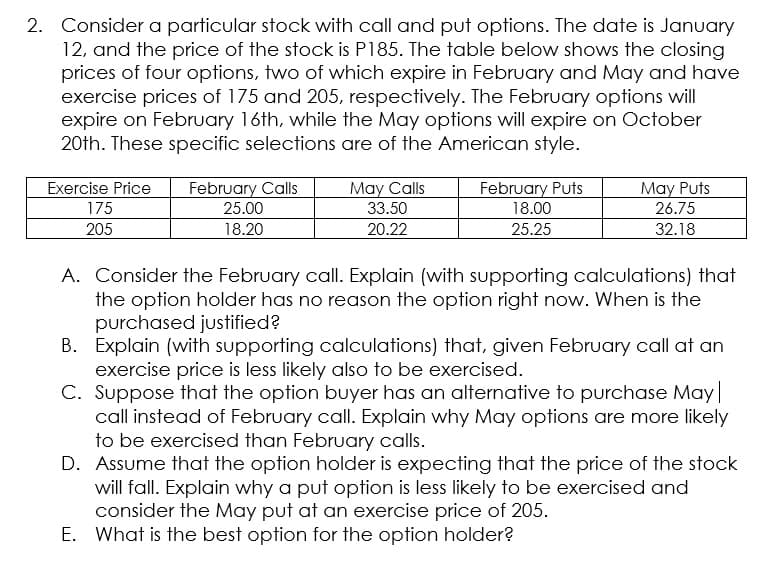

2. Consider a particular stock with call and put options. The date is January 12, and the price of the stock is P185. The table below shows the closing prices of four options, two of which expire in February and May and have exercise prices of 175 and 205, respectively. The February options will expire on February 16th, while the May options will expire on October 20th. These specific selections are of the American style. Exercise Price 175 205 February Calls 25.00 18.20 May Calls 33.50 20.22 February Puts 18.00 25.25 May Puts 26.75 32.18 A. Consider the February call. Explain (with supporting calculations) that the option holder has no reason the option right now. When is the purchased justified? B. Explain (with supporting calculations) that, given February call at an exercise price is less likely also to be exercised. C. Suppose that the option buyer has an alternative to purchase May | call instead of February call. Explain why May options are more likely to be exercised than February calls. D. Assume that the option holder is expecting that the price of the stock will fall. Explain why a put option is less likely to be exercised and consider the May put at an exercise price of 205. E. What is the best option for the option holder?

2. Consider a particular stock with call and put options. The date is January 12, and the price of the stock is P185. The table below shows the closing prices of four options, two of which expire in February and May and have exercise prices of 175 and 205, respectively. The February options will expire on February 16th, while the May options will expire on October 20th. These specific selections are of the American style. Exercise Price 175 205 February Calls 25.00 18.20 May Calls 33.50 20.22 February Puts 18.00 25.25 May Puts 26.75 32.18 A. Consider the February call. Explain (with supporting calculations) that the option holder has no reason the option right now. When is the purchased justified? B. Explain (with supporting calculations) that, given February call at an exercise price is less likely also to be exercised. C. Suppose that the option buyer has an alternative to purchase May | call instead of February call. Explain why May options are more likely to be exercised than February calls. D. Assume that the option holder is expecting that the price of the stock will fall. Explain why a put option is less likely to be exercised and consider the May put at an exercise price of 205. E. What is the best option for the option holder?

Chapter20: Financing With Derivatives

Section: Chapter Questions

Problem 1P

Related questions

Question

Transcribed Image Text:2. Consider a particular stock with call and put options. The date is January

12, and the price of the stock is P185. The table below shows the closing

prices of four options, two of which expire in February and May and have

exercise prices of 175 and 205, respectively. The February options will

expire on February 16th, while the May options will expire on October

20th. These specific selections are of the American style.

Exercise Price

February Calls

May Calls

February Puts

18.00

May Puts

175

25.00

33.50

26.75

205

18.20

20.22

25.25

32.18

A. Consider the February call. Explain (with supporting calculations) that

the option holder has no reason the option right now. When is the

purchased justified?

B. Explain (with supporting calculations) that, given February call at an

exercise price is less likely also to be exercised.

C. Suppose that the option buyer has an alternative to purchase May|

call instead of February call. Explain why May options are more likely

to be exercised than February calls.

D. Assume that the option holder is expecting that the price of the stock

will fall. Explain why a put option is less likely to be exercised and

consider the May put at an exercise price of 205.

E. What is the best option for the option holder?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT