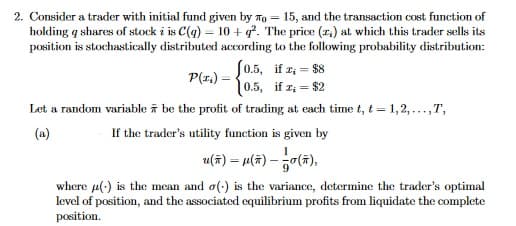

2. Consider a trader with initial fund given by To = 15, and the transaction cost function of holding q shares of stock i is C(g) = 10 + q*. The price (r.) at which this trader sells its position is stochastically distributed according to the following probability distribution: P(z,) = {0.5, if z, = 88 10.5, if z, = $2 Let a random variable i be the profit of trading at each time t, t = 1,2,...,T, (a) If the trader's utility function is given by u(#) = u(#) – 0(#), %3D

2. Consider a trader with initial fund given by To = 15, and the transaction cost function of holding q shares of stock i is C(g) = 10 + q*. The price (r.) at which this trader sells its position is stochastically distributed according to the following probability distribution: P(z,) = {0.5, if z, = 88 10.5, if z, = $2 Let a random variable i be the profit of trading at each time t, t = 1,2,...,T, (a) If the trader's utility function is given by u(#) = u(#) – 0(#), %3D

College Algebra

7th Edition

ISBN:9781305115545

Author:James Stewart, Lothar Redlin, Saleem Watson

Publisher:James Stewart, Lothar Redlin, Saleem Watson

Chapter9: Counting And Probability

Section9.4: Expected Value

Problem 1E: If a game gives payoffs of $10 and $100 with probabilities 0.9 and 0.1, respectively, then the...

Related questions

Question

Hello, Could I have help with this question? It is a HW assignment and not graded.

Transcribed Image Text:2. Consider a trader with initial fund given by To = 15, and the transaction cost function of

holding q shares of stock i is C(g) = 10 + q. The price (r.) at which this trader sells its

position is stochastically distributed according to the following probability distribution:

P(z,) = 0.5, if z, = $8

10.5, if z; = $2

Let a random variable ī be the profit of trading at each time t, t = 1,2, ...,T,

(a)

If the trader's utility function is given by

u(주) -M(#) - 능0(㈜),

where u(-) is the mean and o(:) is the variance, determine the trader's optimal

level of position, and the associated equilibrium profits from liquidate the complete

position.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

College Algebra

Algebra

ISBN:

9781305115545

Author:

James Stewart, Lothar Redlin, Saleem Watson

Publisher:

Cengage Learning

College Algebra

Algebra

ISBN:

9781305115545

Author:

James Stewart, Lothar Redlin, Saleem Watson

Publisher:

Cengage Learning