity. (b) What effective interest rate will Mike get if he keeps the bond for only 5 years and sells it for $900?Shannon purchases a bond for $952.00. The bond matures in 3 years, and Shannon will redeem it at its face value of $1,000. Coupon payments are paid annually. If Shannon will earn a yield of 12%/year compounded yearly, what is the bond coupon rate?Jerry has an opportunity to buy a bond with a face value of $10,000 and a coupon rate of 14 percent, payable semiannually. a. If the bond matures in five years and Jerry can currently buy one for $4000, what is his IRR for this investment?

- Adam buys a three-year bond with a $1000 face value and a 10% coupon rate for $1000 today. If one year later the market interest rate increases by 5% and Adam sells the bond, then his rate of return on this investment is ______% (round to one decimal place, negative if it is a loss)Last year, Joan purchased a $1,000 face value corporate bond with an 10% annual coupon rate and a 25-year maturity. At the time of the purchase, it had an expected yield to maturity of 12.84%. If Joan sold the bond today for $999.13, what rate of return would she have earned for the past year? Round your answer to two decimal places.Linda wanted to invest in a bond issued by JoJo Ltd. The bond has $1,000 par value, matures in ten (8) years and has a coupon rate of 8.5%, with coupon paid semi-annually. What is the maximum price Linda should pay for the bond if her alternative is to invest in her friend's company who will guarantee a 10% pa return, compound semi-annually?

- John purchases a $600 bond that has 6 remaining semi-annual 7% coupon payments for $510. What would be his return per half year period?Suppose that James just bought the same 15-year bond that Jenna bought and at the same time. If James sells his bond five years from the day he purchased it (with 10 years remaining to maturity) for $1,074, what would be the bond's yield to maturity when he sells it? What return would he earn during the time he held the bond? What portion of the return represents capital gains and what portion represents the current yield?Bill buys a 10-year 1000 par value 5% bond with semi-annual coupons. The price assumes a nominal yield of 6%, compounded semi-annually. As Bill receives each coupon payment, he immediately puts the money into an account earning interest at an annual effective rate of i. At the end of 10 years, after the final coupon, redemption value and accumulated value in the extra account shows that Bill has earned at an annual rate of 6.5%. Calculate i.