2. The earnings, dividends, and stock price of BB Company are expected to grow at 7% per year after this year. BB Company's common stock sells for P23 per share, its last dividend was P2.00 and the company pay P2.14 at the end of the current year. BB Company should pay P2.50 flotation cost. Using the dividend growth model, what is the expected cost of retained earnings for BB Company?

2. The earnings, dividends, and stock price of BB Company are expected to grow at 7% per year after this year. BB Company's common stock sells for P23 per share, its last dividend was P2.00 and the company pay P2.14 at the end of the current year. BB Company should pay P2.50 flotation cost. Using the dividend growth model, what is the expected cost of retained earnings for BB Company?

Chapter3: The Financial Environment: Markets, Institutions And Investment Banking

Section: Chapter Questions

Problem 16PROB

Related questions

Question

Please answer asap thank you!

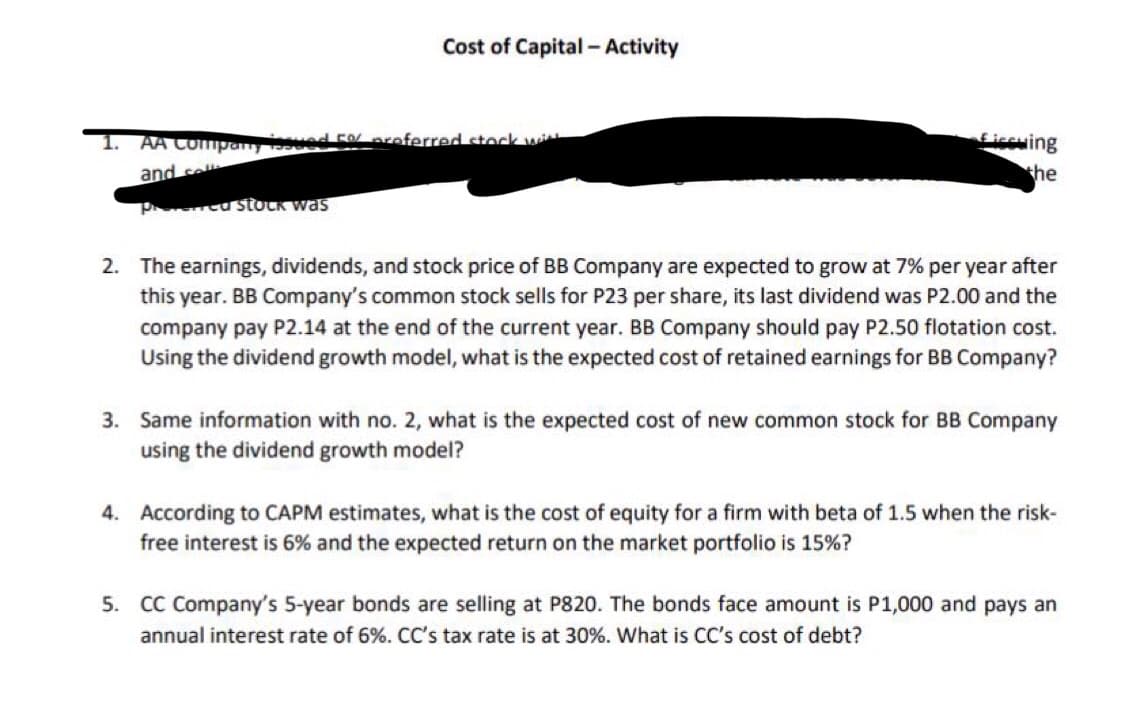

Transcribed Image Text:Cost of Capital - Activity

1. AA Company issued 50 preferred stock wi

and sel

Pred stock was

Ficcuing

the

2. The earnings, dividends, and stock price of BB Company are expected to grow at 7% per year after

this year. BB Company's common stock sells for P23 per share, its last dividend was P2.00 and the

company pay P2.14 at the end of the current year. BB Company should pay P2.50 flotation cost.

Using the dividend growth model, what is the expected cost of retained earnings for BB Company?

3. Same information with no. 2, what is the expected cost of new common stock for BB Company

using the dividend growth model?

4. According to CAPM estimates, what is the cost of equity for a firm with beta of 1.5 when the risk-

free interest is 6% and the expected return on the market portfolio is 15%?

5. CC Company's 5-year bonds are selling at P820. The bonds face amount is P1,000 and pays an

annual interest rate of 6%. CC's tax rate is at 30%. What is CC's cost of debt?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning