2. Richard Corp has the following data for the third week of December: Employee Name Classification Hours Worked Rate per hour A. Kuhol Laborer 45 50 B. Aileen Office Secretary 46 45 C. Jose D. Jay Laborer 50 52 Factory Supervisor 55 52 48 48 E. Richmond Sales agent 60 F. Edward Laborer 45 The following are to be deducted to the gross earnings of employees: Witholding taxes sSS contributions 5% 3% Philhealth 1% Pag-ibig 1% Richard Corp paid its employees one and half times the regular rate for hours worked in excess of 40 hours. Required: Prepare Journal Entries to record A. Payroll B. Labor distribution

2. Richard Corp has the following data for the third week of December: Employee Name Classification Hours Worked Rate per hour A. Kuhol Laborer 45 50 B. Aileen Office Secretary 46 45 C. Jose D. Jay Laborer 50 52 Factory Supervisor 55 52 48 48 E. Richmond Sales agent 60 F. Edward Laborer 45 The following are to be deducted to the gross earnings of employees: Witholding taxes sSS contributions 5% 3% Philhealth 1% Pag-ibig 1% Richard Corp paid its employees one and half times the regular rate for hours worked in excess of 40 hours. Required: Prepare Journal Entries to record A. Payroll B. Labor distribution

Century 21 Accounting General Journal

11th Edition

ISBN:9781337680059

Author:Gilbertson

Publisher:Gilbertson

Chapter12: Preparing Payroll Records

Section: Chapter Questions

Problem 1AP

Related questions

Question

100%

How to answer numbers 2,3,4?

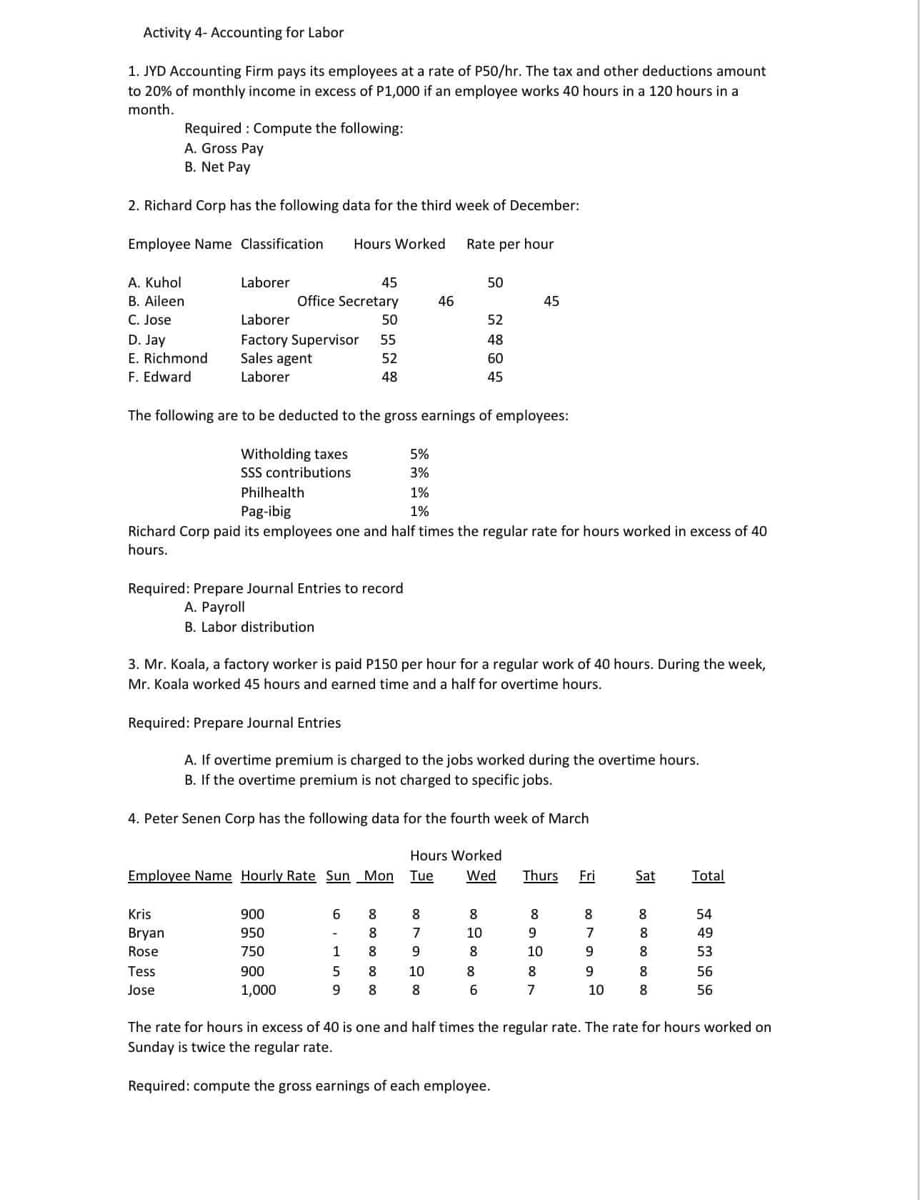

Transcribed Image Text:Activity 4- Accounting for Labor

1. JYD Accounting Firm pays its employees at a rate of P50/hr. The tax and other deductions amount

to 20% of monthly income in excess of P1,000 if an employee works 40 hours in a 120 hours in a

month.

Required : Compute the following:

A. Gross Pay

B. Net Pay

2. Richard Corp has the following data for the third week of December:

Employee Name Classification

Hours Worked

Rate per hour

A. Kuhol

B. Aileen

C. Jose

Laborer

45

50

Office Secretary

46

45

Laborer

50

52

Factory Supervisor

Sales agent

Laborer

D. Jay

55

48

E. Richmond

52

60

F. Edward

48

45

The following are to be deducted to the gross earnings of employees:

Witholding taxes

SSS contributions

5%

3%

Philhealth

1%

Pag-ibig

1%

Richard Corp paid its employees one and half times the regular rate for hours worked in excess of 40

hours.

Required: Prepare Journal Entries to record

A. Payroll

B. Labor distribution

3. Mr. Koala, a factory worker is paid P150 per hour for a regular work of 40 hours. During the week,

Mr. Koala worked 45 hours and earned time and a half for overtime hours.

Required: Prepare Journal Entries

A. If overtime premium is charged to the jobs worked during the overtime hours.

B. If the overtime premium is not charged to specific jobs.

4. Peter Senen Corp has the following data for the fourth week of March

Hours Worked

Employee Name Hourly Rate Sun Mon Tue

Wed

Thurs

Fri

Sat

Total

Kris

900

8

8

8

8

8

8

54

Bryan

950

8

7

10

9

8

49

Rose

750

1.

8

9.

10

9

8

53

Tess

900

8

10

8

8

8

56

Jose

1,000

9

8

8

6

7

10

8

56

The rate for hours in excess of 40 is one and half times the regular rate. The rate for hours worked on

Sunday is twice the regular rate.

Required: compute the gross earnings of each employee.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College