2. Receipt of promissory note from customers in settlement of open accounts. 3. Estimate of uncollectible accounts. 4. Returns and allowances for merchandise sold for cash. 5. Issuance of promissory note for loan proceeds from bank. 6. Initial investments : cash and merchandise. 7. Sold merchandise, C.O.D. 8. Purchased office supplies on account. 9. Withdrawal of merchandise for personal use. 10. Depreciation of fixed assets. 11. Paid salary of employees. 12. Paid 50% of the account in No. 8 above. 13. Sold merchandise. Collected ½ and received a note for the balance.. 14. Payment of expenses. 15. Paid freight for merchandise sold. 16. Payment to suppliers for merchandise bought on account. 17. Purchase of land on account. 18. Bought merchandise. Paid ½ and issued a 30-day note for the balance. 19. Payment of interest due on bank loans. 20. Refund from suppliers 21. Returns and allowances for merchandise purchased on account. 22. Accrual of income. 23. Additional investment in the form of equipment.

2. Receipt of promissory note from customers in settlement of open accounts. 3. Estimate of uncollectible accounts. 4. Returns and allowances for merchandise sold for cash. 5. Issuance of promissory note for loan proceeds from bank. 6. Initial investments : cash and merchandise. 7. Sold merchandise, C.O.D. 8. Purchased office supplies on account. 9. Withdrawal of merchandise for personal use. 10. Depreciation of fixed assets. 11. Paid salary of employees. 12. Paid 50% of the account in No. 8 above. 13. Sold merchandise. Collected ½ and received a note for the balance.. 14. Payment of expenses. 15. Paid freight for merchandise sold. 16. Payment to suppliers for merchandise bought on account. 17. Purchase of land on account. 18. Bought merchandise. Paid ½ and issued a 30-day note for the balance. 19. Payment of interest due on bank loans. 20. Refund from suppliers 21. Returns and allowances for merchandise purchased on account. 22. Accrual of income. 23. Additional investment in the form of equipment.

Chapter7: Accounting Information Systems

Section: Chapter Questions

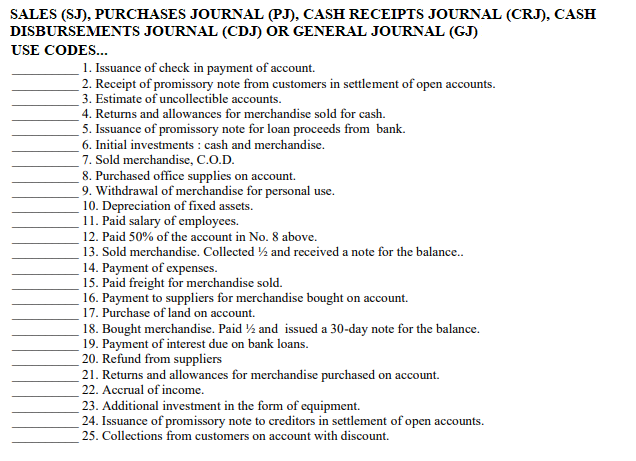

Problem 4EA: For each of the transactions, state which special journal (sales journal, cash receipts journal,...

Related questions

Topic Video

Question

Transcribed Image Text:SALES (SJ), PURCHASES JOURNAL (PJ), CASH RECEIPTS JOURNAL (CRJ), CASH

DISBURSEMENTS JOURNAL (CDJ) OR GENERAL JOURNAL (GJ)

USE CODES...

1. Issuance of check in payment of account.

2. Receipt of promissory note from customers in settlement of open accounts.

3. Estimate of uncollectible accounts.

4. Returns and allowances for merchandise sold for cash.

5. Issuance of promissory note for loan proceeds from bank.

6. Initial investments : cash and merchandise.

7. Sold merchandise, C.O.D.

8. Purchased office supplies on account.

9. Withdrawal of merchandise for personal use.

10. Depreciation of fixed assets.

11. Paid salary of employees.

12. Paid 50% of the account in No. 8 above.

13. Sold merchandise. Collected ½ and received a note for the balance.

14. Payment of expenses.

15. Paid freight for merchandise sold.

16. Payment to suppliers for merchandise bought on account.

17. Purchase of land on account.

18. Bought merchandise. Paid ½ and issued a 30-day note for the balance.

19. Payment of interest due on bank loans.

20. Refund from suppliers

21. Returns and allowances for merchandise purchased on account.

22. Accrual of income.

23. Additional investment in the form of equipment.

24. Issuance of promissory note to creditors in settlement of open accounts.

25. Collections from customers on account with discount.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,