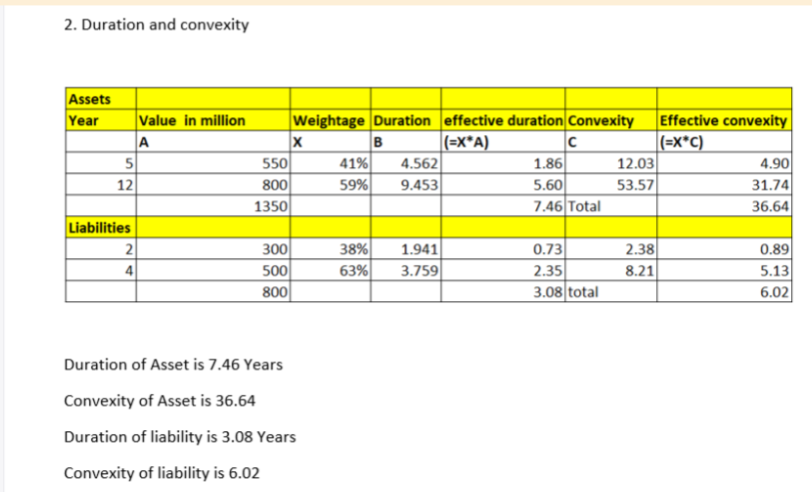

2. Duration and convexity Assets Year A Value in million Weightage Duration effective duration Convexity |(=x*A) B 4.562 41% 9.453 59% Effective convexity |(=x*C) 12.03 53.57 550 800 1350 1.86 5.60 7.46 Total 4.90 31.74 36.64 12 Liabilities 300 500 800 38% 63% 1.941 0.73 2.35 2.38 0.89 5.13 6.02 2 4 3.759 8.21 3.08 total Duration of Asset is 7.46 Years Convexity of Asset is 36.64 Duration of liability is 3.08 Years Convexity of liability is 6.02

I've sent this question however I have found many mistakes in the answer could you please do this again. the attachment shows an image of part B answered by yourself I wanted to know how was the 'Weightage' column worked out and also the rest of the columns numbers are wrong as they dont show the correct answer when inputted in to calcuator.

Consider a bank with the following balance sheet (M means million):

|

Assets |

Value |

Duration of the Asset |

Convexity of the Asset |

|

5yr bond bought at a yield of 3.4% (lending money) |

$550M |

4.562 |

12.026 |

|

12yr bond bought at a yield of 4% (lending money) |

$800M |

9.453 |

53.565 |

|

Liabilities |

Value |

Duration of the Liability |

Convexity of the Liability |

|

2yr bond sold at a yield of 2.4% (borrowing money) |

$300M |

1.941 |

2.384 |

|

4yr bond sold at a yield of 2.8% (borrowing money) |

$500M |

3.759 |

8.206 |

Required

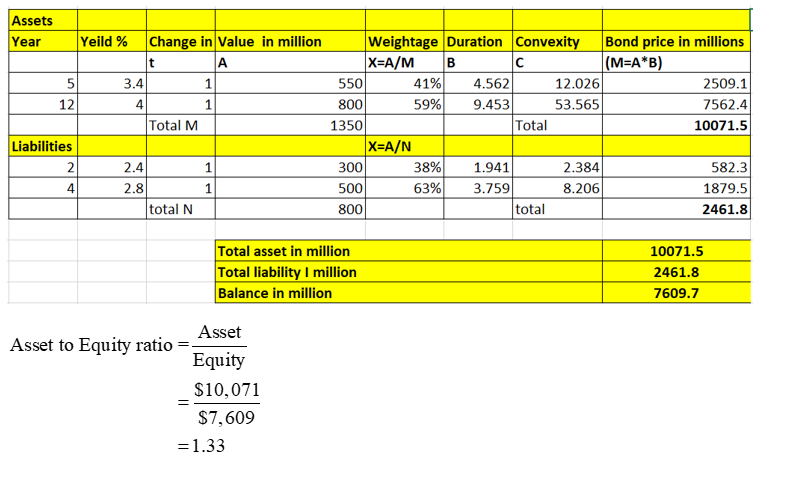

a) Calculate the equity (total asset – total liability) to asset ratio of the bank (Hint: equity to asset ratio = total equity/total asset)

b) Calculate the duration and convexity of the both asset and liability sides;

c) If the interest rates go up by 1%, using the duration and convexity rule to determine the net worth of the bank and the equity to asset ratio;

d) In c)’s scenario, to maintain the equity to asset ratio at 40% which is required by the regulation, the bank decides to raise cash (zero duration and zero convexity) from the equity holders. How much cash does the bank need to raise?

e) Do you agree with the following statement? Explain why.

“The information about a bond’s duration and convexity adjustment is sufficient to quantify interest rate risk exposure.”

“Since you have posted a question with multiple sub-parts, we will solve the first three sub-

parts for you. To get the remaining sub-part solved please repost the complete question and

mention the sub-parts to be solved.”

The total equity is

Step by step

Solved in 2 steps with 3 images