2. Complete the requirements below using the space provided The following information is available for Tables and Shares Corporation: Retained Earnings, December 31. 2017 Net Income for the year ended December 31, 2018 The company accountant, in preparing financial statements for the year ending December 31. 2018, has discovered the following information: S1,500.000 S 250.000 The company's previous bookkeeper, who has been fired, had recorded amortization expense on a machine in 2010 and 2017 using the double declining-balance method of amortization. The bookkeeper neglected to use the straight-line method of amortization which is the company's policy. The cumulative effect of the error on prior years was $9,000, net of income tax. Amortization was calculated by the straight-line method in 2018.

2. Complete the requirements below using the space provided The following information is available for Tables and Shares Corporation: Retained Earnings, December 31. 2017 Net Income for the year ended December 31, 2018 The company accountant, in preparing financial statements for the year ending December 31. 2018, has discovered the following information: S1,500.000 S 250.000 The company's previous bookkeeper, who has been fired, had recorded amortization expense on a machine in 2010 and 2017 using the double declining-balance method of amortization. The bookkeeper neglected to use the straight-line method of amortization which is the company's policy. The cumulative effect of the error on prior years was $9,000, net of income tax. Amortization was calculated by the straight-line method in 2018.

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter1: Accounting As A Form Of Communication

Section: Chapter Questions

Problem 1.10E: Net Income (or Loss) and Retained Earnings The following information is available from the records...

Related questions

Question

can you please reproduce the retained earnings T account for the year

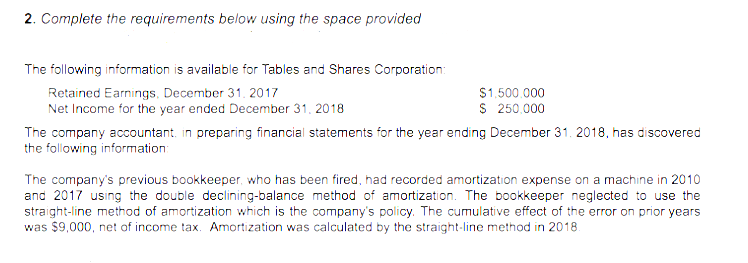

Transcribed Image Text:2. Complete the requirements below using the space provided

The following information is available for Tables and Shares Corporation:

Retained Earnings, December 31. 2017

Net Income for the year ended December 31, 2018

The company accountant. in preparing financial statements for the year ending December 31. 2018, has discovered

the following information

S1,500.000

S 250.000

The company's previous bookkeeper, who has been fired, had recorded amortization expense on a machine in 2010

and 2017 using the double declining-balance method of amortization. The bookkeeper neglected to use the

straight-line method of amortization which is the company's policy. The cumulative effect of the error on prior years

was $9,000, net of income tax. Amortization was calculated by the straight-line method in 2018.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning