2. Please work out the following financial ratios for Windswept, Inc. a) What is the days' sales in receivables in 2021? b) What is the equity multiplier for 2021? c) What is the cash coverage ratio for 2021? d) What is the return on equity for 2021? e) Windswept, Inc. has 90 million shares of stock outstanding. Its price-earnings ratio for 2021 is 12. What is the market price per share of stock?

2. Please work out the following financial ratios for Windswept, Inc. a) What is the days' sales in receivables in 2021? b) What is the equity multiplier for 2021? c) What is the cash coverage ratio for 2021? d) What is the return on equity for 2021? e) Windswept, Inc. has 90 million shares of stock outstanding. Its price-earnings ratio for 2021 is 12. What is the market price per share of stock?

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

Transcribed Image Text:P极光PDF

文件 开始

手型

A。

选择 文本高亮 下划线

插入

322④

编辑

阅读

Aa Aa

m

波浪线 删除线

A4(210x297mm)

o

F2

注释

区域高亮

开始

# F3

转换

x

页面

国

便签

保护

+

直线

箭头

此文档是否需要翻译?

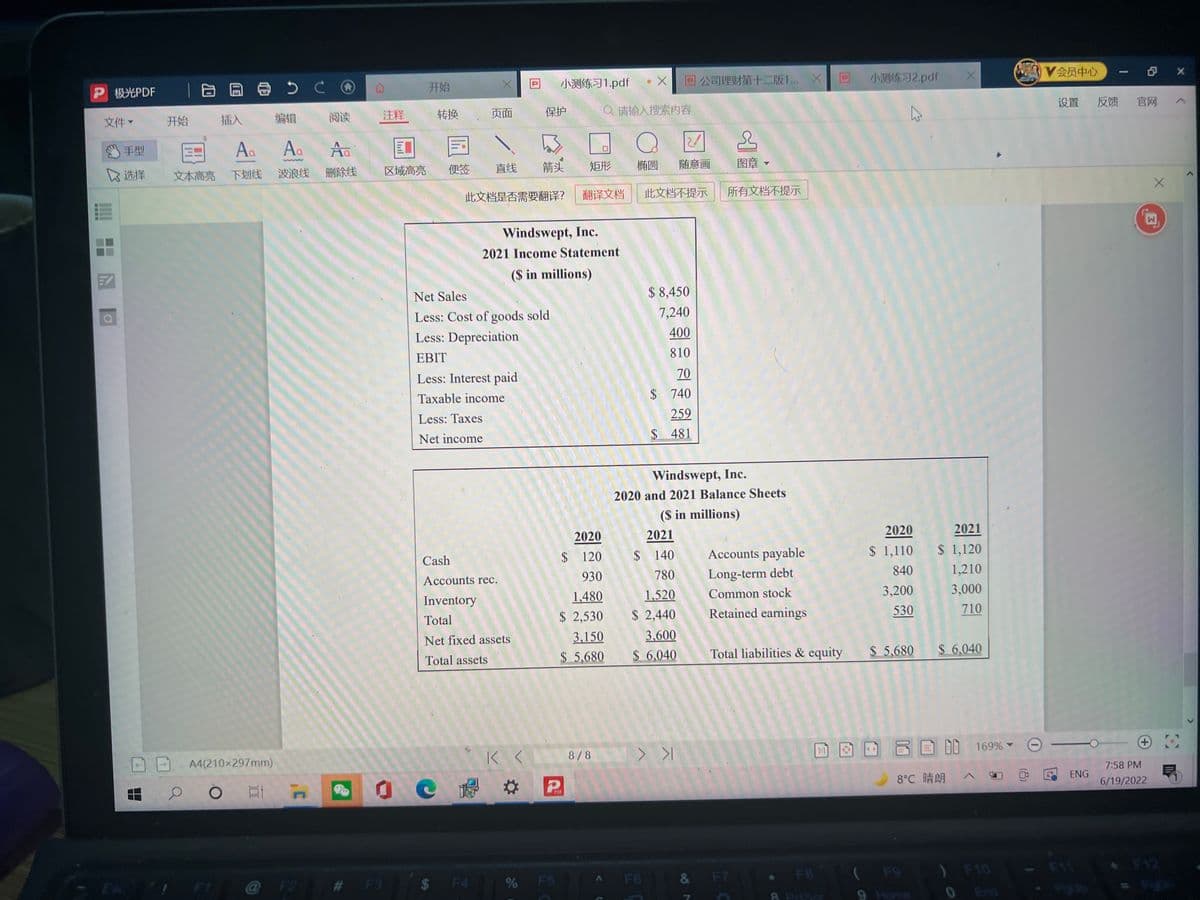

Net Sales

Less: Cost of goods sold

Less: Depreciation

EBIT

Less: Interest paid

Taxable income

Less: Taxes

Net income

Cash

Accounts rec.

Inventory

Total

Net fixed assets

Total assets

K.

g.. 好圖

PDF

$

F4

% F5

小测练习1.pdf

x

请输入搜索内容

Q

1

椭圆 随意画

此文档不提示

$8,450

7,240

400

810

70

$ 740

259

$ 481

Windswept, Inc.

2020 and 2021 Balance Sheets

($ in millions)

2021

$ 140

780

1,520

$ 2,440

3,600

$ 6,040

可

矩形

翻译文档

Windswept, Inc.

2021 Income Statement

($ in millions)

2020

$ 120

930

1,480

$ 2,530

3,150

$ 5,680

8/8

回 公司理财第十二版1... ×

2

图章

所有文档不提示

Fo

&

7

Accounts payable

Long-term debt

Common stock

Retained earnings

Total liabilities & equity

F7

小测练习2.pdf

心

2020

$ 1,110

840

3,200

530

$ 5.680

8°C 晴朗

FB ( F9

x

2021

$ 1,120

1,210

3,000

710

$6.040

00

169%

F10

0

V会员中心 -

设置 反馈 官网

x

ENG

7:58 PM

6/19/2022

x

Transcribed Image Text:P极光PDF

开始

文件

手型

选择

O

。

日

35④

编辑

阅读

Aa A。

Aa

文本高亮 下划线 波浪线 删除线

10

Ö

插入

A4(210x297mm)

O

F1

2-0²-

回 公司理财第十二版1...

小测练习2.pdf

注释

心

2

区域高亮

便签

直线

箭头

矩形

椭圆 随意画

图章 •

requerida a los 35 years

此文档是否需要翻译?

翻译文档

此文档不提示

所有文档不提示

PMT=4,676: se tiene que guardar 4676 cada year a partir de 15 years para que pueda crecer hasta

el future value 336,905 en 20 year.

-

2. Please work out the following financial ratios for Windswept, Inc.

a)

What is the days’ sales in receivables in 2021?

b)

What is the equity multiplier for 2021?

c) What is the cash coverage ratio for 2021?

What is the return on equity for 2021?

e)

Windswept, Inc. has 90 million shares of stock outstanding. Its price-earnings ratio for 2021

is 12. What is the market price per share of stock?

K

<

7/8

可

1:1

6自 169%

口

0@☆P

8°C 晴朗

PDF

$ F4

F5

A

Pa

# F3

3

4

开始

转换

x

页面

%5

Q

小测练习1.pdf

保护

6

Q 请输入搜索内容

F6

& FI

7

F8

8 PrtScr

x

F9

9 Home

F10.

0 End

(8)

V会员中心

设置

反馈

F111

PgUp

-

(+)

7:58 PM

ENG

6/19/2022

F12

官网

x

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education