2. the provision for doubtful debt is to equal 2% of trade receivables 3. Inventory at 31st December 2018 was valued at £5,758.50 4. Vehicle expenses owing £27.50 and rent prepaid £137.50 Required: Prepare an income statement of M.M. Bibsy for the year ending 31st December 2018 and a Statement of Financial Position.

2. the provision for doubtful debt is to equal 2% of trade receivables 3. Inventory at 31st December 2018 was valued at £5,758.50 4. Vehicle expenses owing £27.50 and rent prepaid £137.50 Required: Prepare an income statement of M.M. Bibsy for the year ending 31st December 2018 and a Statement of Financial Position.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter7: Inventories: Cost Measurement And Flow Assumptions

Section: Chapter Questions

Problem 9RE: RE7-8 Johnson Company uses a perpetual inventory system. On October 23, Johnson purchased 100,000 of...

Related questions

Question

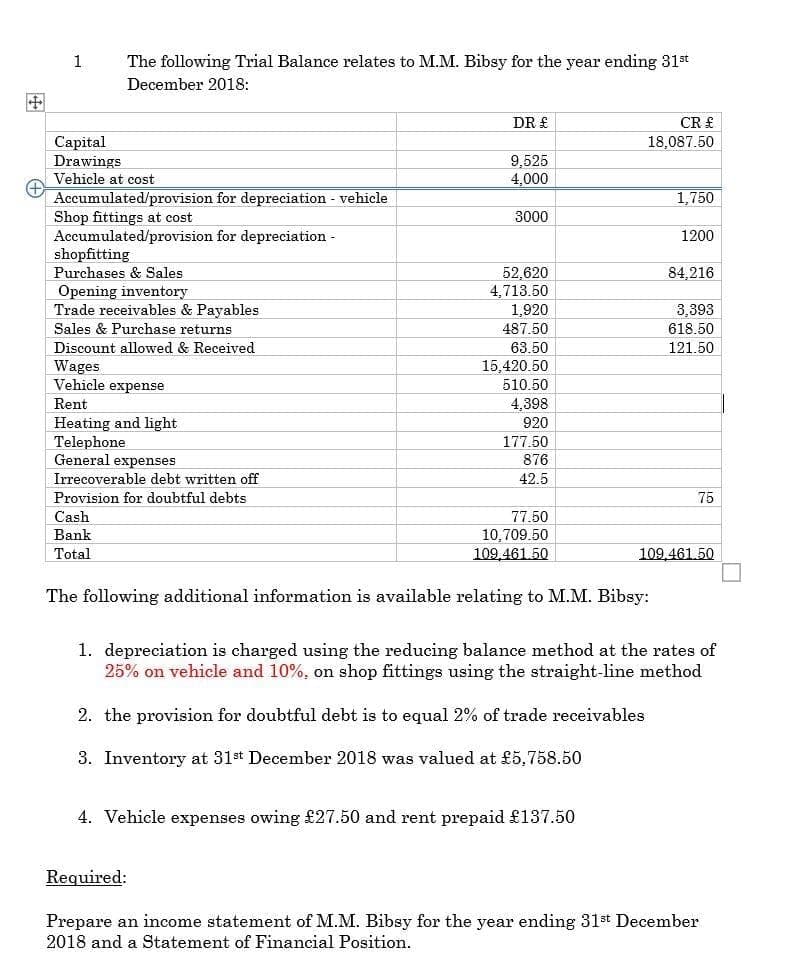

Transcribed Image Text:1

The following Trial Balance relates to M.M. Bibsy for the year ending 31st

December 2018:

田

DR £

CR £

Capital

Drawings

Vehicle at cost

Accumulated/provision for depreciation - vehicle

Shop fittings at cost

Accumulated/provision for depreciation -

shopfitting

Purchases & Sales

Opening inventory

Trade receivables & Payables

18,087.50

9,525

4,000

1,750

3000

1200

84,216

52,620

4,713.50

1,920

487,50

3,393

Sales & Purchase returns

618.50

Discount allowed & Received

63.50

121.50

Wages

Vehicle expense

15,420.50

510.50

Rent

4,398

Heating and light

Telephone

General expenses

920

177.50

876

Irrecoverable debt written off

42.5

Provision for doubtful debts

75

Cash

Bank

77.50

10,709.50

109,461.50

Total

109,461.50

The following additional information is available relating to M.M. Bibsy:

1. depreciation is charged using the reducing balance method at the rates of

25% on vehicle and 10%, on shop fittings using the straight-line method

2. the provision for doubtful debt is to equal 2% of trade receivables

3. Inventory at 31st December 2018 was valued at £5,758.50

4. Vehicle expenses owing £27.50 and rent prepaid £137.50

Required:

Prepare an income statement of M.M. Bibsy for the year ending 31st December

2018 and a Statement of Financial Position.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning