2. Whenever you take out a loan or carry a balance on a credit card, you pay interest. The way that the interest is calculated depends on the type of loan. Simple interest loans are loans where you pay interest only on the amount you borrowed. Federally subsidized student loans and most car loans are simple interest loans. Credit cards debts are in essence loans, but they are not simple interest loans because each month any unpaid interest is added to the amount on which you pay interest. So you pay interest on your unpaid interest! Suppose you plan to borrow $5000 from your uncle to purchase a used car. Your uncle agrees to give you a simple interest loan at an interest rate of 8% and wants you to repay the loan and the interest in one lump sum. The graph below shows how the amount of time it takes you to repay the loan affects the amount you owe. a. How long does it take for your uncle to make $1000 on this deal? Dy. YE 8000 -7200 y= X+b -6400 -5600 b. What is the y-intercept? What does it tell us? -4800 4= 5000 The umount owed 4000 -3200 2400 Ду c. Calculate the rate of change for three pairs of Ar -1600 -800 points. What do you notice? What is the meaning of Ду the in this scenario? 0.5 1, 1.5 2 2.5 3 3.5 4 4.5 5 5.5 Length of Loan (years) X Ar ($) peMo uno

2. Whenever you take out a loan or carry a balance on a credit card, you pay interest. The way that the interest is calculated depends on the type of loan. Simple interest loans are loans where you pay interest only on the amount you borrowed. Federally subsidized student loans and most car loans are simple interest loans. Credit cards debts are in essence loans, but they are not simple interest loans because each month any unpaid interest is added to the amount on which you pay interest. So you pay interest on your unpaid interest! Suppose you plan to borrow $5000 from your uncle to purchase a used car. Your uncle agrees to give you a simple interest loan at an interest rate of 8% and wants you to repay the loan and the interest in one lump sum. The graph below shows how the amount of time it takes you to repay the loan affects the amount you owe. a. How long does it take for your uncle to make $1000 on this deal? Dy. YE 8000 -7200 y= X+b -6400 -5600 b. What is the y-intercept? What does it tell us? -4800 4= 5000 The umount owed 4000 -3200 2400 Ду c. Calculate the rate of change for three pairs of Ar -1600 -800 points. What do you notice? What is the meaning of Ду the in this scenario? 0.5 1, 1.5 2 2.5 3 3.5 4 4.5 5 5.5 Length of Loan (years) X Ar ($) peMo uno

Algebra and Trigonometry (6th Edition)

6th Edition

ISBN:9780134463216

Author:Robert F. Blitzer

Publisher:Robert F. Blitzer

ChapterP: Prerequisites: Fundamental Concepts Of Algebra

Section: Chapter Questions

Problem 1MCCP: In Exercises 1-25, simplify the given expression or perform the indicated operation (and simplify,...

Related questions

Concept explainers

Equations and Inequations

Equations and inequalities describe the relationship between two mathematical expressions.

Linear Functions

A linear function can just be a constant, or it can be the constant multiplied with the variable like x or y. If the variables are of the form, x2, x1/2 or y2 it is not linear. The exponent over the variables should always be 1.

Question

how long does it take for your uncle to make $1000 on this deal?

what is the y- intercept? WHAT DOES IT TELL US?

and i need help with question c

Transcribed Image Text:2. Whenever you take out a loan or carry a balance on a credit card, you pay interest. The way that the interest is

calculated depends on the type of loan. Simple interest loans are loans where you pay interest only on the

amount you borrowed. Federally subsidized student loans and most car loans are simple interest loans. Credit

cards debts are in essence loans, but they are not simple interest loans because each month any unpaid interest is

added to the amount on which you pay interest. So you pay interest on your unpaid interest!

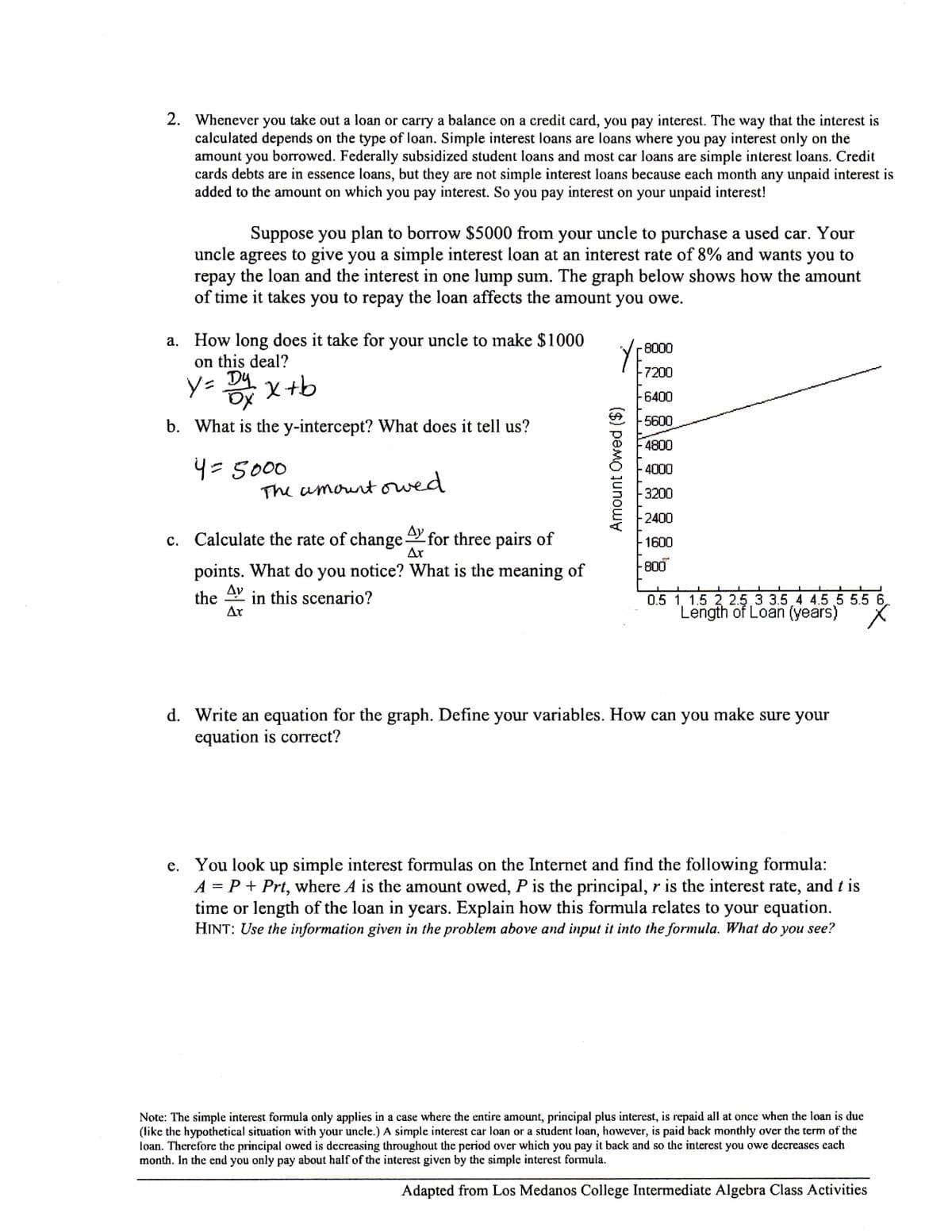

Suppose you plan to borrow $5000 from your uncle to purchase a used car. Your

uncle agrees to give you a simple interest loan at an interest rate of 8% and wants you to

repay the loan and the interest in one lump sum. The graph below shows how the amount

of time it takes you to repay the loan affects the amount you owe.

a. How long does it take for your uncle to make $1000

on this deal?

Dy x+b

8000

-7200

y=

6400

-5600

b. What is the y-intercept? What does it tell us?

4800

4=5000

The amount owed

4000

3200

-2400

Ду

c. Calculate the rate of change

for three pairs of

Ar

-1600

800

points. What do you notice? What is the meaning of

Ay

in this scenario?

the

Ar

0.5 1, 1.5 2 2.5.3 3.5.4 4.5.55.5 6

Length of Loan (years)

X.

d. Write an equation for the graph. Define your variables. How can you make sure your

equation is correct?

e. You look up simple interest formulas on the Internet and find the following formula:

A = P + Prt, where A is the amount owed, P is the principal, r is the interest rate, and t is

time or length of the loan in years. Explain how this formula relates to your equation.

HINT: Use the information given in the problem above and input it into the formula. What do you see?

Note: The simple interest formula only applies in a case where the entire amount, principal plus interest, is repaid all at once when the loan is due

(like the hypothetical situation with your uncle.) A simple interest car loan or a student loan, however, is paid back monthly over the term of the

loan. Therefore the principal owed is decreasing throughout the period over which you pay it back and so the interest you owe decreases each

month. In the end you only pay about half of the interest given by the simple interest formula.

Adapted from Los Medanos College Intermediate Algebra Class Activities

Amount Owed ($)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, algebra and related others by exploring similar questions and additional content below.Recommended textbooks for you

Algebra and Trigonometry (6th Edition)

Algebra

ISBN:

9780134463216

Author:

Robert F. Blitzer

Publisher:

PEARSON

Contemporary Abstract Algebra

Algebra

ISBN:

9781305657960

Author:

Joseph Gallian

Publisher:

Cengage Learning

Linear Algebra: A Modern Introduction

Algebra

ISBN:

9781285463247

Author:

David Poole

Publisher:

Cengage Learning

Algebra and Trigonometry (6th Edition)

Algebra

ISBN:

9780134463216

Author:

Robert F. Blitzer

Publisher:

PEARSON

Contemporary Abstract Algebra

Algebra

ISBN:

9781305657960

Author:

Joseph Gallian

Publisher:

Cengage Learning

Linear Algebra: A Modern Introduction

Algebra

ISBN:

9781285463247

Author:

David Poole

Publisher:

Cengage Learning

Algebra And Trigonometry (11th Edition)

Algebra

ISBN:

9780135163078

Author:

Michael Sullivan

Publisher:

PEARSON

Introduction to Linear Algebra, Fifth Edition

Algebra

ISBN:

9780980232776

Author:

Gilbert Strang

Publisher:

Wellesley-Cambridge Press

College Algebra (Collegiate Math)

Algebra

ISBN:

9780077836344

Author:

Julie Miller, Donna Gerken

Publisher:

McGraw-Hill Education